Applying for bankruptcy on credit cards can be scary, but it’s something that many people with a lot of debt may need to think about. Knowing how to handle this process is important for protecting your finances in the future.

In this guide, we’ll show you the important steps and things to think about when filing for bankruptcy because of credit card debt. This will help you make smart choices and manage your money better.

Understanding Bankruptcy

Bankruptcy is a legal process where a judge and trustee look at what someone or a business owns and what they owe if they can’t pay their debts.

Bankruptcy laws help people and businesses start over after money problems. They need to follow certain steps to do this.

These steps involve giving the bankruptcy court and trustee your financial details, getting credit counseling before filing, filling out over 20 bankruptcy forms, and going to a meeting with your creditors as required by Section 341 of the Bankruptcy Code.

How To File Bankruptcy On Credit Cards?

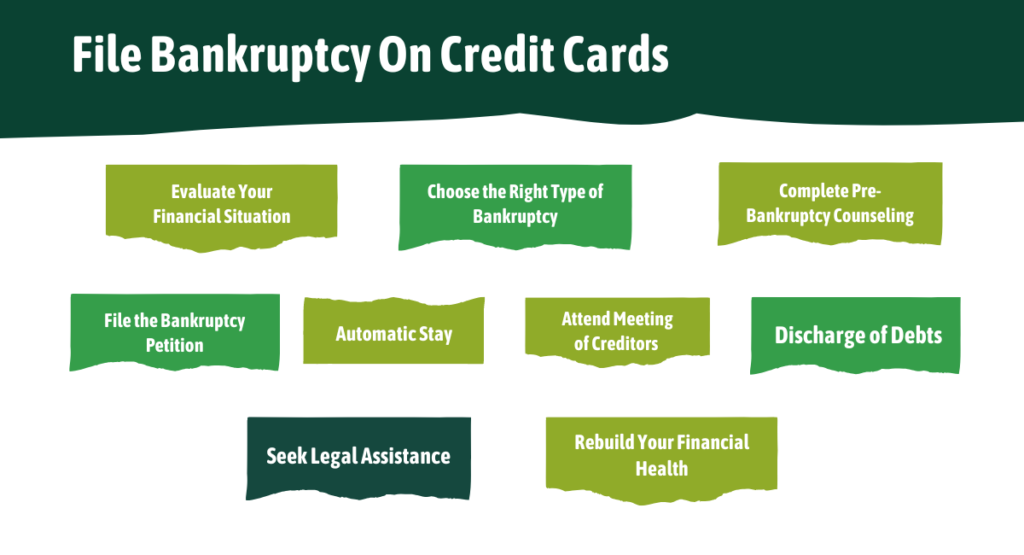

When you file for bankruptcy on your credit cards, there are a few steps you need to take. Here’s a basic guide on what to do next:

Evaluate Your Financial Situation

Check how much money you owe, like on credit cards, and how much money you make and spend. See if you can’t handle your credit card debt, and think about whether filing for bankruptcy is the best choice for your situation.

Choose The Right Type Of Bankruptcy

Determine which type of bankruptcy best suits your needs:

Chapter 7 Bankruptcy: Involves selling off assets that are not protected by law to pay back people or companies you owe money to. After that, any debts that are eligible are usually forgiven, like credit card debt.

Chapter 13 Bankruptcy: You need to make a plan to slowly pay back some or all of what you owe, like credit card bills, over three to five years.

Complete Pre-Bankruptcy Counseling

Before you apply for bankruptcy, you need to finish a credit counseling class from an approved place. This rule is in place to make sure that people really know their money situation and look at other options instead of bankruptcy.

File The Bankruptcy Petition

To start bankruptcy, you must submit a request to the bankruptcy court in your area. This request will have information about your money situation, like what you own, owe, make, and spend.

Automatic Stay

When you file for bankruptcy, creditors can’t keep trying to collect money from you. This includes making phone calls, suing you, taking money from your wages, and trying to take your home.

Attend Meeting Of Creditors

After you submit your paperwork, you will go to a meeting with your creditors called a 341 meeting. You will answer questions regarding your financial condition during this meeting, and your creditors will have the opportunity to ask questions as well.

Discharge Of Debts

If you do everything you need to for your bankruptcy, like taking financial classes and following a payment plan, some debts like credit card bills might go away, so you won’t have to pay them anymore.

Seek Legal Assistance

Because bankruptcy is complicated and can have lasting effects, getting help from a bankruptcy lawyer is a good idea. They can give you advice tailored to your situation, help you follow the law, and stand up for you during the bankruptcy process.

Rebuild Your Financial Health

Deciding to declare bankruptcy can impact your credit score and money situation in the long term. Afterward, manage your money carefully by making a spending plan, saving for emergencies, and using credit wisely to improve your credit score over time.

Which Bankruptcy Is Best For You?

The bankruptcy you choose depends on if you want to get rid of your credit card debt or make a plan to pay it back. You can pick from these options, as stated by the United States Courts:

Chapter 7 bankruptcy helps people eleminate their debts and keep most of their stuff. Businesses can also sell off their assets under Chapter 7.

