Many organizations find that providing employee benefits is an effective strategy for attracting and retaining talent. When constructing a benefits package, knowing which benefits qualify for post-tax deductions and which can be funded with pre-tax contributions is crucial.

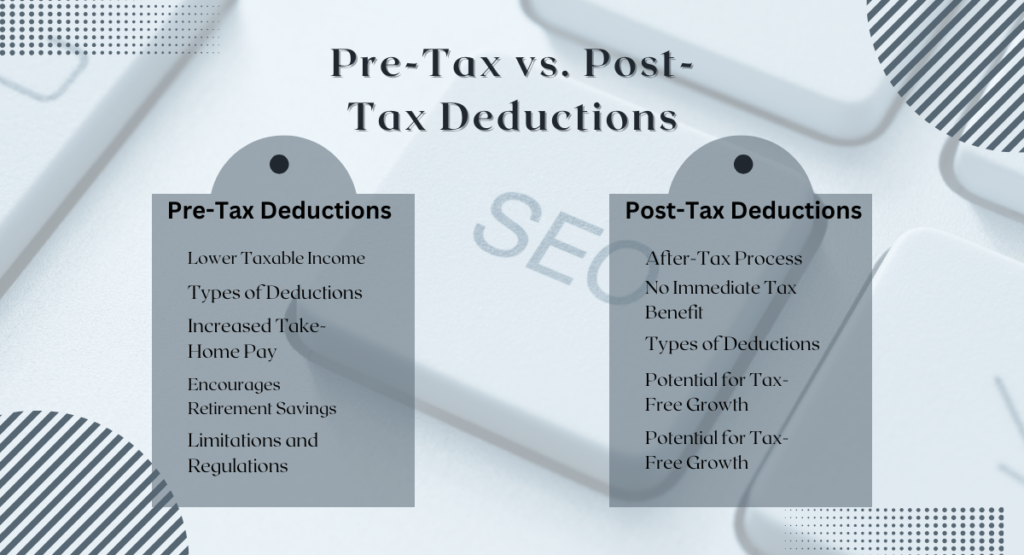

Pre-tax and post-tax advantages and disadvantages exist. Generally, pre-tax deductions offer an immediate tax benefit but affect an employee’s taxable income. Conversely, post-tax deductions do not confer immediate tax relief but exempt future benefit utilization from taxation.

What Is A Post-Tax Deduction?

Post-tax deductions refer to the sums deducted from an individual’s paycheck after the withholding of taxes. Voluntary or mandatory, these deductions may consist of health insurance premiums, disability insurance, contributions to retirement plans, and other benefits provided by the employer. Although post-tax deductions may diminish one’s taxable income, they can furnish significant advantages that aid in future financial planning and ensure financial stability.

It is crucial to distinguish post-tax deductions from pre-tax deductions, the latter of which are withheld from your paycheck before taxes. Gaining comprehension of the distinction between the two can assist one in making well-informed financial decisions and optimizing savings.

Examples Of Post-Tax Deductions

Deductions after taxes include contributions, sponsorships, and savings programs. The following are examples of post-tax deductions:

- Retirement contributions voluntarily. Post-tax contributions to retirement accounts in the United States are illustrated by Roth 401(k) and Roth 403(b) plans. Donations are accepted as post-tax dollars and do not result in an immediate deduction from taxable income. In contrast, qualified Roth withdrawals are tax-free during retirement.

- Certain insurance costs. Although most health insurance premiums are deducted before taxation, specific contributions or plans may be subject to post-tax deductions—particularly if the employee chooses to enroll in supplementary coverage.

- Union contributions. Dues to the union may be deducted from the paychecks of union members. Union dues are typically deductible after taxes.

- Donations to charitable organizations. Contributions to philanthropic causes made by employees via payroll deductions or workplace giving programs may be deducted from the employee’s after-tax income.

- Schedule A deductions are made. Potential deductions include medical and dental expenses, state and local taxes, mortgage interest, employment-related costs, and wagering losses.

Types Of Post-Tax Deduction

Post-tax deductions refer to the sums deducted from an employee’s wage after withholding all relevant taxes. These deductions do not reduce taxable income. The following are frequent forms of post-tax deductions:

- Retirement Plan Contributions: After-tax expenditures fund contributions to Roth IRAs and 401(k) plans.

- Disability Insurance: Depending on the plan, premiums for specific disability insurance policies may be paid with after-tax expenditures.

- Life Insurance Premiums: Life insurance premiums offer the expenses incurred for policies with a beneficiary other than the employer, which surpass a specified value.

- Union Dues: Dues or membership fees paid to a labor union constitute union dues.

- Health and Wellness Programs: Health and wellness programs encompass expenditures on memberships to specific gyms that are not covered by pre-tax health plans.

- Garnishments: Garnishments are court-ordered deductions such as child support, alimony, and other obligations.

- Charitable Contributions: Contributions to charitable organizations are made directly from paychecks.

- Loan Repayments: Contributions to a 401(k) loan or repayments for employer-provided loans if not qualified for pre-tax deduction.

