Knowing how much your small business is worth is important for making smart choices about what to do next, like selling it, getting investors, or making it bigger. But figuring out the value of a small business can be tricky and detailed, needing a close look at different factors and money numbers.

Luckily, technology now makes it easier for small business owners to estimate the value of their company. Online calculators designed for small businesses are simple to use and don’t require advanced financial knowledge or expensive professional help.

In this guide, we will talk about how to figure out how much your small business is worth and introduce you to tools that can help. Whether you have been in business for a while and want to know your business’s value or are just starting out and want to see what your business could be worth, this guide will give you helpful information and tips on using a small business valuation calculator.

Come with us as we start a journey to find out how much your small business is worth and learn more about its finances. Using a small business value calculator, you can make smart choices that help your business grow and become more successful.

Understanding Small Business Valuation

Knowing how much a small business is worth is important for people looking to start a business, invest in one, or sell one. Valuation is the process of figuring out the value of a business, which helps with making smart choices about buying, selling, or investing. Here are some important things to know about valuing small businesses:

Purpose

Valuation is important for different reasons, such as selling a business, obtaining an investment, getting a loan, planning for your estate, dealing with legal issues, and reporting finances. The reason for the valuation decides how it is done and what is taken into account.

Methods

There are different ways to figure out how much a small business is worth. Some common methods include looking at the value of its assets, its income (like Discounted Cash Flow), how it compares to other businesses in the market, and how much it costs to start the business. The method you choose depends on things like what kind of business it is, the industry it’s in, and what information you have.

Factors

Valuation considers many factors to determine a business’s worth. This includes money-related stuff like sales, earnings, money coming in and going out, things the business owns, and debts. Other things like how much people want the product, how well the business stands out from others, any special ideas the business has, how much it can grow, and what’s happening in the industry also help decide how valuable the business is.

Timing

When you value something, the timing can make a big difference. Things like how well the market is doing, trends in the industry, and how the business is doing when you value it can all affect its worth. You might need to update the value regularly to keep up with changes in the business world.

Professional Assistance

Determining the worth of a small business can be difficult, so it’s a good idea to get help from experts like business valuators, accountants, or financial advisors. They know how to do detailed valuations and can explain what factors affect the business’s value.

Subjectivity

Even when using structured methods, valuing a small business involves some personal judgment. Different experts may come up with slightly different values based on how they see the information and the assumptions they make. It’s important to know the reasons and boundaries of any valuation.

Legal And Regulatory Considerations

Valuations must follow legal rules when companies merge, shareholders disagree, or plans are made for property after someone dies. Following these laws guarantees the accuracy and legality of the valuation.

How To Value A Small Business Calculator?

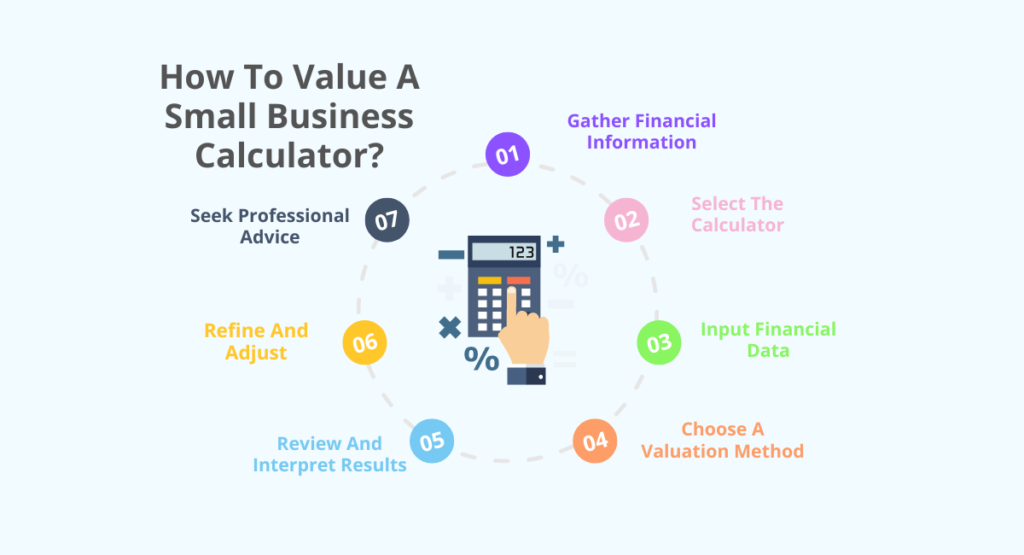

A small business valuation calculator helps figure out how much a business is worth using different money numbers and things. Here’s how to use one well:

Gather Financial Information

Begin by gathering important financial information about the business, like how much money it makes, spends, owns, and owes. The more accurate and specific your financial details are, the more accurate your estimate of the business’s value will be.

Select The Calculator

Select a reliable tool to estimate the value of a small business that fits what you’re looking for. There are various options online, each with different functions. Find one that lets you adjust the information you provide and is easy to use.

Input Financial Data

Put the numbers about money you found into the calculator. This can be old money information and guesses for how much money you will make and spend in the future. Make sure to type in the right numbers so the calculator can give you a correct estimate of how much something is worth.

Choose A Valuation Method

Many tools for valuing small businesses let you pick from different ways to calculate value, like looking at income, market trends, or assets. Pick the one that fits your business and industry the best.

