The perks of Wells Fargo credit cards include rewards programs and low APR offers. A credit limit increase can provide the necessary funds to make larger purchases with a credit card without negatively impacting the credit utilization ratio.

Furthermore, if you are contemplating or presently hold a Wells Fargo credit card, requesting an increase in your credit limit is comparatively straightforward; however, it does require telephone use. Additionally, Wells Fargo will conduct periodic account reviews and provide certain cardholders with automatic credit line increases.

Wells Fargo may conduct either a mild or hard credit inquiry to ascertain your eligibility for a credit limit increase. Soft credit draws occur more frequently. However, if Wells Fargo were to conduct a rigorous credit inquiry, your credit score might experience a temporary decline.

What Is A Credit Limit?

A credit limit specifies the maximum sum that can be applied to a credit card at any given time. You are approved for a particular credit limit when you open a new account; however, that limit is subject to change over time based on variables, including your payment history.

In evaluating your credit card application, the card issuer will assess your eligibility according to criteria. These include your annual income, FICO score, and credit card balances. Should your application be approved, the issuer will utilize the identical information to ascertain your initial credit limit and annual percentage rate.

Many individuals commence their credit journeys with an initial credit limit ranging from $200 to $500. However, the limit may increase to $20,000, $50,000, or even more with time.

Who Is Eligible For A Wells Fargo Credit Limit Increase?

There are no explicit prerequisites for increasing your Wells Fargo credit limit. Nonetheless, you should follow a few fundamental guidelines.

Before requesting an increase in your credit limit, your card should have been in your possession for at least six months. This allows you to showcase a track record of prudent borrowing.

Your payment history must be clean before you request an increase in your credit limit. A history that includes late payments may diminish your likelihood of being authorized.

Establishing a solid credit score before requesting an increase in your credit limit is advisable. Wells Fargo determines your initial credit limit based on your credit score; therefore, you may be eligible for a higher limit if your credit score has increased since you initially applied for your Wells Fargo credit card.

How Do You Increase The Wells Fargo Credit Card Limit?

To request an increase in your Wells Fargo credit limit, please get in touch with the bank at 1-800-642-4720. You can also request an account representative to assist you in expanding your credit line.

Please ensure you are adequately equipped with the precise increase amount, whether a percentage or a total, your account number, and any other pertinent identifying details. Additionally, Wells Fargo may request information regarding recent changes to your employment status or annual income.

To ascertain the eligibility of a cardholder for an increase, credit card issuers such as Wells Fargo customarily evaluate financial information and account standing.

What Should You Do Before You Ask For A Wells Fargo Credit Card Limit Increase?

Wells Fargo requires that you complete the following before submitting a request for an increase in your credit limit:

Check your credit score. You must comprehensively understand your credit score, including comparing your present score and the one applied for your initial Wells Fargo credit card application. Checking your credit score online for free is a simple process.

Ascertain the specific credit limit increase that you wish to request. Before making your request, you should know how much additional credit you request. Requesting a credit limit increase of at most 50 per cent is advisable.

Consider alternative options. You must request an increase in your credit limit for valid reasons. Increasing one’s credit limit may not be the most prudent course of action if one is already burdened with credit card debt.

What Are The Benefits Of Having A Higher Credit Limit?

Your available credit will immediately expand upon receiving an increase in your Wells Fargo card’s credit limit.

This increases your purchasing power and helps boost your credit score. However, the benefits are only available to those who use the additional credit responsibly.

1. Higher purchasing power

A greater credit limit permits more liberal credit card usage while preserving a favourable credit utilization ratio.

2. Improved credit score

The increased credit limit might positively impact the credit utilization ratio, provided you abstain from incurring additional debt. This indicates the proportion of your total available credit that has been utilized; it should be at most 30%. The credit utilization ratio is essential in credit score determination; a lower value signifies improved credit.

What Should You Do If Wells Fargo Denies Your Request?

You have several options if Wells Fargo denies your request to increase your credit limit. As frequently as feasible, you should continue to use your credit card responsibly and pay your bill in full and on time. Alternatively, you may inquire with Wells Fargo again in six months, after which you may observe whether you are qualified for an automatic credit limit increase.

While you wait, you should devote some time to establishing your credit history and credit score. You can lower your credit points by paying your expenses on time, maintaining a low credit utilization rate, and avoiding the closure of old lines of credit.

Additionally, consider the application process for a Wells Fargo credit card that offers the supplementary open credit you require. Certain credit cards offer an introductory APR of 0%, whereas others allow you to accumulate points or cash back per dollar spent. If your credit score falls short of your desired level, you might be qualified for a credit card for debtors with fair credit.

