Having a credit card can give you many benefits, like almost free flights, welcome bonuses, and rewards for buying things. But using credit cards wisely is essential. You can have more than one Capital One card. If you’re ready for that, you can get the most rewards and benefits by having two cards, each with unique features.

Are you considering getting another credit card? Credit cards can be helpful for improving credit and earning rewards, but they’re not the best choice for everyone.

Is It A Good Idea To Have More Than One Credit Card?

There could be benefits to having multiple credit card accounts.

Having more credit available can improve your credit score by comparing how much credit you use to how much you have.

Having more than one card can also let you earn rewards with different types of credit cards. Some credit cards may also offer a bonus when you sign up.

However, having many credit accounts could be risky if you can’t handle them well, like paying your monthly balance on time.

Can you get more than one credit card from the same company?

You may be able to get more than one credit card from the same credit card company, but it depends on their rules. Each company has its own rules, so that can vary. It also depends on how many cards you want to apply for simultaneously.

Can You Have More Than One Capital One Credit Card?

Someone should have a vague number of Capital One credit cards. You can have up to five open credit accounts with Capital One, but it depends on how long you’ve had accounts with them and what kind of cards you have. Capital One might only let you have one or two personal cards, but you could have other business credit cards with them.

The number of cards you can carry depends on your credit history, credit score, how much debt you have compared to your income, and your financial goals. There isn’t a one-size-fits-all answer—some people may need five cards, while others may only need one.

Think about why you want to get a credit card. Do you want to earn travel rewards? Would getting cash back on gas be helpful to you? Are you looking to improve your credit score?

You may only need one credit card if you’re in a particular situation. For instance, the Capital One SavorOne Cash Rewards Credit Card offers 0% APR and allows you to earn cash back on regular purchases.

If you have a Capital One card and want more credit, ask for a credit limit increase instead of getting a new account. If your account is in good standing and you tell Capital One about any income increases, you might get a higher credit limit without asking.

Remember that you can only sometimes transfer a balance to a card from the same company. For example, if you owe money on a Capital One card, you can’t transfer it to another Capital One card. Instead, check out some good balance transfer cards from different companies.

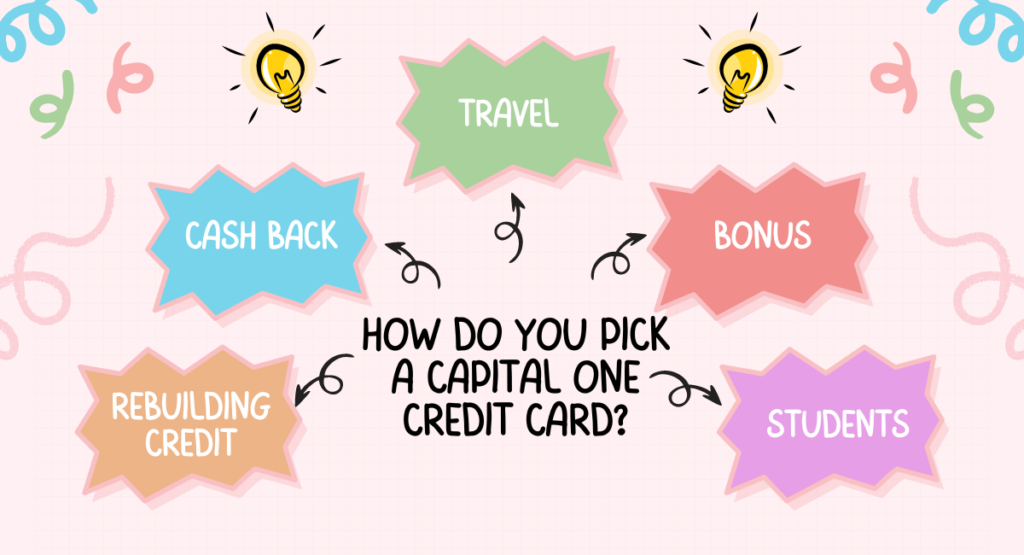

How Do You Pick A Capital One Credit Card?

Capital One offers many different credit cards. Some are good for building credit, others are better for travel and have perks like airport lounge access. Choose the one that is most appropriate for your financial goals.

