Credit must be obtained to establish credit; opening a credit card account may be one method to achieve this objective. One might mistakenly believe that establishing credit card eligibility with a credit history is challenging or attainable. However, that can be different if one knows the initial steps.

Establishing credit by applying for premium rewards credit cards is likely a more advisable course of action. Approval for these types of accounts typically requires decent to excellent credit. You may reconsider the premium credit card concept after establishing a positive credit history and a satisfactory credit score.

How Can A Credit Card Benefit Your Credit Score?

Establishing credit through a credit card requires evidence that you are a conscientious borrower. You can achieve this by remitting your payments promptly. Pay off the balance as a whole or over the minimum payment.

Spending your entire credit limit is damaging to your credit score. A higher credit utilization ratio hurts an individual’s credit score. Use at most 30 per cent of your approved credit limit on credit. Thus, if your credit limit on your cards is $9,000, make every effort to maintain a balance of no more than $3,000 at any given time.

Additionally, refrain from applying for numerous credit cards. Each credit application submission negatively impacts your credit score. While increasing the number of credit cards may improve your credit utilization ratio, doing so can also elevate the likelihood of accumulating additional debt.

Best 6 Ways To Build Credit With A Credit Card

It is crucial to constantly maintain good credit behaviours while managing your credit card responsibly and strategically. This is achieved primarily through keeping a low balance and always making on-time payments.

Here are six essential measures for credit card credit building.

1. Always Make Payments On Time

Establishing credit by consistently making on-time payments is, without a doubt, the most effective method of using a credit card. The most significant determinant of your credit score is your payment report, which accounts for 35% of your FICO Score and is utilized by 90% of the best lenders.

A history of on-time payments contributes significantly to developing a high credit score and demonstrates to lenders that you are a conscientious borrower. On the other hand, late payments remain on your credit report for 7 years and negatively impact your score.

To establish credit with your credit card, ensure you pay the monthly minimum balance by the due date. You should pay off every monthly credit card balance to avoid interest charges. To provide you pay attention to a payment, create automatic payments for the minimum amount due, the balance on your statement, or another amount you choose.

2. Use A Budget With Your Credit Card

Getting your first credit card is a significant credit victory because it allows you to create a positive credit report and improve your credit score. However, it is a tremendous responsibility. The allure of possessing a line of credit akin to unrestricted cash flow may be strong, and the temptation may be vital to use it to pay for items beyond your financial means. However, this may serve as a gateway to debt.

Thankfully, you can regulate how you utilize your credit card. Consider the following tips:

- Apply credit card principles to debit cards. Establish a monthly spending plan that specifies how much you can allocate for various categories, including consumables, dining, and retail. Then, supplement that budget with credit card usage to make sure you spend only what you can afford.

- Monthly credit card usage for one to two charges. Instead of employing it for discretionary expenditures, contemplate designating one or two bills to be charged automatically to your credit card. Additionally, autopay is enabled for your credit card to ensure you pay the balance.

- Ultimately, pay your balance monthly. Although it is accurate to state that making the minimum payment punctually can preserve your payment history, settling your monthly balance in full is more advantageous. This prevents you from incurring debt and interest charges and maintains a low credit utilization ratio.

3. Keep Your Credit Utilization Ratio As Low As Possible

The credit utilization ratio relates the amount of credit utilized to the amount available. Multiply the result of dividing your credit card balance by the card’s limit by 100 to obtain the credit utilization percentage.

As an illustration, consider a credit card with a $10,000 limit and a $2,000 balance; the resulting utilization ratio is 20%. Credit scoring models compute utilization rates on an individual credit card level and if additional credit is obtained across all credit cards.

Aim to maintain a low credit ratio at all times. It is imperative to maintain a ratio below 30% consistently and, for optimal results, below 10%. Decrease the balance on your credit card or augment the credit that is accessible to you to reduce your credit utilization.

Although increasing your available credit can be advantageous, paying off your monthly balance is the most responsible method for using a credit card. Adopting this strategy will effectively manage your utilization, establish a solid payment history, and circumvent interest payments.

