A reputable mobile banking application complements several Chase savings accounts and can assist you in reaching your financial objectives. However, these accounts will not significantly increase your savings. Higher rates are readily available elsewhere, and even the top-yielding account offered by the large bank carries an exceptionally low-interest rate.

Despite offering unimpressive yields, Chase, the largest bank in the United States, consistently provides benefits to new customers. The majority of the incentives are applied to new checking accounts. Chase clients enjoy the substantial advantage of utilizing an extensive network of branches and ATMs.

Why Open A High-Yield Savings Account?

“Is it worthwhile to open a high-yield savings account?” does not have a definitive correct or incorrect response. Undoubtedly, the potential disadvantages of a high-yield savings account may deter some individuals from considering its advantages worthwhile. Despite this, there are significant benefits that, for some, may outweigh any possible drawbacks.

1. It may reduce the impact of inflation.

The interest rate is generally greater in high-yield savings accounts than in standard savings accounts, which is one of the primary reasons an individual might open one. This increased rate of return could mitigate the effects of inflation.

2. Compounding interest

The primary appeal of a high-yield savings account lies in its capacity to accrue compound interest at a rate that surpasses that of a standard savings account. Compounding is defined as the process of accumulating previously earned interest. The total principal of a savings account increases progressively as interest is collected, thereby augmenting the interest earned during the subsequent term period.

The rate of this effect increases over time. Your money may develop more quickly or slowly, depending on the rate of compound frequency, which is set by the type of account you have and the interest rate you are paying. At that point, the prospective benefits of compounding become apparent. This is presuming that no withdrawals are executed from the account.

Does Chase Have A High Yield Savings Account?

At this time, Chase Bank does not provide high-yield savings accounts. Despite being a full-service bank in general, this institution does not offer money market accounts. Examine the money market account rates or the best high-yield savings account rates to discover the most available competitive rates.

The annual percentage yields (APYs) on Chase’s savings products, including the Chase Savings and Chase Premier Savings accounts, are modest compared to those of other prominent, conventional banks. This is in contrast to the high-yield alternatives provided by online institutions.

Chase Savings Account Rates

Founded in New York City more than two centuries ago, Chase Bank is the largest financial institution in the United States, boasting a network of 16,000 ATMs and more than 4,700 branches. In addition to numerous financing options, the full-service bank provides diverse financial services, including two savings accounts, additional deposit account types, rewards credit cards, and more.

Compared to the finest high-yield savings accounts, Chase savings accounts offer rates that are much lower than the national average and far lower. Additionally, the accounts incur monthly fees unless you meet the requirements to waive them.

The “relationship rate” for the Chase Premier Savings account is contingent upon linking a Chase Premier Plus Checking or Chase Sapphire Checking account. You then have until the end of the month to conduct a minimum of five eligible transactions every month from the linked checking account to qualify for the increased APY on the savings account.

Tips For Opening A High-Yield Savings Account

The prospect of a higher-than-usual rate of return may be sufficient to entice some individuals to open a high-yield savings account despite the inconvenience that may arise from managing accounts at multiple financial institutions.

However, similar to opening a new bank account, there are a few essential factors to bear in mind to ensure everything runs efficiently.

1. Look for the best interest rates: When browsing for a high-yield savings account, prioritize higher interest rates; this may seem obvious. Remember that an APY, which considers compounding frequency and interest, can offer a more precise representation of actual returns than an interest rate.

2. Know the fees: Similar to how considering all costs associated with the account can provide a more comprehensive understanding of the potential growth of your funds. Assessing the charges linked to the account, including monthly service fees and withdrawal limit fees, can provide insight into the possible expenses associated with storing funds at a specific financial institution.

3. Understand deposit requirements: Numerous financial institutions require an initial deposit when establishing a savings account. Some individuals may have little pressing economic needs. However, by thoroughly understanding the institution’s requirements of your choice, you can prepare any required funds in advance.

4. Pick the right financial institution: There are currently many financial institutions from which to select high-yield savings accounts. While online banks constitute the majority, certain credit unions also provide high-yield savings accounts. A credit union may have distinct procedures compared to a bank, including membership fees and eligibility requirements. Conducting preliminary research on the specific requirements of the available options can assist in identifying the most suitable choice.