- Educational Assistance: Contributions towards initiatives that do not qualify for pre-tax advantages.

- After-Tax Health Insurance Premiums: Except specific plans not eligible for pre-tax deductions on health insurance premiums.

How To Calculate Your Post-Tax Deductions

Understanding the impact that post-tax deductions have on one’s income can be achieved through calculation. Examining the pay stub and discerning the specific amounts withheld from one’s payment is necessary to ascertain the post-tax deductions.

Examine the information about your 401(k) or other retirement plan to determine the proportion of your income being contributed towards retirement contributions. To compute the premiums for health insurance and other supplementary benefits, examining the benefit information and discerning the monthly deductions from each salary is necessary.

After identifying your post-tax deductions, you can calculate your take-home pay by deducting them from your total income. This information can be utilized to strategize your financial future.

Pre-Tax vs. Post-Tax Deductions

The primary distinctions between pre-tax and post-tax deductions pertain to their tax treatment and the timing of the deduction.

For example, pre-tax deductions are deducted from the aggregate income of an employee before the computation of income taxes. This deduction decreases the taxable income of the employee.

On the contrary, after-tax deductions are computed and deducted from an employee’s income after calculating and withholding income taxes. Deductions made after taxes do not affect an employee’s taxable income.

Advantages And Disadvantages Of Post-Tax Deductions

One benefit of post-tax deductions is the possibility of future withdrawals or benefits being tax-free.

In the context of retirement savings in the United States, it is possible to withdraw both the contributions and the investment proceeds tax-free, provided that specific conditions are fulfilled.

Additionally, after-tax deductions are detrimental because they do not generate immediate tax advantages. Individuals who utilize after-tax dollars to contribute to accounts or claim deductions do not incur a reduction in their taxable income for the current year.

What Are Post-Tax Benefits?

Post-tax benefit contributions, also referred to as after-tax deductions, are withheld from an employee’s wage after the deduction of taxes. As post-tax deductions diminish net pay as opposed to gross income, they fail to mitigate the overall tax liability of the individual.

When benefits are deducted after taxes, the employer and employee must pay additional income, payroll, and employment taxes. The employee will not, however, generally be required to pay income tax on the benefits when they utilize them in the future.

As an illustration, an employee does not incur any further tax liability upon retirement age on withdrawals made from a post-tax retirement plan. Consequently, employees may find post-tax deductions more favorable than pre-tax deductions.

All federal, state, and local taxes have been paid on the contributions because they are withheld before benefit contributions.

Do Post-Tax Deductions Show On A W-2?

Specific post-tax deductions can be reflected on Form W-2; however, this is deduction-dependent.

As an illustration, contributions to a Roth 401(k), a prevalent form of post-tax deduction, are detailed in Box 12 of Form W-2. The code AA denotes this section of the form, which facilitates the Internal Revenue Service’s (IRS) monitoring of contributions to a Roth 401(k) and guarantees that no individual surpasses the annual maximum contribution limit.

Only some post-tax deductions, however, are reflected on this form. Certain expenses, such as life insurance premiums and union dues, need designated reporting spaces on the W-2 form. The fact that these deductions are reflected on pay slips instead of the W-2 may need to be clarified. Certain occupations permit workers to claim union dues as a business expense using Form 2106. In contrast, premiums for life insurance are classified as personal expenses for tax purposes due to the absence of a mandatory government requirement for policyholders to maintain such coverage.

To prevent perplexity and guarantee comprehension among staff members, human resources professionals ought to be ready to elucidate these differentiations to guarantee precise tax reporting and that personnel are fully informed about the intricacies of their comprehensive compensation package.

Strategies For Managing Your Post-Tax Deductions

You can attain your financial objectives and maximize your savings by effectively managing your after-tax deductions. Several strategies warrant consideration:

1. Maximize Your Retirement Contributions.

You can optimize your savings and minimize your prospective tax obligations by making the most permitted contribution to your retirement plan. Maximizing your annual contribution and collaborating with a financial advisor is advisable to formulate a retirement strategy that aligns with your financial objectives and meets your requirements.

2. Choose The Right Health Insurance Plan.

You can maintain financial security and save money on medical expenses by selecting the appropriate health insurance plan. When choosing a health insurance plan, each individual should consider both the coverage offered and the cost of premiums.

3. Review Your Benefits Regularly.

Consistently evaluating your benefit options can assist you in optimizing your savings and maintaining financial stability. One should determine the worth of each benefit provided and its potential influence on one’s economic welfare.

4. Avoid Common Mistakes.

Staying financially stable can be accomplished by avoiding common errors, such as neglecting to review one’s pay receipt regularly or failing to comprehend the tax ramifications of retirement contributions.

Gaining knowledge about the effects of post-tax deductions on one’s income can empower one to exert authority over one’s financial prospects and optimize one’s savings. One can accomplish financial security and success by selecting an appropriate health insurance plan, retirement strategy, and additional benefits. Therefore, establish a plan, assess your after-tax deductions, and strive to ensure your financial security in the long run.

Thank you for reading…..