In personal finance, budgeting is like navigating through life with financial agility. Understanding variable expenses is key to a good budget. Variable expenses are unpredictable but important costs that can make budgeting challenging.

They can be fun to spend on but need careful monitoring to stay on track. This article explores what variable expenses are, how they affect your budget, and tips for managing them effectively. Learn how to use variable expenses to build financial resilience and success.

What Is A Variable Expense?

Variable expenses can change each month, unlike fixed expenses which stay the same. These costs can happen regularly but the amount you pay can vary from month to month.

It can be harder to budget for expenses that change each month, because you might not know exactly how much they will be. If you don’t keep track of these expenses, you might end up spending too much or too little on them. Using a budgeting app can help you keep better track of these expenses and avoid any surprises.

Variable expenses can be things you need to pay for, like a doctor’s visit when you’re sick, or things you choose to spend money on that you don’t really need. These are the “wants” in your budget.

Examples Of Variable Expenses

What is included in a budget for variable expenses can be different for each person. Some common variable expenses you might have are:

- Gas

- Parking fees

- Groceries

- Dining out

- Clothing

- Personal care expenses

- Healthcare expenses

- Home maintenance and repairs

- Entertainment

- Hobbies and recreation

Certain costs that change often may not happen regularly. For instance, you might go on trips a few times a year. The cost each time could be different, but you don’t pay for these costs every month. Instead, you can plan for these variable expenses by saving money specifically for them.

What Is A Variable Expense For Many Adults?

Variable expenses are important in personal finance and can change depending on what you choose to spend money on. Unlike fixed expenses that stay the same each month, variable expenses can go up or down based on your lifestyle and other factors.

These expenses are for things you don’t really need, but can make your life better. Understanding variable expenses is critical for effective money management and meeting future financial goals.

Some common variable expenses for adults are eating out, having fun, traveling, hobbies, buying clothes, and grooming. Eating out includes spending money at restaurants, cafes, or ordering food to go, which is convenient and lets people socialize.

Having fun includes activities like going to movies, concerts, or using streaming services, giving people a chance to relax and have fun. Travel expenses cover costs for vacations, short trips, and transportation other than regular commuting, allowing people to discover new places and make memories.

Hobbies and recreation are things like sports, arts and crafts, gaming, or gym memberships that make people happy. Clothing and accessories are purchases like clothes, shoes, and grooming products that show personal style.

Gifts and special occasions are expenses for birthdays, holidays, weddings, and other celebrations to show appreciation and mark important events with family and friends.

To control variable expenses well, you need to plan, watch, and prioritize. First, make a budget with your regular bills, savings goals, and flexible spending. Keep an eye on your spending with budget tools, apps, or spreadsheets to see where you can do better.

Set limits for each flexible spending category based on your income, goals, and lifestyle to stick to your budget and not spend too much. To control variable expenses well, you need to plan, watch, and prioritize. First, make a budget with your regular bills, savings goals, and flexible spending.

Keep an eye on your spending with budget tools, apps, or spreadsheets to see where you can do better. Set limits for each flexible spending category based on your income, goals, and lifestyle to stick to your budget and not spend too much.

Deciding what to spend money on first means figuring out which optional expenses make you happiest or match your beliefs and putting more money towards them. Thinking ahead about upcoming costs that might change, like holidays or trips, lets you plan your budget and avoid money problems.

Looking for ways to save money, like using discounts or coupons, can help you spend less without giving up the things that make you happy. Deciding what to spend money on first means figuring out which optional expenses make you happiest or match your beliefs and putting more money towards them.

Thinking ahead about upcoming costs that might change, like holidays or trips, lets you plan your budget and avoid money problems. Looking for ways to save money, like using discounts or coupons, can help you spend less without giving up the things that make you happy.

Changing how much money you spend on flexible expenses when your income, expenses, or financial goals change is important for being able to adjust to different situations. By being careful with how you spend money and sticking to a budget, people can use flexible expenses to become financially stable and successful. Being good at managing flexible expenses helps people take charge of their money and live the way they want.

