Acquiring credit can present challenges for individuals with low credit scores. However, the most effective method for enhancing one’s credit score is demonstrating the ability to utilize credit responsibly. Obtaining a credit card despite having poor credit can assist you in establishing credit again.

Additionally, carrying at least one credit card in one’s pocketbook provides certain benefits. Credit cards offer the convenience of immediate purchase and later payment, and interest is typically waived if the balance is repaid in full before the due date. Unlike debit cards, numerous credit cards provide rewards, consumer protections, and enhanced security against fraudulent activities.

What Is A Bad Credit Score?

A poor credit score on the FICO Score 8 scale, which ranks credit scores from 300 to 850 and is one of the most frequently used by lenders, is below 670. In particular, a grade ranging from 580 to 669 is deemed satisfactory, whereas a grade between 300 and 579 is deemed inadequate. The scores are delineated in greater detail in the table that follows.

VantageScore, a further credit scoring formula created by the three major credit bureaus (Experian, TransUnion, and Equifax), employs a similar 300-850 scale. However, the definitions that are linked to each score range differ marginally. VantageScores between 601 and 660 are deemed acceptable, 500 to 600 are considered poor, and 300 to 499 are deemed extremely poor. Please refer to the following table for a comprehensive breakdown.

A positive correlation exists between credit score and the likelihood of obtaining credit with more favorable terms and interest rates. If your credit score is low, obtaining affordable credit or being authorized for a loan or credit card may be challenging.

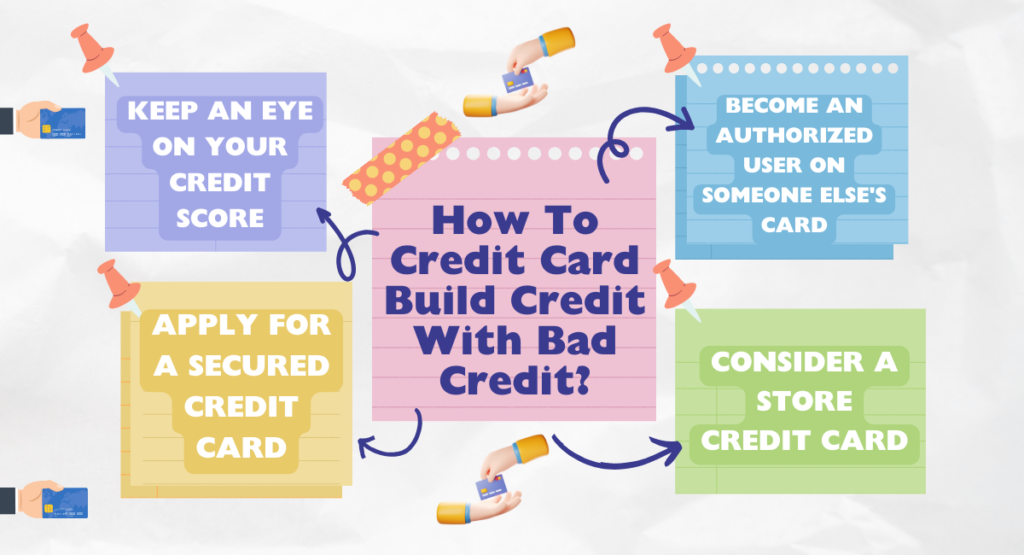

How To Credit Card Build Credit With Bad Credit?

Although credit scores are not included in an individual’s credit report, they serve as the basis for calculating said scores. How to build credit with a credit card despite poor credit:

1. Keep an eye on your credit score

Verify your precise credit score to ascertain the range within which you fall, even if you are aware that it is below ideal. You may discover that your credit score is fair, making you eligible for more credit cards than a low score.

Additionally, knowing your credit score can prevent you from applying for cards you are unlikely to qualify for. It is prudent to be selective with your credit card applications, as the majority of them result in a hard credit inquiry, which is typically removed from your credit score.

There are multiple methods through which one can obtain a free credit score;

Wells Fargo, Bank of America, American Express, Capital One, Chase, and Discover are among the many credit card issuers that provide complimentary credit score evaluations. Certain issuers restrict cardholders’ access to the service, whereas others permit anyone to utilize it.

