Understanding Health Savings Accounts (HSAs) can be confusing, especially when it comes to knowing what expenses are covered. One common question is whether you can use HSA funds to pay for a gym membership.

HSAs are meant to help people save money for medical expenses, but the IRS has specific rules about what qualifies as a medical expense.

This article explains when you can use your HSA for a gym membership and how it relates to improving your health and eligible medical expenses.

What Is A HSA?

An HSA, or health savings account, is a type of bank account designed specifically for healthcare expenses. You put money in this account before taxes are taken out, and you use that money only for healthcare expenses. If you have insurance with a high deductible, you can have an HSA. But you can’t have or use an HSA if you have Medicare or Medicaid.

Many banks offer HSA accounts to their customers. Some insurance companies also allow eligible policyholders to open HSA accounts. Opening an HSA with your current bank may have advantages, like special interest rates. If you don’t have an HSA yet, check if your loyalty can give you some benefits.

You are the only person who owns your HSA. You can put money in or take money out of your account whenever you want. Be careful: you might have to pay a tax penalty if you spend your HSA money on something that is not allowed. Always keep your receipts and invoices as proof that your purchases are allowed, so you don’t have to pay a penalty.

Can You Use HSA For Gym Membership?

HSA money can be used for important medical costs, such as prescription copays and doctor visits. It can also be used for things like medical equipment, non-prescription medicines, and even products for menstrual care. However, gym memberships are not considered necessary medical expenses.

That’s not the end of the story. Many doctors believe that exercising is important for your health. You can make your gym membership count as a medical expense by getting a Letter of Medical Necessity. If you talk to your doctor about how going to the gym can help you, they can write you a Letter of Medical Necessity.

What Is A Medical Necessity Letter?

A Letter of Medical Necessity is a paper that says why something is needed for your health and to prevent or treat your condition.

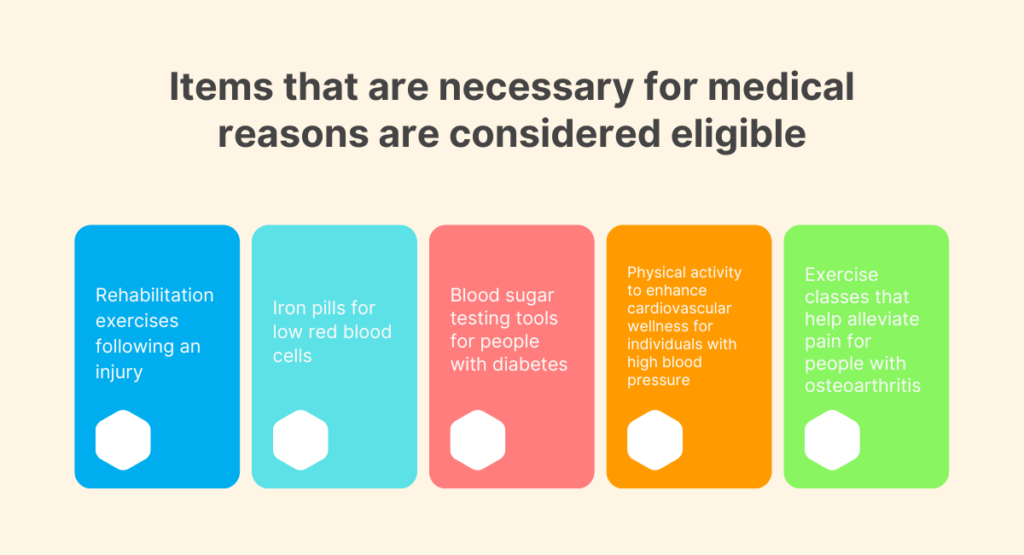

Items that are necessary for medical reasons are considered eligible:

- Rehabilitation exercises following an injury

- Iron pills for low red blood cells

- Blood sugar testing tools for people with diabetes

- Physical activity to enhance cardiovascular wellness for individuals with high blood pressure

- Exercise classes that help alleviate pain for people with osteoarthritis

About fitness, the letter explains why the cost meets HSA/FSA guidelines. To ensure that your fitness fees are paid for or reimbursed with HSA funds, you should keep your Letter of Medical Necessity and any relevant receipts for three years.