Here are some of the top Capital One cards for different needs:

1. Rebuilding credit: The Capital One Platinum Secured Credit Card has a $200 credit limit and a $49 deposit. You could get a higher credit limit within six months. Even if you were recently turned down for a credit card or missed loan payments, you might still qualify for this card.

2. Cash back: The Capital One SavorOne Cash Rewards Credit Card gives you money back on certain purchases, such as food, entertainment, and hotels. New cardholders can get a 0% interest rate for the first 15 months.

3. Travel: The Capital One Venture X Rewards Credit Card (rates & fees) is one of today’s most lucrative travel cards. It would help if you likely had an excellent credit score to qualify. Cardholders earn 2 miles every dollar on all qualifying purchases, 5 miles per dollar on flights booked via Capital One Travel, 5 miles on Capital One Entertainment purchases through December 31, 2025, and 10 miles per dollar on hotels and rental vehicles booked through Capital One Travel. The card also includes a welcome.

4. Bonus: You’ll get 75,000 extra miles if you spend $4,000 on purchases in the first three months of opening the account. The annual fee is $395.

5. Students: The Capital One SavorOne Student Cash Rewards Credit Card allows college students to build credit history and earn rewards. Cardholders earn 10% cash back on Uber and Uber Eats purchases until 11/14/2024, 3% cash back on dining, dining, popular streaming services, and grocery stores (excluding superstores such as Walmart and Target), 5% cash back on Capital One Travel hotels and rental cars, 8% cash back on Capital One Entertainment purchases, and 1% on all other purchases. There’s no annual fee, and students with fair credit or higher may reasonably apply.

Pros And Cons Of Having Multiple Credit Cards

Many credit cards can change your credit score differently based on your use. Here are some things that can help or hurt your credit when getting a new card.

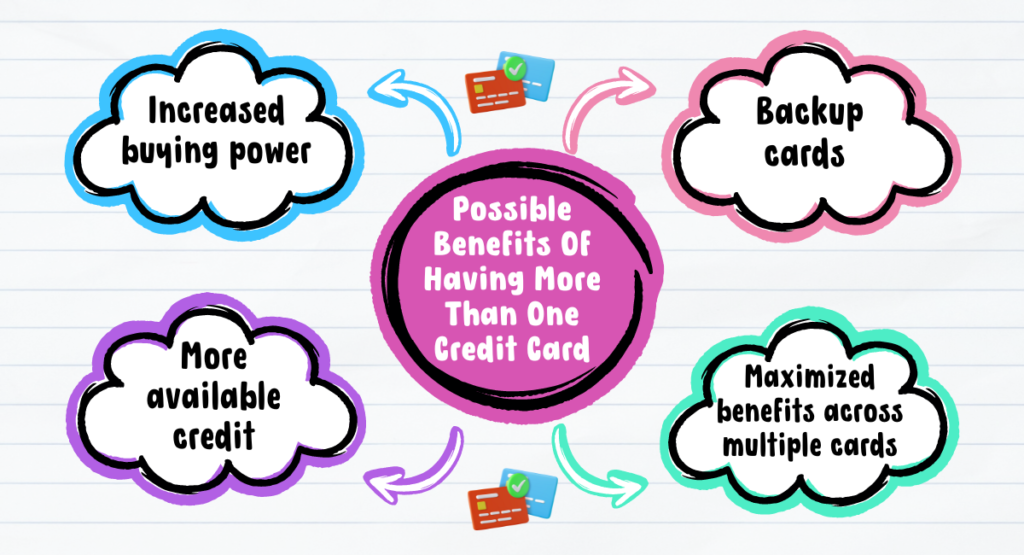

Possible Benefits Of Having More Than One Credit Card

Having more than one credit card and utilizing it carefully can have the following advantages:

1. Increased buying power: Having more money accessible can allow you to spend more, which can be really useful in a money crisis.

2. More available credit: Getting another credit card can give you more credit. Using less of this credit could improve your credit scores.

3. Maximized benefits across multiple cards: There are different kinds of credit cards, like ones that give you rewards for traveling and ones that give you cash back. Some cards have a special 0% APR rate for a limited time.