Experian, a credit bureau, provides complimentary access to your FICO Score of 8. Your credit score is also available for purchase from FICO or any of the three main credit bureaus (Experian, Equifax, and TransUnion).

You can obtain a free copy of your credit records from the three credit reporting agencies by visiting AnnualCreditReport.com. Although it will not display your precise credit score, your credit report can give you a glimpse of the components contributing to it and enable you to verify any potential errors.

2. Apply for a secured credit card

A secured debit card is an instrument that can assist individuals in rebuilding or establishing credit. They function by requiring a security deposit in advance, which is typically between $50 and $200. Typically, the line of credit granted is equivalent to the deposit amount; therefore, a secured credit card with a $200 deposit will likely have a $200 credit limit.

If granted a secured credit card, timely monthly payments and avoiding exceeding your credit limit should be your top priorities. To establish credit and advance to an unsecured card, you must demonstrate that you can responsibly manage modest quantities of credit. Before applying for the card, ensure the issuer notifies the three main credit bureaus of your payment transactions.

Pros of secured credit cards

- Credit access for individuals lacking a credit history or possessing a low credit score

- Credit score enhancement via responsible credit use and on-time payments

- Possibility of advancing to a conventional, unsecured credit card in the future

Cons of secured credit cards

- Deposit of security required

- Minimal credit limit

- Exceptionally high interest rates for carrying a balance

- Opportunities to receive rewards or benefit from other perks are restricted.

- Card activity may not be reported to the three main credit bureaus.

3. Consider a store credit card

Obtaining a credit card despite poor credit may be as simple as waiting in the checkout lane closest to you. Even with poor credit, qualifying for a retail credit card is generally more straightforward.

Nevertheless, the fact that retailers offer credit cards to customers with poor credit does not imply that store credit cards are the most advantageous option. Most store credit cards have significantly higher interest rates than others, and their deferred interest plans may cost you more than anticipated.

Before you apply for a store card, please review our guide to see whether or not it is worthwhile.

Pros of retail credit cards

- Possibility of approval despite low credit

- Possibility to establish credit by exercising responsible usage

- Store rewards and discounts

Cons of retail credit cards

- Elevated interest rates

- Minimal credit limit

- Reward and purchasing restrictions at particular retailers

4. Become an authorized user on someone else’s card

Obtaining authorization to use a trusted family member’s or friend’s credit card is the final method to establish credit while gaining experience with the system. You will be granted authorization as an authorized user, which grants you access to your credit card account and enables you to make purchases using the card without incurring any liability for payment.

You can benefit from others’ excellent credit practices by becoming an authorized user. The card issuer’s obligation to disclose authorized users’ card activity to credit bureaus may enhance your credit score through the card’s punctual payments and minimal credit utilization.

Request that an individual you have confidence in and who has confidence in you also add you as a registered user to their credit card. Ensure that all expectations and spending limits are communicated.

Pros of becoming an authorized user

- Possibility to establish credit without incurring personal credit card liability

- There is no credit verification required.

Cons of becoming an authorized user

- Credit damage is possible if the primary cardholder fails to exercise responsible credit usage.

- Errors committed with the card may hurt your relationship with the primary cardholder. Rewards are the rightful property of the primary cardholder.