4. Keep Your Credit Accounts Open

Consider terminating the account of one of your credit cards if you are using it sparingly. However, it is preferable to maintain open credit accounts whenever feasible.

An outstanding credit score results from an extensive history of responsible credit management; the average age of your credit accounts is a component of that history. By closing your earliest credit card, you reduce the average age of your accounts.

If you’ve upgraded to a new card, refrain from closing previous accounts to enhance your credit score. Checking your credit card’s terms is essential for making the most prudent choice regarding your finances and credit.

One possible justification for closing a credit card is the payment of an annual charge. A “downgrade” from one credit card to another, subject to a yearly charge, is occasionally feasible via the same lender. This can assist you in maintaining an active credit card, thereby preventing credit damage without incurring a costly fee.

5. Don’t Open Too Many Accounts At Once

Refrain from opening multiple credit cards in a short period to promote the average age of your credit accounts and prevent the addition of numerous inquiries to your credit report, which could make you appear risky to lenders.

An application for new credit generates a hard inquiry on your credit report, which may marginally affect your credit scores. Therefore, after obtaining a credit card, it is prudent to maintain that card for an extended period.

When you’re ready for an upgrade or card with new features, apply for credit cards carefully, aiming to space out applications by a minimum of six months between each new card.

6. Check Your Credit Regularly

Checking your credit history and score is an element of responsible credit management. This entails confirming that both are accurate and that your positive credit actions positively affect your score.

You may perform a free credit score inquiry to ascertain your credit standing. Furthermore, you can streamline the process by subscribing to Experian’s complimentary credit monitoring service.

An alert will be generated if additional information is added to your report, which can assist you in monitoring your development. Moreover, identity theft can be indicated by any unidentified activity on your credit report; therefore, it is prudent to dispute such activity as soon as you become aware of it.

Alternative Ways To Build Credit

Credit cards can be advantageous for those who wish to build a positive credit history. Furthermore, by meeting your monthly credit card payment obligations, you effectively establish credit and prevent the imposition of supplementary interest charges—precisely what the purpose of credit card usage should be.

However, credit building does not solely rely on credit cards. Alternate methods of establishing credit may be more to your liking. You may possess several credit cards and wish to increase the variety of accounts that appear on your credit report. In either case, the following are some additional credit-building alternatives to contemplate.

1. Credit-Builder Loans

Individuals who wish to establish or restore their credit history might qualify for a credit-builder loan. An alternative method of receiving the funds is for the lender to retain the loan proceeds and deposit them into a distinct savings account. In the interim, monthly payments are made until the loan balance is repaid.

Upon completing the final payment, the lender will promptly return the loan proceeds to you, deducting any outstanding fees. Although some credit builder loans are not free, they can be a reasonably priced method to establish credit. Analyze the fees and interest rates of various lenders, similar to how you would evaluate any other form of financing.

Additionally, before applying, you should verify that the score-building loan will be reported to the credit bureaus, preferably all three. Otherwise, the account could be more effective for credit building. Credit-building loans assist you in establishing a favourable credit history, provided that the lender reports the account and you consistently make on-time payments.

2. Experian Boost

A free service provided by Experian, one of the three leading credit reporting organizations in the United States, can assist you in establishing credit. By subscribing to Experian Boost, you authorize Experian to use your credit card and bank account information.

Once the credit bureau has access to eligible telecommunications, utility, and subscription services accounts, it will employ software to search for them. The system will then be able to include any eligible accounts it discovers on your Experian credit report, thereby granting you the chance to include a more significant number of positive payment histories.

According to Experian, most new members receive an approximate 13-point immediate increase. However, it is essential to note that this approach will only assist you in establishing credit with some three credit bureaus.

3. Rent Reporting

Rent reporting is another outside-the-box method of including alternative credit history on one’s credit report. While most landlords and rental management companies do not disclose rent payments to credit bureaus, a minority do. It is appropriate to inquire.

Additionally, some businesses charge for rent reporting services. On your behalf, these organizations collect rent payment history from your landlord or bank account information and transmit it to one or more credit reporting agencies.

