A balance transfer credit card can save you several hundred dollars in interest and help you pay off debt faster. According to our study, even the average balance transfer credit card offers a 0 percent APR for about 13 months, with a 3.1% balance transfer fee and a $0 annual fee, representing a significant savings over the typical card overall. We researched over 1,500 cards using WalletHub’s patented 100-point card rating system to uncover the top balance transfer card deals.

When comparing balance transfer credit cards, the two most important factors to consider are the 0% intro APR length and the debt transfer charge size, typically 3% or 5% of the amount transferred (sometimes 0%). You should only consider cards with hefty balance transfer fees if they provide a very long 0% term to compensate. Our balance transfers calculator can show you how much you’d save with each card, allowing you to choose the best offer.

What Is A Balance Transfer Credit Card?

A balance transfer card lets you transfer all or part of your current credit card debt to a new card and repay it at a lower interest rate. Even better, some debt transfer cards may provide an introductory 0% APR on the transferred amount.

Balance transfer schemes frequently offer periods ranging from six months to nearly two years in which clients can pay off loans without incurring interest costs. After the 0% intro APR introductory period expires, the remaining balance will be billed at the card’s standard interest rate.

Before you accept an offer, be sure you know what a balance transfer is and how it works. It can be a great strategy to reduce debt, but only if done correctly and responsibly.

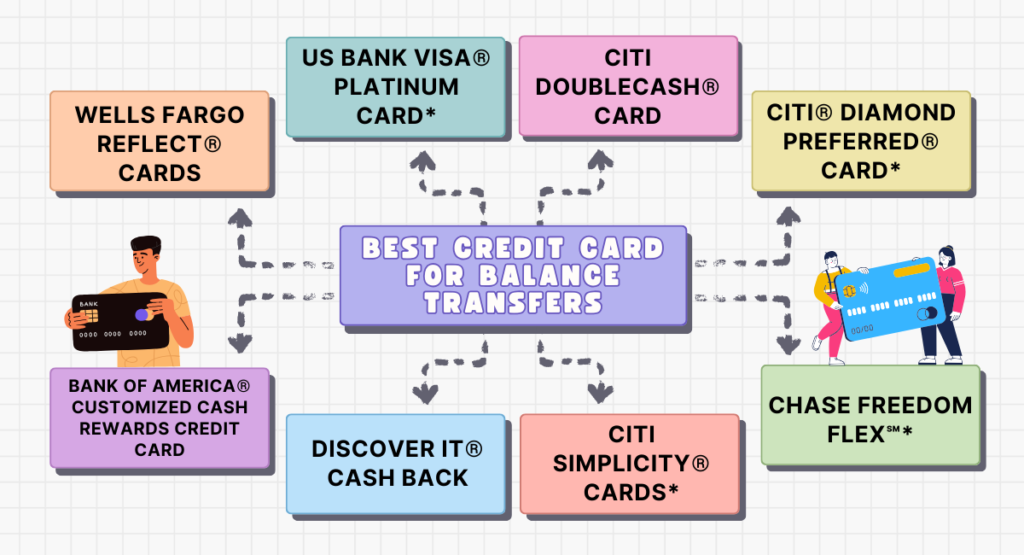

Best Credit Card For Balance Transfers

Here are some best credit card for balance transfers:

1. Wells Fargo Reflect® Cards

If you want to pay less interest on your current debt, the Wells Fargo Reflect® Card is a simple option. Complete the balance transfer during the eligibility timeframe; otherwise, you will not be eligible for the introductory APR.

Balance transfer offer: 0% introductory APR for 21 months from the beginning of the account on purchases and qualified balance transfers. The variable APR afterward is 18.24%, 24.74%, or 29.99%. Balance transfers completed within 120 days are eligible for the intro APR and a 5% balance transfer charge (minimum $5 applicable).

Balance transfer fee: 5%; minimum: $5.

Annual fee: $0.

Other advantages and disadvantages: While this card does not give rewards, it includes money-saving features such as up to $600 in mobile protection when you pay monthly with it and access to roadside assistance.

2. US Bank Visa® Platinum Card*

The U.S. Bank Visa® Platinum Card* does not generate rewards but provides a long runway for paying off debt if you transfer the balance from another card.

