Figuring out how to deposit a check that is not in your name can be a confusing process. It brings up concerns about whether it’s allowed, what the bank rules are, and what is the right thing to do. Many people wonder if it’s okay to deposit a check that is meant for someone else, like a relative, a company, or a buddy.

In this guide, we will try to understand this question better. We will look at the things that affect it, like laws, banking rules, and ways to handle it. This will help you know what to do if you come across this situation.

In this article, we will talk about situations where you might deposit a check that has someone else’s name on it. This could happen if you’re looking after a child’s money or helping a family member or friend with their finances. We will also look at the risks involved and suggest other ways to handle the situation.

Understanding The Rules For Depositing Checks

Banks and credit unions have strict rules they must follow for deposits, withdrawals, and confirming customers’ identities because they are closely monitored.

Based on the rules of the Uniform Commercial Code (UCC), a bank can only cash a check if the customer agreed to the payment and it follows the bank’s rules.

Remember, depositing a check made out to someone else without permission could be against the law. If you sign the check as that person and put it in your account, you might be accused of check forgery.

Can I Deposit A Check With Another Name?

“Can I Deposit A Check With Another Name?” is a common question. The answer depends on rules, bank policies, and possible solutions.

Legally, the name on a check shows who it’s for. Banking rules usually say the person or company it’s for has to sign the check before it can be cashed or deposited. The signature gives permission for the bank to do the transaction.

But there are times when you might need to deposit a check with a different name. For instance, you might get a check meant for a family member who can’t deposit it, or you might get a check for a business you represent.

In these situations, it’s important to think about the possible dangers of depositing a check that has someone else’s name on it. Different banks have different rules for depositing checks for someone else, and some might need extra paperwork or proof to do it. Also, depositing a check with someone else’s name without permission could make people worry about fraud or lying.

Before trying to deposit a check with a different name, it’s best to talk to your bank first and think about other options. This could mean getting permission from the person named on the check, looking into other ways to endorse it, or using different methods like electronic transfers to get the money.

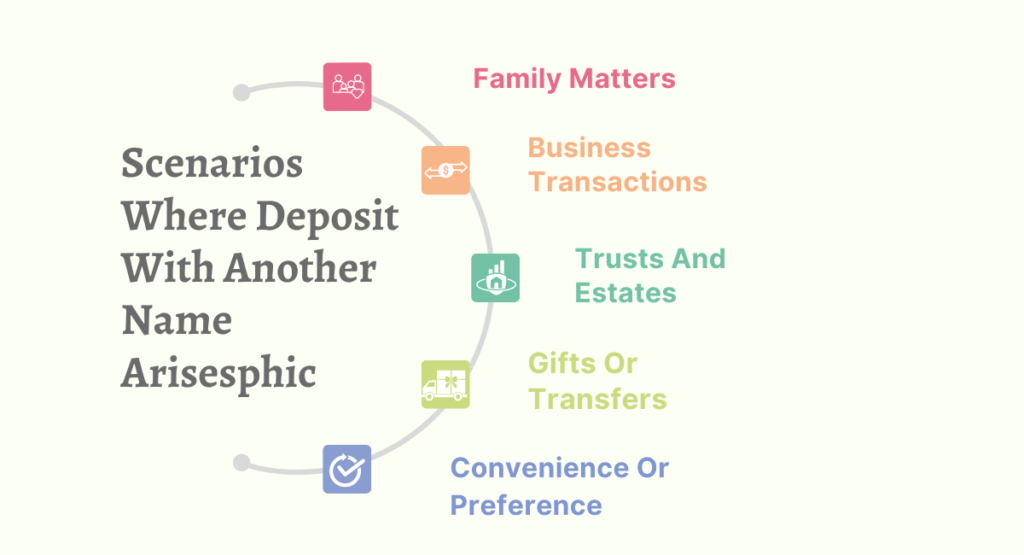

Scenarios Where Deposit With Another Name Arises

Examples of when you might need to deposit a check with a different name can be different and might happen for special reasons. Here are some common situations where this could happen:

Family Matters

You could get a check for a family member who can’t deposit it because they’re sick, unable to, or not there. In these situations, you might need to deposit the check for them.

Business Transactions

If you own a business by yourself or are in charge of a business, you might get checks that are written out to the business instead of your own name. Putting these checks into your business bank account might need some extra steps or rules to follow.

Trusts And Estates

Some people who receive checks from trusts or estates may want to put the money in their own bank account instead of one just for the trust or estate.

Gifts Or Transfers

People may get checks from friends or people they know as presents or for informal money exchanges. If the person wants to put the check in their bank account instead of having the person who wrote it do it, they may have to deposit it with a different name.

Convenience Or Preference

Sometimes, a person may want someone else to deposit their check for them because it’s easier or they like it better that way.