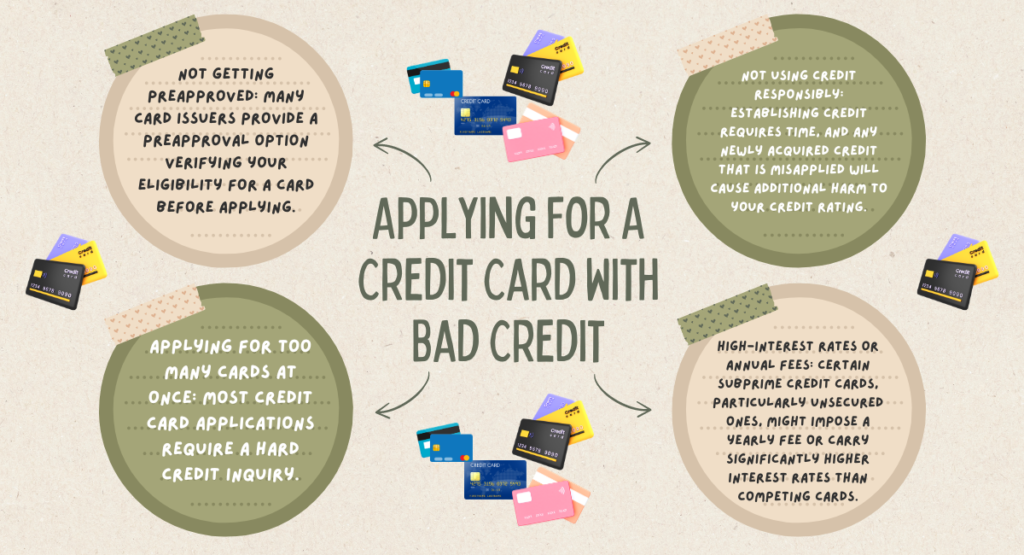

What Should You Watch Out For When Applying For A Credit Card With Bad Credit?

If you intend to register for a credit card despite having poor credit, consider the following advice.

1. Not getting preapproved: Many card issuers provide a preapproval option verifying your eligibility for a card before applying. It does not perform a rigorous credit check, so your score will not be affected. This will allow you to register for cards you will likely obtain.

2. Applying for too many cards at once: Most credit card applications require a hard credit inquiry, which may temporarily deduct your credit score if you apply for too many. Multiple card applications submitted within a brief period may raise an issuer’s red flag and result in a lower credit score.

3. High-interest rates or annual fees: Certain subprime credit cards, particularly unsecured ones, might impose a yearly fee or carry significantly higher interest rates than competing cards. Before applying for a credit card with poor credit, ensure you have thoroughly reviewed the fine print and agree with the terms.

4. Not using credit responsibly: Establishing credit requires time, and any newly acquired credit that is misapplied will cause additional harm to your credit rating. Placing emphasis on punctual payments and avoiding excessive proximity to one’s credit limit are vital strategies for enhancing credit.

How To Maintain A Good Credit Score?

After putting in the necessary effort to improve a low credit score, the next step is maintaining that progress. This requires timely payment of all expenses, maintenance of low credit card balances, and the pursuit of new credit only when necessary.

15% of a FICO Score is attributed to the length of credit history; therefore, you may wish to maintain ancient accounts to preserve a lengthy average credit history. This may entail making occasional minor charges to your oldest card and promptly reimbursing the balance. Consider the money you could save compared to the potential drawbacks of a shorter credit history if you no longer use a card with a high annual charge.

Credit mix, or the variety of credit categories associated with a given account, accounts for 10% of the FICO Score. It is optional to obtain a new loan for the sole purpose of diversifying your credit portfolio. However, consistently managing a credit card is among the most effective ways to preserve a decent credit score.

Therefore, consider applying for a security card that typically requires a deposit that also serves as the credit limit. Improving your credit score through monthly payments of modest charges could eventually qualify you for a conventional, unsecured credit card.

If you continue to struggle despite these measures, seeking assistance may enable you to regain your footing. An authorized credit counseling organization can help you develop a strategy to reduce debt and improve your financial management. To verify that you are conducting business with a legitimate credit counseling agency, the U.S. Department of Justice keeps a list of approved agencies organized by state.

Consider debt consolidation as an alternative course of action if you are beset by substantial credit card debt. Debt consolidation loans enable borrowers to consolidate several high-interest debts into a solitary payment, often at a reduced interest rate, thereby simplifying the task of monitoring said payment.

Any organization claiming to restore your credit for a fee or with minimal or no time or effort should be approached cautiously. Time is required for credit status to improve. In the end, nothing a credit rehabilitation company does can be accomplished with sufficient time and effort by the individual.

In Conclusion, Rebuilding credit through a credit card ultimately demands perseverance, self-control, and regular financial conduct. It is possible to progressively enhance one’s credit score through prudent card selection, reasonable usage, and ongoing monitoring of credit activities. Remember that increasing your credit requires time, but it is possible with diligence and perseverance.

Thank you for reading…..

Read More: How Do You Increase The Wells Fargo Credit Card Limit?