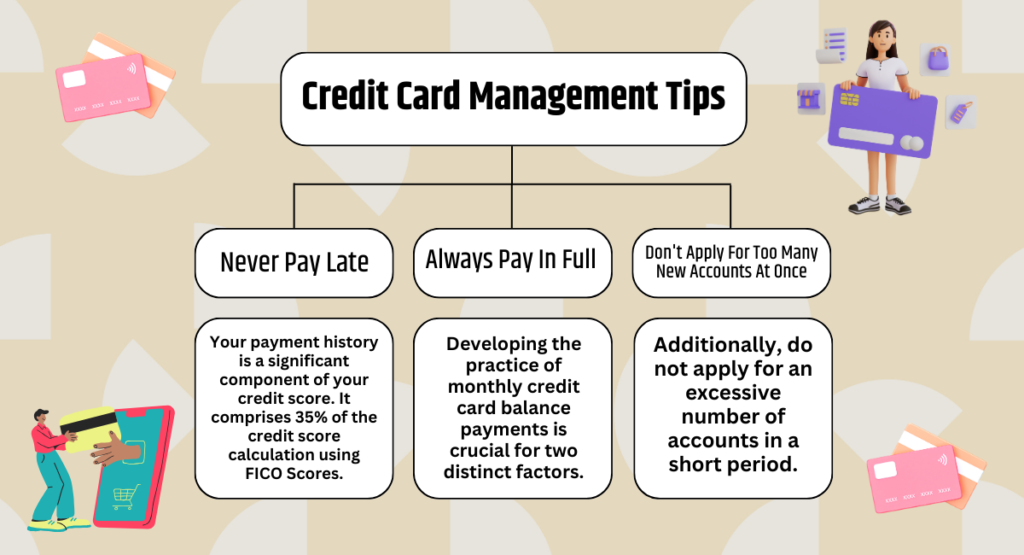

Credit Card Management Tips

Credit card obligations, like all other credit obligations, have the potential to either improve or negatively impact an individual’s credit score. How you handle your credit cards will also determine whether the effect on your credit score is positive or negative.

Respecting the following three guidelines about your credit card accounts is essential.

1. Never Pay Late

Your payment history is a significant component of your credit score. It comprises 35% of the credit score calculation using FICO Scores.

A credit report may reflect delinquent payments for a maximum of seven years. Those delinquencies may negatively impact your credit score for the duration they remain on your credit report, particularly in the beginning. A recent history of delinquent payments may significantly impair one’s credit score.

2. Always Pay In Full

Developing the practice of monthly credit card balance payments is crucial for two distinct factors. Initially, by remitting the entire balance on your account statement by the designated due date, you can circumvent the imposition of costly interest charges.

Based on data from the Federal Reserve for November 2023 about interest-bearing accounts, the mean interest rate is 22.75%. Additionally, certain credit cards may carry an above-average APR. It is prudent to avoid these excessive interest rates.

Credit card utilization is the second reason you should pay off your monthly credit card balance. The relationship between a credit card’s balances and limits is quantified as credit utilization. An increase in the percentage of credit card limits utilized results in a corresponding decline in credit scores attributed to the utilization rate.

A modest credit card balance compared to the cardholder’s credit limit may benefit one’s credit score. A credit usage rate below 30% is advised to prevent adverse effects on one’s credit score.

3. Don’t Apply For Too Many New Accounts At Once

Additionally, do not apply for an excessive number of accounts in a short period. Those new credit card applications could temporarily lower your credit score if you commit this error.

Credit scoring models, such as Vantage Score and FICO, consider the frequency of new credit applications, as an excessive volume of such applications may suggest an elevated level of credit risk. But you should be all right if you stagger your applications for new financing. The FICO Score is only temporarily impacted by credit inquiries for twelve months.

In conclusion, Using a credit card responsibly is among the most efficient methods for establishing or enhancing one’s credit rating. Creditworthiness can be progressively improved by implementing strategies such as maintaining low balances, making on-time payments, and selecting suitable credit cards.

Remember that the objective is not merely to utilize credit but judiciously. Your credit card can become a potent instrument in your financial toolkit, providing access to better economic opportunities with diligence and sound judgment.

Thank you for reading…..

Read More: The Most Expensive Canadian Coins