Understanding when Capital One reports your credit card activity to the credit bureaus is important for managing your credit score.

This is especially crucial if you plan to apply for a loan or credit soon and want your credit report to show your current financial situation.

This article will explain when Capital One shares information about your credit card usage, payments, and balance with the credit reporting agencies.

What Day Does Capital One Report To Credit Bureaus?

This depends on when you got your Capital One credit card. They set a due date for you. Usually, your credit cycle is 30-35 days. Usually, you have a few extra days after the due date to make a payment without a penalty. But if you go past that time, the bank will probably tell the credit bureaus that you made a late payment.

It’s important to know that Capital One doesn’t send information to the credit bureaus on weekends. This means that if your payment is due at the end of the week, you might have two additional days to pay before it’s considered late.

Another important point to remember is the balance that Capital One sends to the credit bureaus. For example, let’s say you have a balance of $200 on your due date, but then you spend an additional $500 after the due date but before the balance is reported.

Capital One will report the amount you owe on the day your payment is due. So, in this situation, Capital One would report a $200 balance, not a $700 balance.

How Credit Reporting Works?

Let’s go back a bit and discuss how credit reporting works. Every month, lenders and credit card companies give information about their customers to three big credit bureaus: Equifax, Experian, and TransUnion.

They provide a report that includes details about the customers’ personal and account information, such as their credit limit, current balance, and payment history.

For instance, if you have a Capital One credit card with a maximum spending limit of $1,000 and you currently owe $300, Capital One will inform the credit reporting agencies about this.

Creditors don’t have to give information to the credit bureaus. Some only give information to certain bureaus, not all three. Capital One, like other big creditors, gives information to all three bureaus.

When the companies that keep track of your credit receive information from the people you owe money to, they put all that information together with the rest of your credit history. Then, they use all of this information to figure out your credit scores.

When you make payments on time and keep a low balance on your Capital One credit cards compared to your credit limit, your credit score may go up.

However, if you miss payments or have a high balance compared to your credit limit, your credit score may go down when Capital One reports this to the credit bureaus.

How Frequently Does Capital One Report To The Credit Bureaus?

Usually, Capital One tells the credit bureaus about your payments every 30 to 45 days. This depends on when you make your payments. For example, suppose your payments are usually due on the 15th of the month and you have a one-week late payment period.

In that case, Capital One will probably report to the credit bureaus shortly after you miss the payment deadline. Sometimes, banks don’t report serious late payments until you have missed a few payments.

However, this can vary from bank to bank and from person to person. To find out when your statement closes, you can look at your credit card statement, check your online or mobile app account, or call customer service.

Another important thing to remember is that your credit report may not immediately update right after Capital One reports your account. It could take a few days to several months for the information to show up or affect your credit report. It might take even longer to show up on your credit score.

Why Does Your Credit Card’s Reporting Date Matter?

You may be wondering why it’s important when Capital One tells the credit bureaus about your payment history. As long as you pay your bill on time, isn’t that good enough? However, the timing of when this information is reported is actually more significant than you might realize.

One of the most important things that affects your credit score is how much of your available credit you are using. This is called your credit utilization ratio. For example, if you have a credit card with a limit of $1,000 and you owe $500, your credit utilization is 50%.

In general, try to keep your credit card usage below 30% (and preferably lower) to improve your credit score. If you use too much of your available credit, it may indicate to lenders that you are not responsible for credit. Your credit card usage makes up 30% of your credit score calculation, so having a high percentage can greatly affect your score.

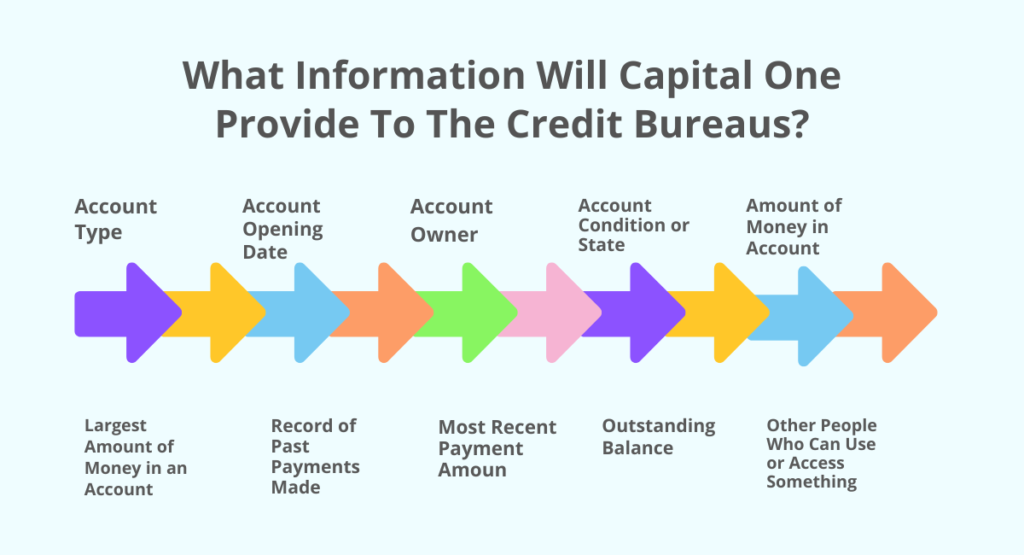

What Information Will Capital One Provide To The Credit Bureaus?

Every time Capital One sends information to the credit bureaus, they include a variety of details. They send a lot of information to make sure the correct account is identified, and the late payment is properly recorded. Here are some of the details that Capital One usually sends to the credit reporting bureaus:

- Account Type

- Account Opening Date

- Account Owner

- Account Condition or State

- Amount of Money in Account

- Largest Amount of Money in an Account

- Record of Past Payments Made

- Most Recent Payment Amount

- Outstanding Balance

- Other People Who Can Use or Access Something

Capital One sends information to credit bureaus every month, but the specific day can change for each account. This usually happens shortly after the statement closing date. Knowing this schedule and managing your account accordingly can help you improve your credit score. Remember, timing is important when it comes to your credit. Paying off your balance at the right time can make a big difference in how your credit utilization and payments are recorded, which affects your overall credit status.

Thanks for reading. I hope you find it interesting.