Your credit score is among your most crucial financial indicators. A strong credit rating can mean the difference between loan acceptance and refusal, and borrowers with the best credit scores receive the most favorable interest rates. A good credit score can help you qualify for an apartment or job. One key aspect to grasp is when credit cards report to credit bureaus, as this timing can impact your credit score.

“Checking your credit report and rating regularly is one of the best ways to protect your financial health,” says Rod Griffin, Experian’s senior director of consumer education and advocacy.

Every credit card purchase and payment, whether on time or late, will likely be reported to one of the three major credit-reporting agencies: Equifax, Experian, or TransUnion. Once these agencies have received the information, they will use it to update your credit score.

What Are Credit Bureaus?

Credit bureaus, often known as credit reporting agencies, are corporations that collect and store consumer credit data. They collect information from creditors, such as credit card issuers, banks, and lenders, to compile consumer credit reports. These reports include payment history, credit limits, account balances, and queries.

The three primary credit bureaus in the United States are Equifax, Experian, and TransUnion. They utilize this information to generate credit scores, which lenders use to determine creditworthiness when people apply for loans, credit cards, or other financial items.

Is It Essential To Know When Your Issuers Report?

Determining when your creditor(s) submit to the credit bureaus can be helpful in the following situations. You may need to know when your credit card issuer will report. You can call and ask and may or may not receive an answer.

Alternatively, the response you receive may alter over time. This is why knowing where you stand with your credit cards is critical to avoid these problems (or at least be prepared for a temporary reduction in your credit score).

You can use a credit card to make a large purchase. There are situations when doing so makes excellent sense, such as when you have a cashback credit card. Furthermore, using a credit card provides substantial consumer safeguards, including extended warranties, theft and damage insurance, and price protection, which are unavailable when paying in cash. Credit cards have a place in your finances and may be valuable if utilized properly.

When Do Credit Cards Report To The Credit Bureau?

There is so much uncertainty about when credit card issuers report to credit agencies because there is no one-size-fits-all solution.

What is the good news? There are trends to consider that might help consumers make informed decisions.

“Your balances are normally reported to the credit bureaus on the statement’s [closing] date,” says Tina Endicott, vice president of business development and marketing at Partners Financial Federal Credit Union. “However,” she said, “it may take up to a week for the bureau to update your data.”

This may depend on the agency. Different bureaus may update at varying rates and frequencies.

And while you may typically expect your credit card activity to be reported to the bureaus at the end of your payment cycle, this is not an absolute rule.

“How often credit card companies report to nationwide credit bureaus depends on the [company],” says Nancy Bistritz-Balkan, former head of relations and marketing at Equifax.

“It can be anywhere from monthly to daily for a single consumer’s details, depending on the lender’s or creditor’s choices and procedures,” she explained. “Most creditors and lenders [i.e., credit card firms] provide data at least once a month.”

The Problem With Credit Reporting

Do you want to establish your credit history or improve your credit scores before purchasing a home or making a significant purchase? You will want to ensure that your good credit history is reported.

But here’s the thing: not all lenders record your transactions to credit bureaus. If they do, they may only report to some leading credit bureaus. Credit reporting is voluntary, and credit card firms do not necessarily disclose whose credit bureaus they report to.

Some organizations, such as Capital One, specifically say they will report your credit status to the three major credit bureaus. Others may not share that information as openly.

Overall, keeping your credit in excellent standing throughout the board is preferable. You can accomplish this by making timely, total payments and keeping your balances low.

