The Chase Ultimate Rewards program can provide extraordinary value. It is unsurprising that the currency consistently ranks near the top of TPG’s monthly valuations, with our most recent estimate placing it at 2.05 cents per point.

One notable attribute of the Ultimate Rewards program is the considerable versatility of its points, extending beyond mere redemption possibilities to encompass the ability to transfer points among Chase credit cards.

Indeed, it is one of the most customer-centric transferable points programs in its category. Combining Ultimate Rewards points in a single account can effectively increase the value of some cards by as much as 50%. Furthermore, despite Chase’s recent implementation of a redesigned rewards portal, the functionality to combine points remains intact.

Why Transfer Chase Points?

Among the most effective methods for managing Ultimate Rewards points is transferring points between Chase cards.

The sum of 1,000 Ultimate Rewards points from one Chase credit card and 500 Ultimate Rewards points from another Chase credit card is 1,500 Ultimate Rewards points. This sum can be applied to a travel purchase, statement credit, or any other redemption options Ultimate Rewards provides.

You can convert cash back from a Chase credit card that offers a reimbursement option to points by transferring the funds to a Chase card that offers Ultimate Rewards points. One hundred points will be awarded for each dollar transferred.

Certain Chase credit cards permit the 1:1 transfer of Ultimate Rewards points to travel loyalty programs, which can be an outstanding strategy for earning complimentary hotel accommodations or accumulating miles toward a complimentary flight.

How Do You Transfer Chase Points To Another Person?

This feature allows you to consolidate your points into a single account and transfer points to or from another individual’s account.

However, before combining Ultimate Rewards points, please review the following terms and conditions:

Transferring your points is permitted, but only to another Chase Ultimate Rewards card you or one household member possesses. Should we have any reason to suspect that you have been involved in fraudulent activity about your credit card account or Ultimate Rewards account, or if you have abused Ultimate Rewards in any manner (e.g., purchasing or selling points, transferring or transferring points to an ineligible third party or account, or repeatedly opening or maintaining credit card accounts with the sole intention of generating rewards or manufacturing purchases, repeatedly opening or otherwise maintaining credit card accounts for manufacturing spend, If we have reason to suspect that you have participated in any of these activities, your credit card account will be terminated.

When you transfer points between your own accounts, you comply with these regulations. However, to transfer points to another individual’s Ultimate Rewards account, that individual must be a household member (or business owner in the case of Chase Ink cards).

To transfer points to another user’s account for the first time, you must dial the number printed on the reverse side of your card. Declare to the agent that you and a household member wish to combine your points. A transfer can be initiated after providing the agent with the card number of a member of your household.

Following your phone call, your household member’s account should become eligible for online point transfers. Consequently, a single phone call should suffice unless you or a household member choose to terminate the account.

After adding an account for a household member, the procedure remains unchanged from what I described previously. You will select the desired number of points to transfer, examine the transfer request’s details, and then submit it.

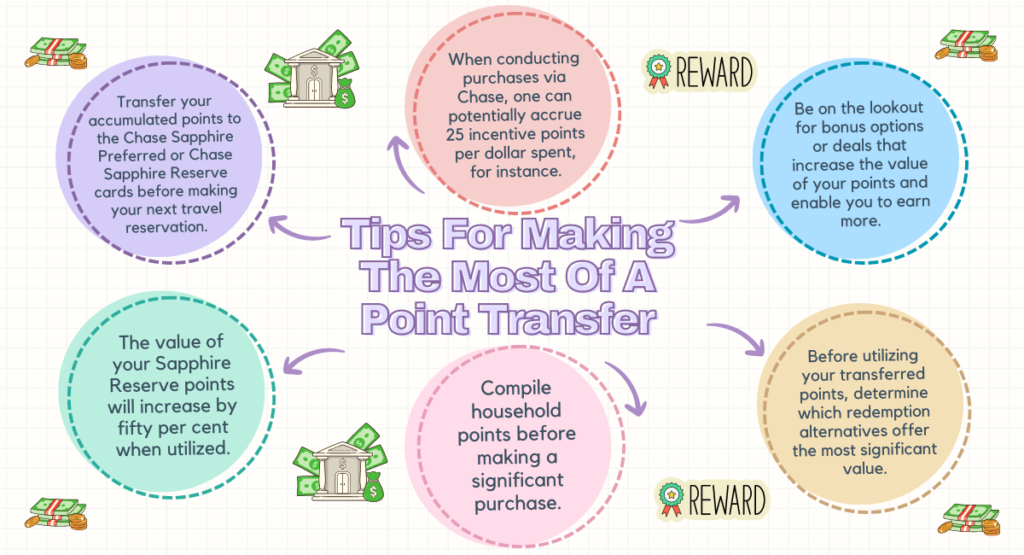

Tips For Making The Most Of A Point Transfer

Are you curious about the process of transferring Chase points? The following are some suggestions for optimizing your upcoming points transfer:

Transfer your accumulated points to the Chase Sapphire Preferred or Chase Sapphire Reserve cards before making your next travel reservation. Your point total will increase by 25% when you use your Sapphire Preferred card to book travel through Chase Ultimate Rewards.

The value of your Sapphire Reserve points will increase by fifty per cent when utilized. Consequently, 50,000 points can be redeemed for $625 in travel-related benefits with the Sapphire Preferred and $750 with the Sapphire Reserve.

