Although being appointed executor is widely regarded as a privilege, the duties associated with the position can be intricate and laborious. Gaining knowledge of them will facilitate selecting the most suitable individual to serve as your executor and guarantee that any determination you make regarding your executorship is well-informed.

An executor is responsible for the following: identifying and collecting the estate’s assets; safeguarding and investing those assets until they are distributed to beneficiaries; paying any liabilities or debts owed by the property; filing the necessary tax returns for the deceased and the estate; and ultimately, distributing the assets to beneficiaries by the terms of the will.

What Is An Executor?

The individual designated to administer a deceased person’s last will and testament is referred to as the executor of an estate. The main responsibility of the executor is to execute the decedent’s directives regarding the administration of their affairs and personal desires.

In cases where no prior appointment has been made, the executor is appointed by the testator of the will (the individual who creates the will) or by a court.

How Executors Work?

The executor is responsible for ensuring that every asset mentioned in the will is duly accounted for and subsequently transferred to the appropriate beneficiary or beneficiaries. Real estate, direct investments, financial holdings such as equities, bonds, money market investments, and collectibles such as artwork are all assets.

As required by the Internal Revenue Code, the executor must evaluate the estate’s value using the date when the deceased died or the alternative valuation date.

Additionally, the executor is responsible for ensuring that all of the decedent’s debts, including taxes, are satisfied and that an official notice is served to creditors. The executor is legally required to carry out the decedent’s wishes and act in the decedent’s best interest.

The executor is typically a family member, attorney, or accountant; their only requirements are that they be at least 18 years old and devoid of any previous felony convictions.

Some individuals who appoint themselves as executors believe they will not have to perform any labor for years. Nonetheless, completing the task at hand requires commencing work without delay. Jim Morrison once said, “The future is uncertain, and the end is always near.” Therefore, you accept immediate legal liability if you consent to serve as an executor.

What Is The Role Of An Executor In Estate Planning?

Executives play a crucial role in estate planning for individuals, their families, and beneficiaries. Estate planning is a comprehensive concept encompassing the preservation, administration, and distribution of a deceased person’s assets. Additionally, it considers the administration of the person’s assets and financial responsibilities (such as debts) in the case of their incapacity.

The responsibilities of an executor in the context of estate planning are manifold. An executor is responsible for the ultimate obligations of an estate, oversees the management of the decedent’s assets during the probate procedure, and coordinates the distribution of assets by the decedent’s testament after their demise.

Estate planning is undertaken for various reasons, including the preservation of family wealth, provision for surviving spouses and children, financing the education of children and descendants, and bequeathing a legacy to a charitable organization. A will is the most fundamental component of estate planning. Additional significant estate planning responsibilities include:

- Establishing beneficiary-named trust accounts to reduce estate taxes

- Creating a guardian for dependents who are still alive

- Appointing an executor of the estate to supervise the will’s provisions

- Creating or revising beneficiary designations for retirement, IRA, and life insurance plans

- Establishing memorial preparations

- Establish annual gifts to qualified charitable and non-profit organizations to reduce the taxable estate.

- Showing a durable power of attorney (POA) to make investment and asset decisions

Although being appointed as an executor is a privilege, carrying out the provisions of a will requires considerably more effort than one might anticipate. Before committing to serve as an executor, familiarize yourself with some of the potential risks involved. Additionally, be aware of how to mitigate some of these potential dangers to ensure that your duties as an executor operate smoothly.