Balance Transfer Offer: Get a 0% introductory APR on purchase and balance transfers for 21 payment phases, followed by a variable APR ranging from 18.74% to 29.74%. A balance transfer fee of 5 percent of the amount transferred or a $5 minimum, which is greater, applies.

Balance transfer fees are 5% of the amount for every transfer or a $5 minimum, whichever is greater.

Annual fee: $0.

Other benefits and drawbacks: The U.S. Bank Visa® Platinum Card* has very few additional features but gives up to $600 in telephone protection and the ability to view your credit score online.

3. Citi DoubleCash® Card

The Citi Double Cash® Card’s rewards structure includes significant and uncomplicated cash-back returns on every transaction and an introductory APR on balance transfers.

Balance transfer offer: Receive a 0% intro APR on transferring balances for 18 months. Following that, the regular variable APR will be 19.24%—29.24%, depending on creditworthiness.

A first balance transfer fee of $5 or 3%, whichever is greater, is charged for transfers conducted within the first four months of account setup. Following that, the fee will be 5% of the transfer amount (minimum $5).

Balance transfer fee: 5% of each account transfer; $5 limit after 4 months from account opening.

Annual fee: $0.

Other advantages and disadvantages: Unlike comparable cards with transfer of balance offers, Extra Cash has staying power beyond the initial time. It earns 2% back in cash on all purchases: 1% when the purchases happen and another 1% when they are paid off. However, no card, even this one, is perfect as it provides few extra bonuses or safeguards.

4. Citi® Diamond Preferred® Card*.

Many balance transfer cards need you to transfer during the first month or two after opening your account to be eligible for the 0% intro APR offer. However, the Citi® Diamond Preferred® Card* offers one of the most liberal periods of any card on the market, with four months from the moment you open your account to transfer debt to the card.

Balance transfer offer: No initial APR for 21 months on qualifying transfers of balances from the date of the first transfer and 0 percent intro APR for a year on purchases from the date the account is opened.

The variable APR range will be 18.24% to 28.99%. Balance transfers must be performed within four months of the account’s establishment. Each balance transfer incurs a fee of $5 or 5 percent of the transfer balance, whichever is greater.

Balance transfer fees are 5% of each balance transfer, with a $5 minimum.

Annual fee: $0.

Other advantages and disadvantages: The Citi Diamond Preferred lacks frills—such as rewards—but, like most Citi cards, you can select the day of the month for your payment due date. You will also have access to exceptional events through Citi Entertainment®.

5. Bank of America® Customized Cash Rewards Credit Card

The Bank of America® Customized Cash Reward credit card is an excellent option for someone who spends on everyday items like gas or groceries but wants to maximize their earnings if their most significant expenses change.

Balance transfer offer: 0% introductory APR for balance and purchase transfers for 15 billing cycles, followed by a variable APR ranging from 18.24% to 28.24%. The intro rate applies to any balance transfers made within the first 60 days; each transfer within this period incurs a 3% balance transfer fee, which increases to 4% afterward.

Balance transfer fee: 3% for 60 days after account opening, then 4%.

Annual fee: $0.

Other advantages and disadvantages: This card’s secret sauce is that eligible individuals for the bank’s Preferred Rewards program can earn an extra 25 percent to 75 percent bonus points on all purchases. The disadvantage may be that you’ll need at least $20,000 in total assets to qualify for Preferred Rewards.

6. Discover it® Cash Back.

If you need to transfer debt but also want an enjoyable cash-back card, the Discover it® Cash Back is a good option. When engaged, you can receive 5% cash back on ordinary purchases at various locations every quarter, up to a quarterly spending limit of $1,500. Plus, you get unlimited 1% cash back for all other purchases—automatically.

Balance transfer offer: Get a 15-month 0% introductory APR on qualified purchases and balance transfers. The standard rate ranges from 17.24% to 28.24%. A balance transfer charge of up to 5% of the transferred amount will apply.

Balance transfer cost: 3% initial balance transfer fee, up to 5% fee on subsequent balance transfers (see terms)*

Annual fee: $0.

Other advantages and disadvantages: Discover is less commonly recognized abroad than other card networks, so it may not be the most excellent option if you enjoy traveling and do not already have a Visa or Card in your wallet. This card comes with an excellent first bonus: Discover will instantly match all cash back collected at the end of your first year as a cardholder. There are no minimum or maximum awards.