How To Get A Medical Necessity Letter?

You just need to ask your doctor for a Letter of Medical Necessity. Doctors know how to do it and are usually willing to write letters for patients who want to take control of their health.

You can also receive a Letter from your doctor stating that the gym membership is necessary for your health. We have made it easier for you to get this letter and pay for the gym membership using your HSA/FSA.

You will answer a few questions about your health to see if you can get a Letter of Medical Necessity. If you qualify, a doctor will give you a letter that lets you use your HSA money for your gym membership. We work with gyms and wellness companies to make sure your wellness activities are affordable and easy to do.

What Types Of Expenses Are Eligible For HSA?

The IRS has a long list of expenses for medical, dental, and vision care that it considers to be qualified expenses for HSAs. If you use your HSA funds for any of these approved expenses, you won’t have to pay taxes on the money.

You can use your HSA to pay for things that regular insurance doesn’t usually cover. This includes copayments and expenses for yourself, your spouse, and your dependents. If an HDHP covers your adult dependents and don’t have other insurance, their expenses are also eligible.

Your HSA needs to be officially set up before you can start using it for expenses. The specific date when your HSA is considered established is determined by state law. In many states, if you become eligible for an HSA on January 1st, but your first contribution doesn’t reach your HSA administrator until January 10th, then your HSA is only considered established on January 10th.

List of expenses that can be paid for using a Health Savings Account (HSA)

Here are some expenses that the IRS allows for Health Savings Accounts. Remember, this list may not include everything, so it’s best to ask your plan provider if you have any doubts about whether an expense is covered.

- Abortion

- Acne laser treatment

- Acupuncture

- Ambulance fees and emergency care

- Artificial limbs

- Birth control pills, injections, and devices, such as IUDs

- Blood pressure monitors

- Body scans

- Breast pumps and lactation supplies

- Breast reconstruction surgery following cancer

- Canes and walkers

- Childbirth expenses, such as care from a midwife or obstetrician

- Childbirth classes for the expectant mother

- Chiropractic care

- Contact lenses and saline solution

- Crutches

- Dental care, including sealants, cleanings, fluoride treatments, fillings, braces, X-rays, extractions, and dentures

- Diabetes supplies include blood sugar test kits and medication.

- Diabetes education and nutrition counseling

- Eye exams

- Eye surgery, including laser surgery

- Eyeglasses, including prescription and reading glasses, and prescription sunglasses

- Blue-light-blocking glasses

- First-aid kits

- Flu shots

- Guide dogs to assist with disabilities

- Food, grooming, and veterinary care for guide dogs

- Hearing aids and batteries

- Hospital expenses for both inpatient and outpatient services

- Infertility treatment, including in vitro fertilization; sperm, egg, and embryo storage; fertility monitors; and sperm washing

- Egg donor expenses related to infertility treatment

- Inpatient drug and alcohol treatment

- Insulin

- Lab fees

- Long-term care premiums, up to a qualifying amount dependent on your age

- Medical alert bracelets

- Medical Records Fees

- Medicare premiums for individuals 65 and older, excluding Medicare supplemental policies

- Night guards to treat teeth-grinding

- Nursing care, whether provided at home or in a nursing facility

- Occupational therapy

- Oxygen and oxygen equipment

- Physical exams

- Physical therapy

- Prescription medications

- Psychiatrist care

- Psychologist care

- Smoking cessation programs and drugs, including nicotine patches and gums

- Speech therapy

- Surgery, excluding elective cosmetic surgery

- Thermometers

- Tubal ligation (female sterilization) and tubal ligation reversal

- Ultrasounds

- Vaccines

- Vasectomy (male sterilization) and vasectomy reversal

- Wheelchairs

- X-rays

Although HSAs provide flexibility for medical expenses, using them for gym memberships is usually not allowed unless a doctor prescribes it for a specific medical need. It’s important to know the rules and exceptions so you can use your HSA funds properly and stay within IRS guidelines. Remember, the main purpose of an HSA is to financially support medical expenses, so it’s important to use the funds wisely and for their intended purpose.

Thanks for reading. I hope you find it interesting.