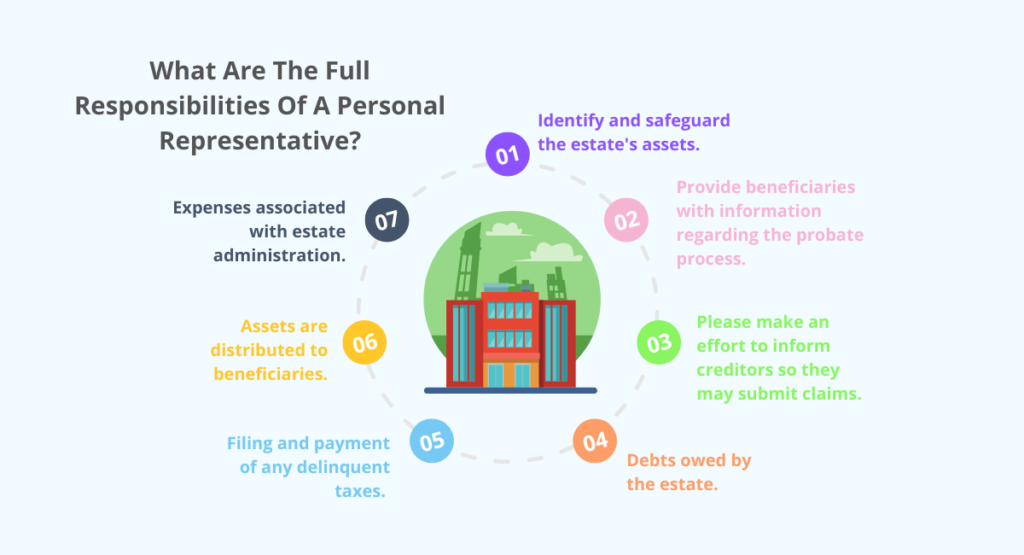

What Are The Full Responsibilities Of A Personal Representative?

It is expected of a personal representative to:

- Identify and safeguard the estate’s assets.

- Provide beneficiaries with information regarding the probate process.

- Please make an effort to inform creditors so they may submit claims.

- Debts owed by the estate.

- Filing and payment of any delinquent taxes.

- Assets are distributed to beneficiaries.

- Expenses associated with estate administration.

Beyond the responsibilities enumerated above, personal representatives have additional obligations. As a result of the intricate legal issues at hand, the personal representative might consider engaging the services of an attorney. A personal representative can receive assistance from an attorney with any matters that may arise during the probate procedure.

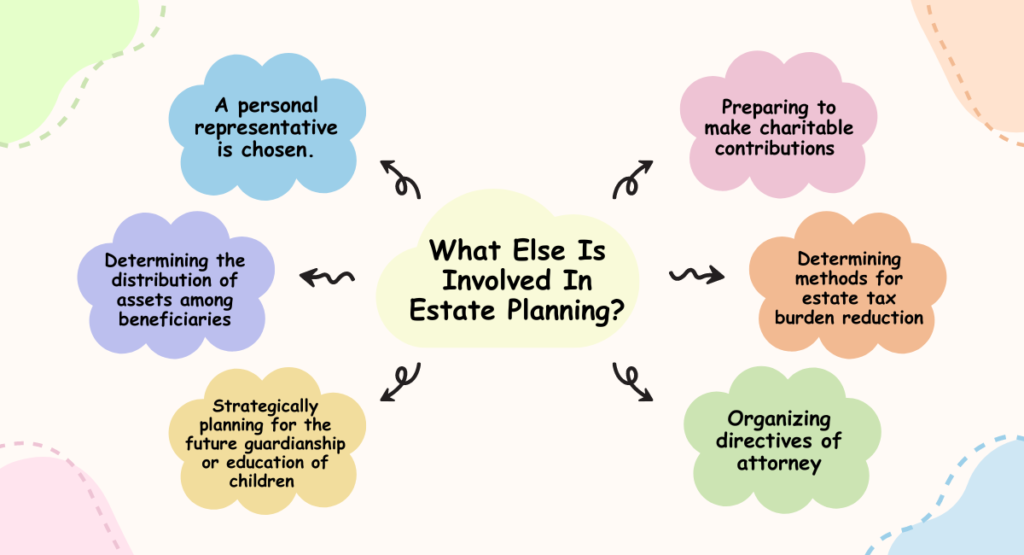

What Else Is Involved In Estate Planning?

Estate planning enables people to establish provisions for administrating their estate after their demise. The practice of estate planning may comprise:

- A personal representative is chosen.

- Determining the distribution of assets among beneficiaries

- Strategically planning for the future guardianship or education of children

- Preparing to make charitable contributions

- Determining methods for estate tax burden reduction

- Organizing directives of attorney

A legal professional can provide comprehensive assistance throughout the estate planning process, including elucidating the responsibilities of a personal representative and aiding in drafting a will.

What Does An Executor Of An Estate Do?