Reminders Before Requesting A Credit Limit Increase

There is no assurance that Wells Fargo will grant your request to increase your credit line. Nonetheless, you may increase your chances of approval by analyzing a few crucial factors.

1. Know how much of a credit increase to request.

In the absence of published guidelines from Wells Fargo regarding credit limit increases, adherence to industry best practices is advised. This means that your request can be at most 25 per cent of the extant balance on your card. For example, in the case of a Wells Fargo card bearing a $5,000 limit, it is customary to request an increase of the card by a maximum of $1,250 from the bank.

Furthermore, if Wells Fargo inquires about the reason for your credit limit request, specify the impending expenses you intend to charge to the card. Regardless of the veracity of that statement, they will have an additional motivation to grant your request.

2. Know your current credit score.

Wells Fargo will almost certainly consider your credit score when evaluating your application for an increased credit limit. This may be accomplished via a hard or soft credit draw. It is advisable to ascertain one’s credit score before requesting an increased credit limit, as the likelihood of success is minimal for those with below-average or subpar credit.

The requirement to qualify typically varies by credit card, income, and usage history, with a decent or exceptional credit score being the bare minimum. This means that a minimum credit score 670 is required, with a 740 or higher score offering a greater likelihood of approval. Before submitting a request, you should consider enhancing your credit score if you do not meet this criterion.

3. Know your credit utilization.

In calculating your credit utilization ratio, every debt you incur from various categories of revolving credit is accounted for. In contrast, card issuers frequently consider card-specific credit utilization when approving requests for increased credit lines. It would help to keep this number below 30% in both situations.

The credit utilization ratio of a Wells Fargo card sporting a credit limit of $6,000 and an outstanding balance of $2,000 is determined to be 33%. Reducing the balance to less than $1,800 will result in a satisfactory credit utilization ratio. Nevertheless, paying off most of your balance before requesting an increase in your credit line is preferable.

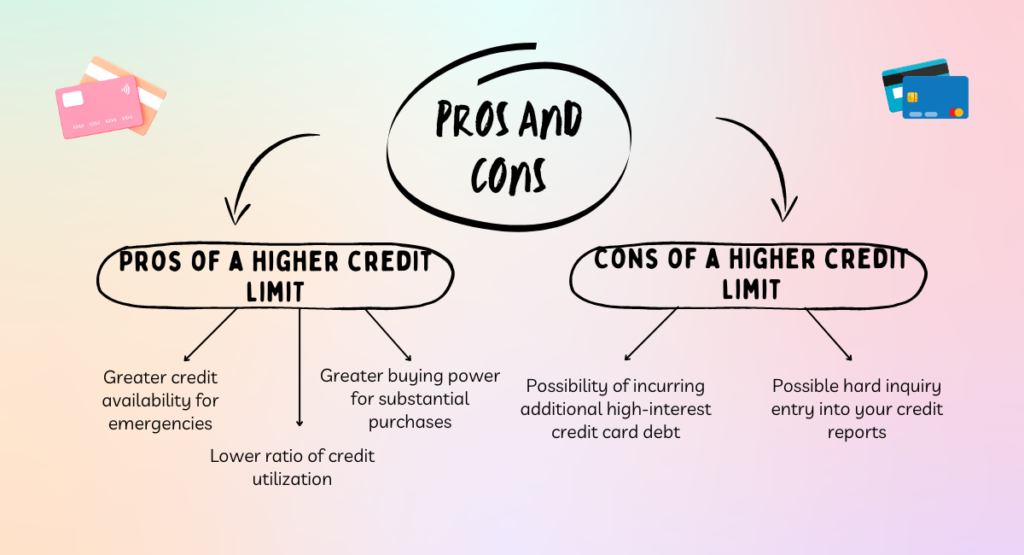

Pros And Cons To Acceptable When Requesting A Higher Credit Limit

There are many advantages and disadvantages associated with seeking an increase in credit limit from Wells Fargo or any other creditor.

While there may be exceptions depending on your specific circumstances, the following are the primary considerations:

Pros of a higher credit limit:

- Greater credit availability for emergencies

- Lower ratio of credit utilization

- Greater buying power for substantial purchases

Cons of a higher credit limit:

- Possibility of incurring additional high-interest credit card debt

- Possible hard inquiry entry into your credit reports

In conclusion, submitting a credit limit increase request to Wells Fargo online is uncomplicated. Maintaining sound financial and credit practices can increase the likelihood of being approved. When utilised prudently, an elevated credit limit can benefit expense management, credit score enhancement, and financial flexibility.

Thank you for reading….

Read More: Does Chase Freedom Flex Have Foreign Transaction Fees?