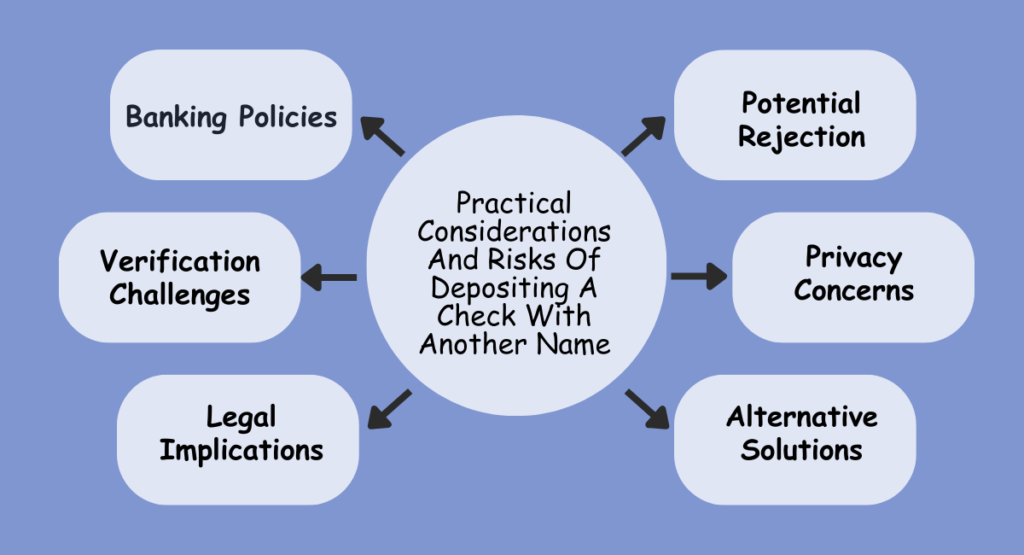

Practical Considerations And Risks Of Depositing A Check With Another Name

When thinking about depositing a check that has a different name on it, it’s important to think about the practical things and possible risks. Here are some important things to remember:

Banking Policies

Many banks have rules about depositing checks with names that are different from the account holder’s name. Some banks may allow third-party checks in certain situations, while others may need more proof. Make sure you know your bank’s rules before depositing a check like this.

Verification Challenges

When you deposit a check with someone else’s name on it, it might be harder for the bank to make sure it’s real. They might look at these deposits more carefully to make sure they’re not fake or not allowed. This could make it take longer or be more difficult to deposit the check.

Legal Implications

If you try to deposit a check with someone else’s name without permission, it could be illegal. This might lead to accusations of fraud or lying. Make sure you have permission from the person named on the check before depositing it.

Potential Rejection

Banks can decide not to accept checks that don’t meet their rules. If a bank finds a check with a different name doesn’t follow their rules, they can choose not to deposit it. This might mean the check is sent back without being paid or is kept for more checking.

Privacy Concerns

When you deposit a check with someone else’s name on it, you might have to give out personal or financial information to other people. It’s important to think about how this could affect your privacy and make sure to keep your information safe.

Alternative Solutions

Sometimes, there are other ways to deposit a check that has a different name on it. You can ask the person named on the check to sign it, use electronic transfers to move the money, or get a new check with the right name on it. Trying these options can reduce risks and follow banking rules.

Can I Put Someone Else’s Check In My Bank Account?

Yes, you can deposit a check for someone else, either into their account or yours. Different banks and credit unions have their own rules for depositing checks not made out to you, so the process and requirements may be different.

Here are some situations where someone might ask you to put their checks in the bank for them:

One of your brothers or sisters borrowed money from you. Instead of giving you cash, they decide to write you a check with their name on it.

An older family member gets a check but can’t go to the bank to put it in their account. They don’t use mobile banking. You say you’ll put the check in their account for them.

Your friend without a bank account got a check in the mail. They want you to put it in your account and give them the money.

How Do You Put Money In The Bank For Someone Else?

To deposit a check for someone else, you need to know if you’re putting it in your account or theirs. Follow the steps below, but also check the bank rules to avoid problems.

If you want to put someone else’s check into your own bank account:

Check the details on the check to ensure everything is filled out correctly. This includes the date, who it’s payable to, the amount, and the signature line.

Ask the person to write “Pay to the order of (your name)” on the back of the check where you sign, and then sign their name underneath it.

Bring the check to your bank and write down the amount, your name, and account number on a deposit slip.

Hand the check and deposit slip to the bank teller to put money into your account. If you don’t get a receipt, make sure to ask for one so you can keep track of the deposit.

If you want to give a check to someone else to deposit, you can do it by writing their name on the back of the check and signing it over to them. Then they can deposit it into their bank account.

If you are putting a check into someone else’s bank account:

Ask them to check the check carefully to make sure the information is right. If it is, they can sign the back of the check and write “For deposit only” in the box.

They will have to write their name, account number, deposit date, and the amount of the check on a deposit slip.

Bring the check and deposit slip to the bank to put money in the account. It’s a good idea to get a receipt as proof of the deposit.

It’s easier to deposit a check for someone else into their account by taking it to their bank. But if you try to deposit it into your own account, the bank might say no.

If you give your check to someone else, it becomes a third-party check. Some banks may let you deposit or cash these checks, but they don’t have to. If your bank doesn’t allow third-party checks, you can’t deposit a check for someone else into your account.

If you want to deposit a check with someone else’s name on it, it’s important to think about the rules and risks involved. Talk to your bank first and think about other options to follow the rules and stay safe. By handling this situation carefully, you can handle your money matters honestly and confidently.

Thanks for reading. I hope you find it helpful.

Read More: What Is An Intangible Asset Check All That Apply?