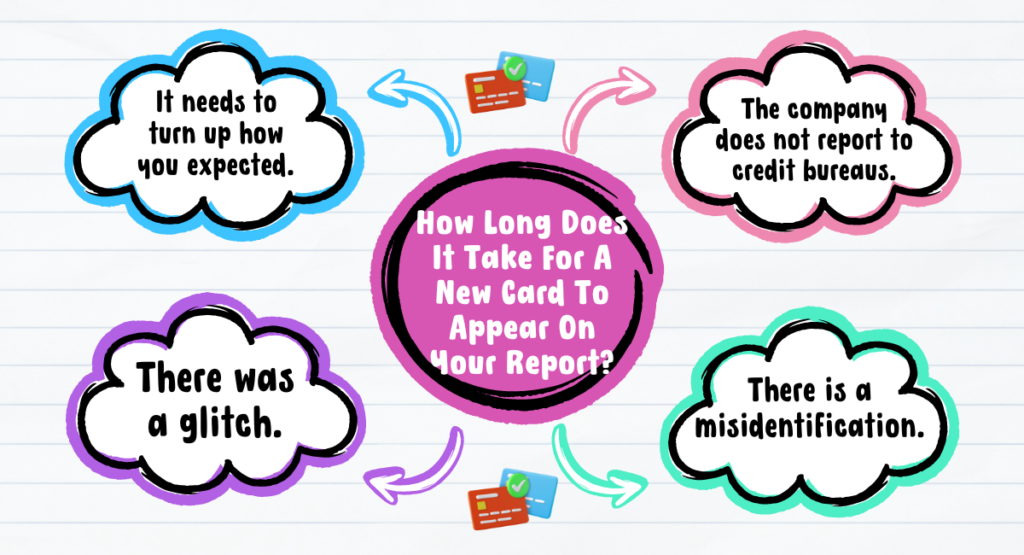

How Long Does It Take For A New Card To Appear On Your Report?

When you open a new credit card account, it does not instantly appear on your credit report. The new account will usually appear 30 to 60 days after you open it, though this may differ depending on the lender, your card’s billing period, and when the account was submitted to each of the three bureaus.

In rare cases, a new card may not appear on your credit record. This could happen if:

It needs to turn up how you expected. The new card is on your credit report but should appear as expected. For example, a new retail credit card may appear under a different name than the business where it was issued but somewhat under the name of the bank that runs the store’s credit card program.

There was a glitch. Flukes occur; for example, if the credit card issuer you applied with merges with another company, new account activity may not appear during the consolidation period. Typically, this is a transitory issue that will fix itself, but you should contact your issuer if it has yet to be resolved after many months.

The company does not report to credit bureaus. Many credit card providers report account transactions to all three major credit bureaus, but others do not. Some issuers may report to only one or two bureaus rather than all three. If you want to develop or improve your credit, ensure that your card issuer reports your account activity to all credit bureaus.

There is a misidentification. It’s unlikely, but if you or the card issuer erroneously entered your name or Social Security number, the account may not be linked to your credit file. If this occurs, contact your credit card company to confirm they have the correct identification details.

How Does It Affect Your Credit Utilization?

Credit utilization is essential; it accounts for 30% of your FICO score and is regarded as “extremely influential” to your VantageScore. Using a considerable portion of your available credit can make a significant difference.

Assume you use one of your credit cards to pay for a large purchase. You know the purchase will push you above the suggested 30 percent utilization rate, but you intend to pay it off when you receive the bill (or at least pay a significant chunk off to reduce your utilization rate). Thus far, so good.

However, suppose your credit card company, like many others, reports at the end of the billing period (after you make the purchase but before you finish the payment). Your score will suffer until you finish the payment and report it to the agencies in the next billing cycle. This is because your purchase has hurt your credit utilization.

Of course, if you adhere to your plan, this will only be a short issue, and your score will recover after the payment is completed and reported. However, obtaining new credit in the meantime may be difficult.

Even if you don’t apply for new credit, others, such as insurance companies, potential employers, or landlords, may review your credit report while this factor is lowering your score. You may have an answer prepared, but the chances of them asking and you being able to explain yourself are likely minimal.

Here’s a recommendation for those of you who, for whatever reason, want your card debt to be zero so that your utilization factor is low and your score is good, such as when applying for a mortgage or financing a car. Pay the whole debt and keep your card(s) in a drawer until the next month or billing cycle. The credit card issuer will report after the following month or cycle. Your zero balance to the bureaus and utilization factor will award you the most available points.

In conclusion, understanding when credit cards report to credit bureaus enables people to make informed financial decisions and maintain healthy credit profiles. You may improve your credit score and overall economic well-being by tracking payment due dates, monitoring credit utilization, and ensuring credit reporting accuracy.

Thank you for reading…..

Read More: Can You Have More Than One Capital One Credit Card?