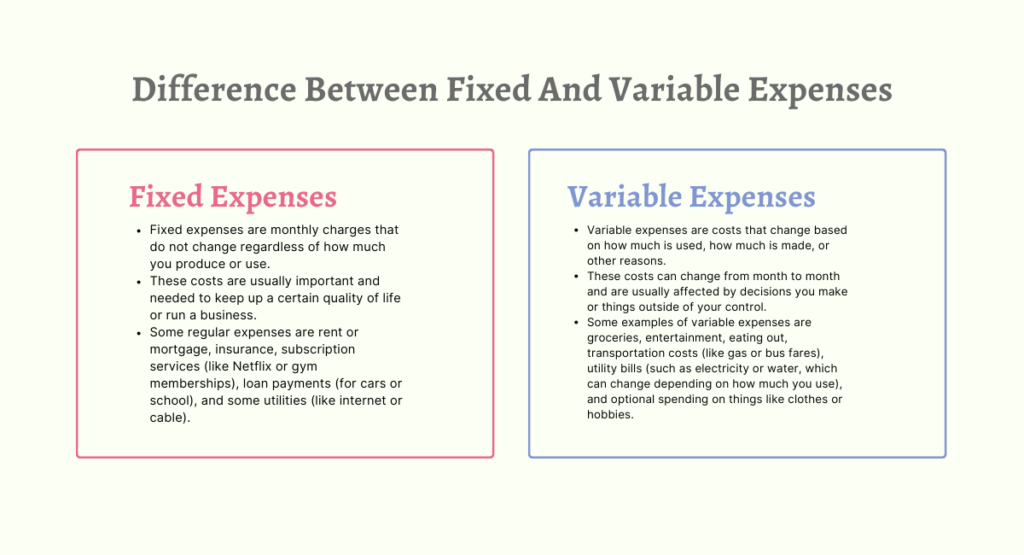

What’s The Difference Between Fixed And Variable Expenses?

Fixed expenses and variable expenses are two types of costs for running a household, business, or personal budget. Fixed expenses stay the same each month, while variable expenses can change:

Fixed Expenses

- Fixed expenses are monthly charges that do not change regardless of how much you produce or use.

- These costs are usually important and needed to keep up a certain quality of life or run a business.

- Some regular expenses are rent or mortgage, insurance, subscription services (like Netflix or gym memberships), loan payments (for cars or school), and some utilities (like internet or cable).

Variable Expenses

- Variable expenses are costs that change based on how much is used, how much is made, or other reasons.

- These costs can change from month to month and are usually affected by decisions you make or things outside of your control.

- Some examples of variable expenses are groceries, entertainment, eating out, transportation costs (like gas or bus fares), utility bills (such as electricity or water, which can change depending on how much you use), and optional spending on things like clothes or hobbies.

Tips For Saving On Fixed And Variable Expenses

If you need more space in your budget, saving money each month can help. How you save money can depend on if you’re trying to reduce your regular or changing expenses.

Some expenses are easier to reduce than others. For instance, you can save money on insurance by looking for a better deal. But saving money on housing might mean moving or refinancing your mortgage.

By paying off your debts, you can save money by combining or rearranging your bills. For example, transferring your balance to a credit card with a 0% interest rate for a limited time can help you save on interest charges. Just make sure you can pay off the balance before the offer ends. You can also think about refinancing student loans or combining debts with a personal loan that has a low interest rate to save money.

If you want to spend less on things that can change, you may need to make some changes in how you live. For instance, you could spend less by not going out to eat or buying new clothes. Another way to save money is to plan your meals better, use coupons, or buy store-brand items instead of name brands.

When your expenses can change, you can usually manage them better than expenses that stay the same. This makes it easier to find ways to save money.

Budgeting For Both Fixed And Variable Expenses

First, make sure to set aside money for important things like rent, car payments, and child care. These are costs that stay the same each month, so it’s best to pay them first. After that, you can decide how much money you want to spend on things like going out to eat or having fun.

It’s also important to keep track of spending on things that are not necessary. This can help you see where you can spend less money if you want to save more each month.

The 50/30/20 rule can help you plan your money for things you have to pay for every month and things you want to buy. It says you should use 50 percent of your money for needs, 30 percent for wants, and 20 percent for saving.

For many adults, variable expenses are costs that change each month based on personal choices and situations. These expenses include things like groceries, eating out, entertainment, transportation, and extra spending. It’s important to know the difference between fixed expenses (like rent or bills that stay the same each month) and variable expenses. By separating your expenses into these categories and keeping track of them in a monthly budget, you can see where your money is going and find ways to save. Managing variable expenses is crucial for making a budget and planning for your finances.

Thanks for reading. I hope you find it interesting.

Read More: What Does An Outstanding Balance Mean?