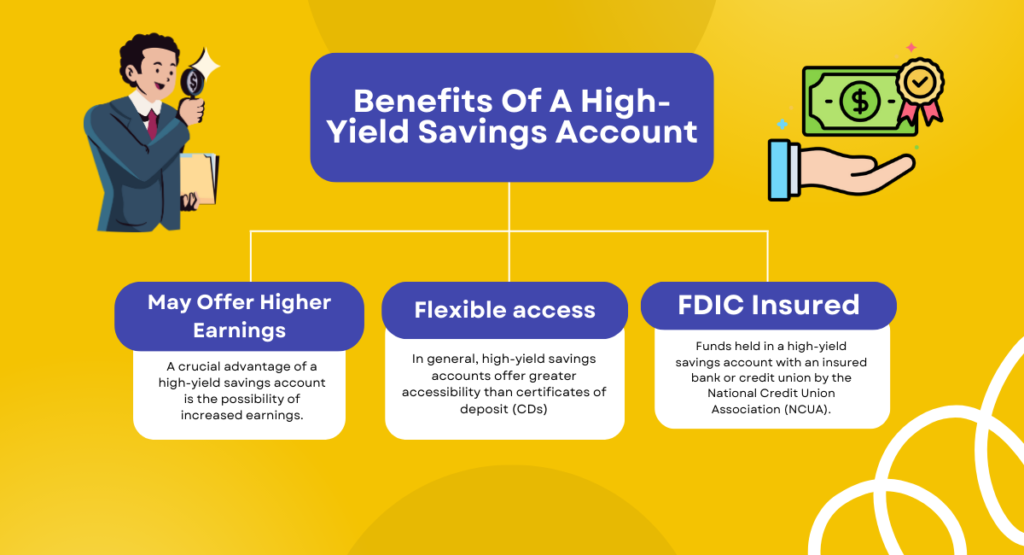

Benefits Of A High-Yield Savings Account

Although the primary benefit of a high-yield savings account may appear self-evident, it may be prudent to investigate the account’s complete spectrum of potential advantages.

Doing so, you may better understand how these particular savings accounts differ from other account types.

1. May Offer Higher Earnings

A crucial advantage of a high-yield savings account is the possibility of increased earnings. High-yield savings accounts generally accrue interest daily, accelerating your interest earnings accumulation.

2. Flexible access

In general, high-yield savings accounts offer greater accessibility than certificates of deposit (CDs), the latter of which frequently entail stiff penalties for early withdrawals and have a fixed term. Like CDs, high-yield savings accounts may offer higher returns, but holding the funds for a specified period is unnecessary. Without the obligation of CDs, this makes them a tempting choice for individuals searching for a higher interest rate than conventional savings accounts.

3. FDIC Insured

Funds held in a high-yield savings account with an insured bank or credit union by the National Credit Union Association (NCUA) or the Federal Deposit Insurance Corporation (FDIC) are safeguarded to the extent permitted by law, with the maximum allowance per type of deposit account and insured institution.

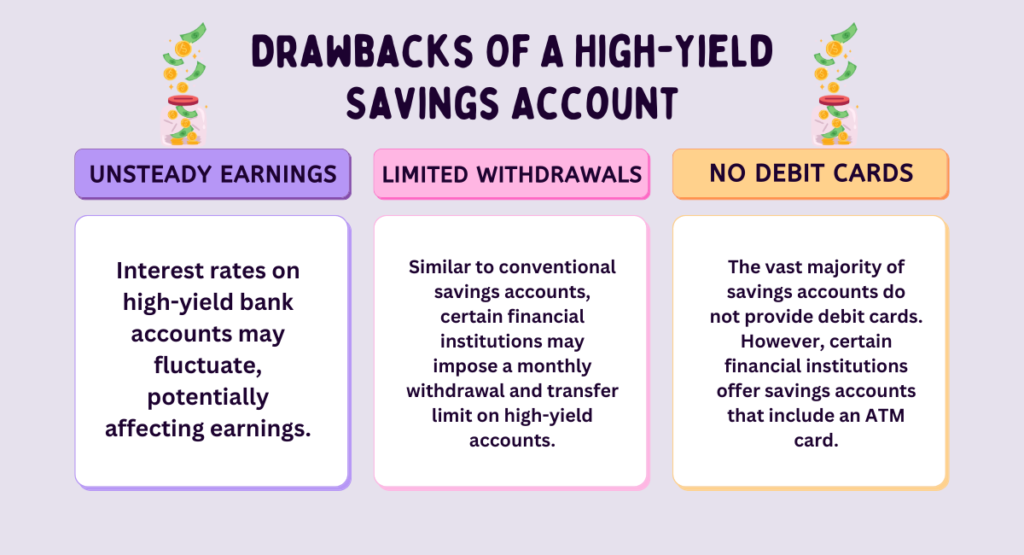

Drawbacks Of A High-Yield Savings Account

Although high-interest savings accounts offer numerous advantages, it is also prudent to consider a few potential disadvantages.