Review And Interpret Results

After you put in all the needed information, check the value estimate given by the calculator. Make sure you understand how the calculation was done. Remember, the value shown is just an estimate and might not be exactly what your business is worth.

Refine And Adjust

If you want, you can adjust your inputs and do the calculation again to see how different scenarios and values might affect the value of your business. Changing important factors like sales estimates or discount rates can help you see how different things can change the overall value of your business.

Seek Professional Advice

Small business value calculators can be helpful, but they might not show all the details of your business. It’s a good idea to talk to an expert like a business appraiser, accountant, or financial advisor for a more detailed and accurate value, especially if you’re making big decisions for your business based on the value.

How Do You Calculate The Value Of A Business?

You might need to find out how much your business is worth for different reasons. For example, if someone wants to buy it, if you plan to sell it soon, or if you need to know for insurance reasons (like if your business gets damaged in a fire).

The price someone will pay for your business usually depends on two things: how much money they can make from it (ROI) and how risky it is. If your business makes a lot of money and is not very risky, you can probably sell it for more.

As a business owner, you have likely invested a lot of time, money, and effort into building and expanding your business. ROI shows how much extra money you have made compared to what you initially invested after deducting all your business costs. The basic ROI formula is:

ROI (%) = (Return/Original Investment) x 100%

For instance, say you put $100,000 into the business at first, and you make $20,000 in profit. Then your ROI would be 20%:

ROI (%) = ($20,000/$100,000) x 100% = 20%

A good return on investment is important, but it’s also important to consider the risks. If someone is taking a big risk in buying a business, they should expect a higher return on their investment. Riskier investments that have the potential for higher returns can also lose value quickly due to their unpredictability.

A new owner should be okay with the balance between the current return on investment and the risk of owning the business. For example, a restaurant that has been making more money each year for the past five years may be less risky for a new owner than one that has had the same revenue for two years.

To reduce the chance of your business failing in the future, a buyer might also want to see proof of these qualities in your business:

- Predictable factors that lead to new sales

- Opportunity for business to grow or expand

- Good connections with suppliers

- A team of dedicated, hardworking, and inspired employees

- Many customers come back to buy again.

- No past or current legal cases or tax problems.

- Having a well-known brand with clear trademarks, copyrights, and legal background.

- Well-documented ways to do things to make the business run smoothly.

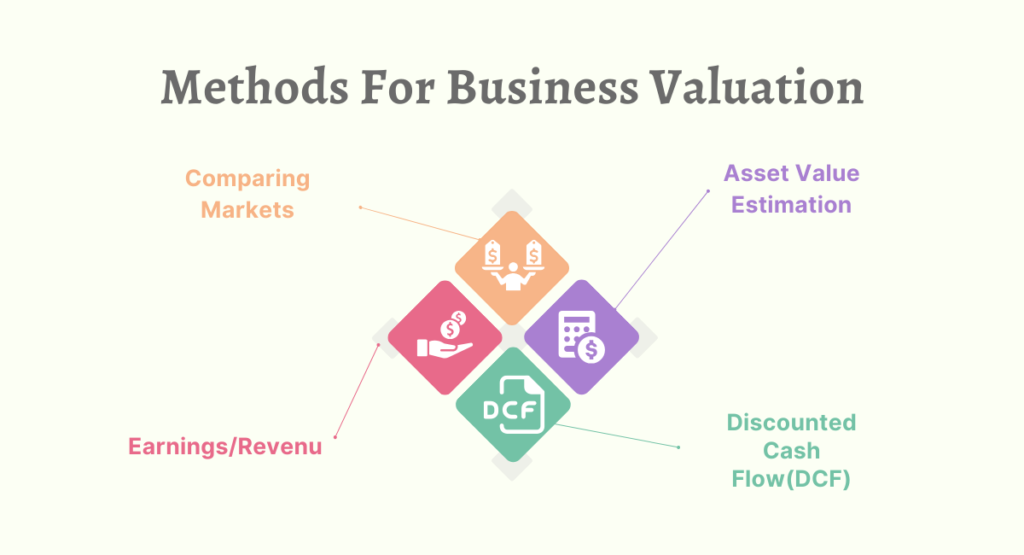

Methods For Business Valuation

Let’s take a look at four primary methods for determining the value of a business:

Asset Value Estimation

The asset-based approach looks at how much the company’s stuff is worth after you take away what it owes. This can help figure out how much the company is worth when selling or closing down, but it might need to be changed to match what the stuff is really worth on the market.

Discounted Cash Flow(DCF)

This method looks at future money coming in and uses a discount rate to figure out how much it’s worth now. If the value is higher than what we paid, it might be a good opportunity for profit. Just remember, we’re estimating future money, so there are some limits to how accurate this method can be.

Earnings/Revenue

The times revenue business valuation method looks at how much money a business makes over time and then multiplies that by a certain number. This number changes depending on the industry or the economy. The earnings multiplier method is also used to predict how well a business will do in the future. This method changes the price-to-earnings ratio to match current interest rates.

Comparing Markets

One way to figure out how much a company is worth is to multiply the share price by the number of shares. But this can be tricky for businesses owned by one person, since it’s hard to find information on similar sales.

In short, a small business valuation calculator can help you estimate how much your business is worth by looking at important factors like finances, industry trends, and growth. By using the right methods and entering the correct information, you can learn more about your business’s value and make smart choices for the future. Keep in mind that while calculators are useful, it’s a good idea to get advice from experts for a full and accurate valuation.

Thanks for reading. I hope you find it helpful.