Compile household points before making a significant purchase. If you intend to redeem United States Ultimate Rewards points, consider merging your household’s Chase rewards before making a large purchase.

You and your spouse or companion may combine cash back or points in a single account. For instance, you can redeem your points at the Apple Ultimate Rewards store if you are considering purchasing a new iPhone.

Before utilizing your transferred points, determine which redemption alternatives offer the most significant value. As per Chase’s statement, 100 points are equivalent to one dollar when redeemed for cash or gift certificates; however, their value decreases to $0.80 when utilized with Chase Pay.

Be on the lookout for bonus options or deals that increase the value of your points and enable you to earn more. Although Chase offers some of the finest sign-up bonuses in the industry, those are not the only Ultimate Rewards bonuses available.

When conducting purchases via Chase, one can potentially accrue 25 incentive points per dollar spent, for instance. Upon your subsequent login to Chase Ultimate Rewards, consider exploring potential avenues for point accumulation or maximizing the value of your current points.

Should You Transfer Your Ultimate Rewards?

If you have multiple Chase credit cards, consider consolidating your Ultimate Rewards points into a single account. Furthermore, you can enhance the value of your Ultimate Rewards points transferred to the Chase Sapphire Preferred or Reserve card by redeeming them for travel through Chase Ultimate Rewards.

You and another household member who earns Chase points can consolidate rewards toward a trip, an Apple purchase, or another substantial redemption option by combining those points into one account. Notably, Chase cash-back rewards can be converted to Ultimate Rewards points through a point-earning card transfer.

Gaining knowledge about the process of transferring Chase points will enable you to maximize the utility and worth of your points. Apply the advice in this article to your upcoming Chase points transfer to assess the extent to which your Chase Ultimate Rewards points can travel.

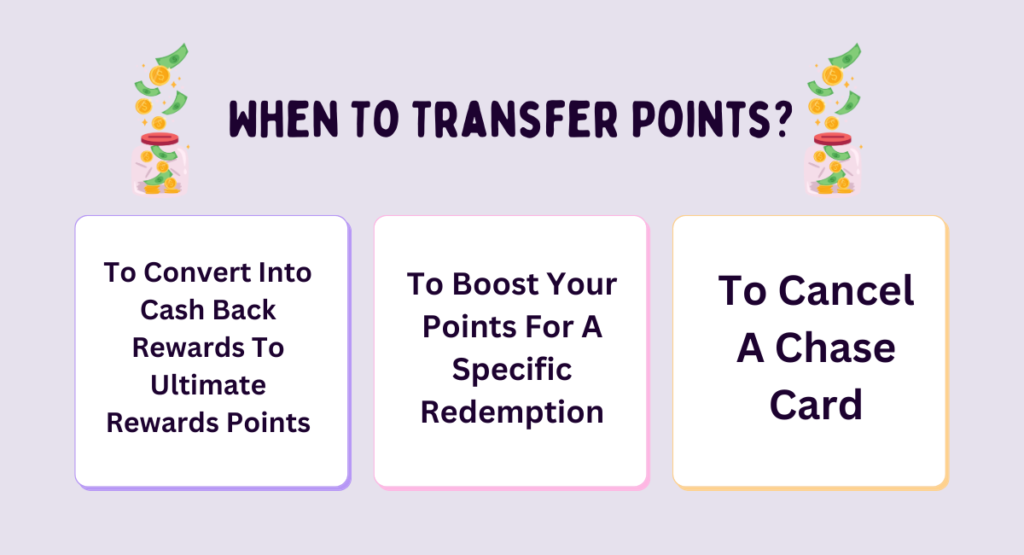

When To Transfer Points?

In certain circumstances, transferring points to maximize their value may be the most prudent course of action.

1. To Convert Into Cash Back Rewards To Ultimate Rewards Points

The optimal strategy for optimizing rewards is to transfer points from a Chase card, which offers non-transferable points with a maximum value of 1 cent, to a premium card that dispenses Ultimate Rewards points.

As an illustration, points accumulated with the Chase Sapphire Reserve are valued at 1.5 cents when redeemed for travel via the Chase Ultimate Rewards portal. However, when using the Chase Sapphire Preferred card, the point value is increased to 1.25 cents within the same portal. By transferring your Ultimate Rewards points to the appropriate transfer partner, you can maximize the value of your cash-back dollars.

2. To Boost Your Points For A Specific Redemption

While an individual may need to possess an adequate number of points for redemption, transferring points to another account within the same household may result in a sufficient combination of points to accomplish the objective.

3. To Cancel A Chase Card

If you possess multiple Chase cards, you may be required to deactivate one of them. To prevent any loss of Chase points, it is prudent to transfer obtained Chase points from one account to another. You may transfer the funds to a member of your designated household or one of your other accounts.

In conclusion, transferring Chase Ultimate Rewards points to another individual can be a highly effective strategy for optimizing the practical use of one’s points. Whether assisting a family member with travel arrangements or combining resources for a more significant redemption, you must understand how to transfer your points securely and efficiently. For optimal reward utilization, consistently adhere to Chase’s instructions and verify all pertinent details before initiating a transfer.

Thank you for reading…..