Although the specific duties and obligations of an executor may differ from state to state and estate to estate, they typically encompass the following:

- Engaging in dialogue with the counsel (or another court having authority over probate proceedings)

- Acquiring authority and identifying probate assets, including:

- Bank accounts

- Salaries accrued

- Individual property

- Retirement funds or life insurance proceeds payable to the estate.

- Business interests held by the decedent

- Expenses, taxes, and obligations paid with estate assets

- Ascertaining the estate distributions to be made

- Conducting distributions to heirs and beneficiaries

- Assisting attorneys and accountants throughout the estate administration process

- Maintaining detailed records and accounts and, if required, filing with the court an inventory and accounting of assets

The duties and obligations listed here are examples of the various categories of obligations an Executor might be entrusted with. There may be estates that necessitate further obligations, while specific duties mentioned above may not be mandatory.

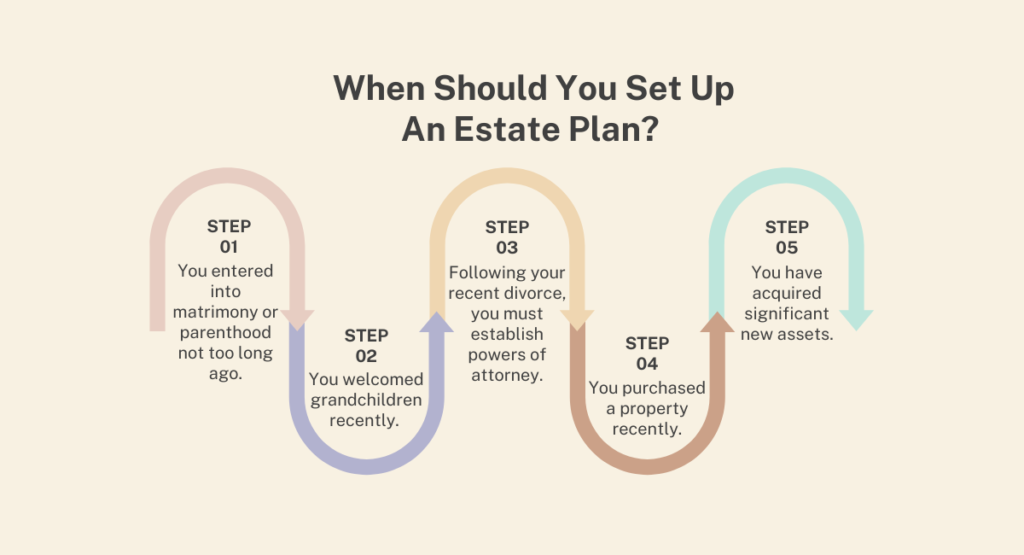

When Should You Set Up An Estate Plan?

It is possible to develop an estate plan at any point in one’s existence. You may wish to establish or revise an estate plan if the following applies:

- You entered into matrimony or parenthood not too long ago.

- You welcomed grandchildren recently.

- Following your recent divorce, you must establish powers of attorney.

- You purchased a property recently.

- You have acquired significant new assets.

If you are still determining whether modifications to an existing will are necessary, our team can assist you in weighing your options. You are not required to undergo the process alone.

Being An Executor

To qualify for the role of executor, one ought to:

- Ensure that the testator maintains an inventory of their assets and liabilities, encompassing real estate, investment accounts, bank accounts, and insurance policies.

- Please know the location and access instructions for the original will and asset inventory.

- Understand the function of the attorneys or agents named by the testator and their names and contact information.

- Deliberate on the testator’s funeral or memorial service preferences, encompassing specific directives regarding interment or cremation.

- To reduce the likelihood of future complications, the testator and, if possible, the beneficiaries should consult regarding the will.

- Maintain copies of each of these documents.

The person responsible for executing a last will is the executor. They must ensure that the legacies and intentions of the deceased are duly carried out. Under the probate court’s supervision, this frequently entails the distribution of the estate’s assets, settlement of any outstanding obligations, and payment of any taxes owed. Before death, individuals often designate the executor of their estate in their will. If an executor is not specified, one will be appointed by a probate court.

Thank you for reading…..

Read more: What Are Capital Markets In Real Estate?