4. Backup cards: Having multiple credit cards gives you choices if a card is broken, missing, stolen, or used fraudulently. You can also consider using a digital wallet to buy things without physical cards or cash. Virtual credit card numbers are also a handy way to shop online without giving stores your card number.

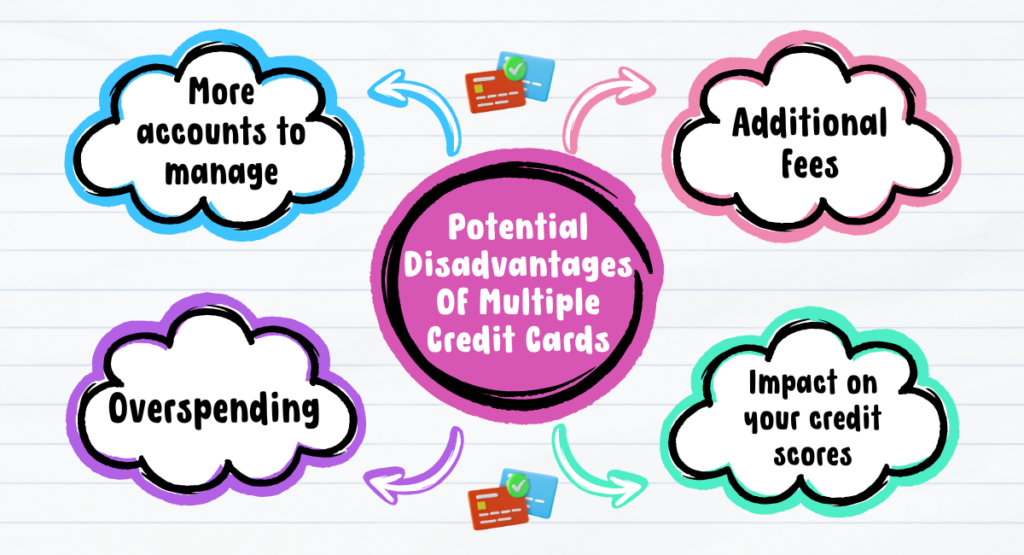

Potential Disadvantages Of Multiple Credit Cards

Potential disadvantages of having multiple credit cards can include:

1. More accounts to manage: If you have many different payment deadlines and credit card amounts to keep track of, you might be more likely to forget to pay on time or pay late, which could lower your credit score. But if you have several cards from the same company, it might be easier to keep track of payments.

2. Overspending: Make a plan for your money and only spend what you can pay back each month. This will help you control how much you use your credit card. The CFPB suggests using cash for small purchases and finding ways to use your card less, like paying for your coffee with cash instead of a card.

3. Impact on your credit scores: When you sign up for a new account, your credit scores go down for a while. Getting many credit cards at once could make lenders think you must manage your money better.

4. Additional fees: Some credit cards have yearly fees. If you have many cards like this, the costs can increase. Consider whether the rewards and perks from a card make up for the yearly fee.

How To Apply For Multiple Cards With One Credit Card Issuer?

Most credit card companies are okay with customers having more than one card, especially if it means they will use the cards more and be loyal to the company. However, there are some restrictions, even if they are sometimes easy to understand.

One important thing to remember is that Capital One won’t give you a new credit card if you’ve applied for two or more in the last month. It’s also unlikely that you’ll get approved for a Capital One card if you’ve already been approved for one in the previous six months. Using their preapproval tool, you can quickly check if you qualify for another Capital One card.

You can still apply for cards from other companies even if you apply for Capital One cards. Just follow the rules of the different companies, like Chase’s 5/24 rule. Chase won’t approve a card if you’ve been approved for five or more cards in the last two years.

In Conclusion, You can have more than one Capital One credit card, but it’s essential to consider how each card fits into your overall money plan. If you handle multiple cards well, you can get the most out of them and boost your credit score.

But you need to plan carefully and spend wisely. Consider the good things about having more cards and the risks like owing more money and paying higher fees. Make sure you make an intelligent choice after thinking about all the factors.

Thank you for reading…..