Chapter 9 bankruptcy helps cities and towns with money problems to manage their debt better.

Chapter 11 bankruptcy helps businesses change how they owe money and stay open for business.

Chapter 12 bankruptcy helps farmers and fishermen who are struggling with debt to make a plan to pay it back.

Chapter 13 bankruptcy lets people create a plan to pay back their credit card and other debts over several years.

Chapter 15 bankruptcy helps debtors from other countries.

Can I Be Sued After Filing For Bankruptcy?

When you file for bankruptcy, a rule called the “automatic stay” helps protect you from credit card companies trying to sue you for money.

If the credit card company sued you for debt before you filed for bankruptcy and the case is still ongoing, the lawsuit can’t move forward until the automatic stay is lifted, unless the bankruptcy court allows it.

If you get rid of your debts in Chapter 7, it usually includes getting rid of debts from lawsuits for owing money.

Are There Consequences For Filing Bankruptcy?

Filing bankruptcy on credit cards can lower your credit score for a little while, but not paying your bills can do the same. Bankruptcy can clear your debts and give you a new beginning.

After finishing bankruptcy, you can apply for a new credit card. By paying on time for your new card, you can eventually boost your credit score.

Can I Still Have My Credit Card After Bankruptcy?

People who owe money and declare bankruptcy may want to keep one credit card for emergencies. However, all debts must be included in the bankruptcy filing. Debtors can choose to keep paying a specific debt even after filing for bankruptcy, which is called reaffirming the debt.

This means they agree to pay back that debt according to the original terms. While it’s common to reaffirm debts for things like a house or car, it’s usually not a good idea to reaffirm credit card debt.

If you do, the credit card company may still close your account and you’ll have to pay back the debt, as well as any extra fees. Instead, it’s better to include all credit card debt in the bankruptcy and then get a secured credit card after the bankruptcy is over to rebuild your credit.

Advantages And Disadvantages Of Bankruptcy

Declaring bankruptcy can help you stop having to pay your debts and keep your home, business, or ability to manage money, depending on the type of bankruptcy you file. However, it can make it more difficult to borrow money, obtain a mortgage or credit card, purchase a home or company, or rent an apartment because your credit score will likely fall.

If you’re thinking about filing for bankruptcy, your credit is likely not in good shape. Keep in mind that a Chapter 7 bankruptcy remains on your credit report for ten years, whereas a Chapter 13 bankruptcy stays for seven years. This may make it difficult for you to obtain additional loans or credit cards in the future.

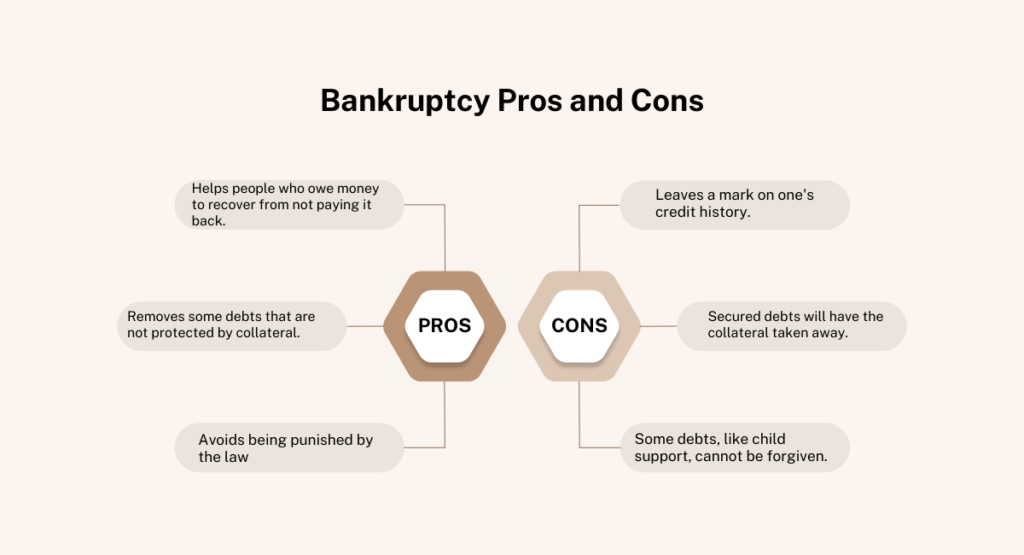

Bankruptcy Pros And Cons

Pros

- Helps people who owe money to recover from not paying it back.

- Removes some debts that are not protected by collateral.

- Avoids being punished by the law

Cons

- Leaves a mark on one’s credit history.

- Secured debts will have the collateral taken away.

- Some debts, like child support, cannot be forgiven.

Declaring bankruptcy on credit cards can be hard and overwhelming, but it can help you get out of debt and start fresh. By learning about the process, looking at your money situation, and getting advice from lawyers, you can go through bankruptcy with confidence and manage your money better. Keep in mind that bankruptcy can help with debt right away, but it’s important to see it as a way to get back on track financially and make a stronger financial base for the future.

Thanks for reading. I hope you find it helpful.

Read More: How Do You Calculate Missing Cost Basis?