1. Unsteady Earnings

Interest rates on high-yield bank accounts may fluctuate, potentially affecting earnings. Although they strive to provide superior interest rates compared to conventional savings accounts, these rates are subject to change over time due to financial market fluctuations or policy adjustments by the financial institution.

2. Limited Withdrawals

Similar to conventional savings accounts, certain financial institutions may impose a monthly withdrawal and transfer limit on high-yield accounts. Failure to adhere to this limit may result in penalties or restrictions on your account. Consequently, it is critical to comprehend the terms and conditions of any high-yield savings account that you are contemplating opening.

3. No Debit Cards

The vast majority of savings accounts do not provide debit cards. However, certain financial institutions offer savings accounts that include an ATM card, enabling the holder to withdraw funds conveniently when necessary.

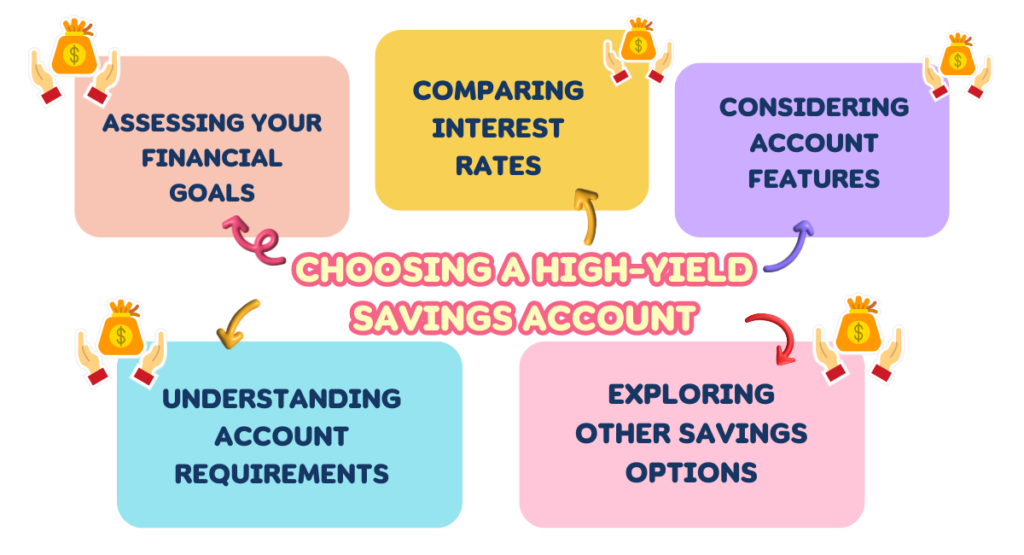

Choosing A High-Yield Savings Account

When evaluating your savings options, consider the advantages and disadvantages of savings accounts.

To assist you in reaching a more knowledgeable conclusion, let us examine several potential courses of action:

1. Assessing your financial goals: Before committing to a new savings vehicle, evaluate your financial objectives. Do you save for a particular purpose, such as an emergency fund? Or are you interested in growing your money over the long term? One may ascertain whether a high-yield savings account is suitable by comprehending one’s objectives.

2. Comparing interest rates: One of the primary advantages of a high-yield savings account is the chance for greater earnings. When evaluating your options, comparing various financial institutions’ rates and annual percentage yields (APYs) to optimize your earnings potential is advisable.

3. Considering account features: High-yield savings accounts may include various features, including mobile applications and online banking tools. Understanding the most significant features may help you determine which accounts most closely correspond to your preferences.

4. Understanding account requirements: A high-yield savings account’s terms, conditions, and prerequisites may differ depending on the financial institution and account type. Examining its requirements is a potentially beneficial initial step in evaluating a new savings account.

5. Exploring other savings options: Although high-yield savings accounts provide numerous advantages, additional savings alternatives exist. CD accounts, for instance, typically offer higher interest rates than conventional savings accounts. Furthermore, implementing savings strategies such as CD ladders may yield greater earnings.

In conclusion, Chase needs to provide a high-yield savings account compared to online institutions when interest rates are the only consideration. Although Chase offers diverse financial products and a reputation for dependability, investors who place a premium on high yields may find more favourable prospects for savings growth with online banks or credit unions.

It is imperative to consistently evaluate one’s financial objectives, risk tolerance, and the necessity for fund accessibility when selecting an appropriate savings account or investment vehicle.

Thank you for reading….

Read More: How To Find For Sale By Owner Homes?