7. Citi Simplicity® Cards*

If you want to pay off a balance over a long period, consider the Citi Simplicity® Card*.

Balance transfer offer: 0% intro APR for 21 months on balance transfers from the date of the first transfer and 0 percent intro APR for a year on purchases from the date the account is opened. The variable APR range will be 19.24% to 29.99%.

For transfers made within a year of opening the account, an initial transfer of the balance fee of $5 or three percent of the transfer amount, whichever is greater, applies. Following that, the balance transfer fee of $5 or 5 percent of the balance transferred, whichever is greater, is charged.

Balance transfer fee: 5 percent of every balance transfer amount, with a $5 minimum.

Annual fee: $0.

Other benefits and drawbacks: The Citi Simplicity delivers a triple zero punch: no annual charge, no penalty interest rate, and no late fees. However, the card receives a 0 score in the rewards-earning section since it does not earn any.

8. Chase Freedom Flex℠*.

The Chase Freedom Flex℠* card offers 5% cash rebates on up to $1,500 in quarterly rotating categories (activation required), 5% cash back on Chase Travel℠ purchases, 3% cash back on eating and drugstores, and 1% cash return on all other transactions.

It also provides purchase and additional warranty protection, trip cancellation and disruption coverage, an auto rental accident damage waiver, and mobile protection.

Balance transfer offer: Get a 0 percent introductory APR on purchases and balance transfers for 15 months from account activation, after which a variable APR of 20.49% – 29.24% applies. A balance fee for transfers of up to 5% (minimum $5) of the total amount transferred applies.

Balance transfer fees: Transfer fees are $5 or 5 percent of the amount transferred, whichever is larger.

Annual fee: $0.

Other advantages and disadvantages: The Freedom Flex comes with an initial reward of $200 after spending $500 on purchases within the first three months of account setup. While the card provides a variety of travel-related advantages, it does incur a foreign transaction fee, making it less than ideal for international use.

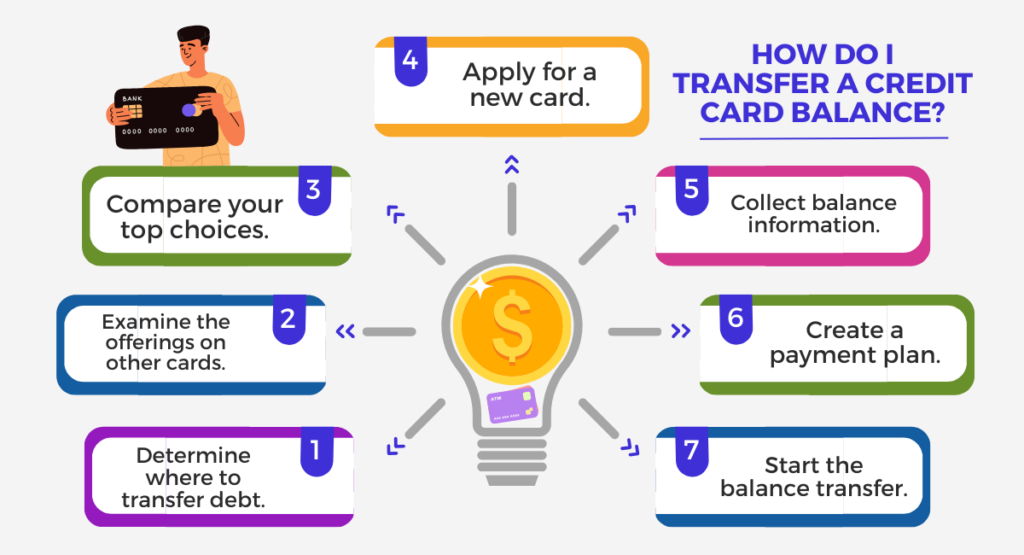

How Do I Transfer A Credit Card Balance?

Evaluate your existing debt. Determine which cards carry a balance and at what rate of interest.

- Determine where to transfer debt. You can transfer debts to existing cards or open an additional credit card.

- Examine the offerings on other cards. If you want a new credit card, consider options with advantageous terms.

- Compare your top choices. Examine the balance transfer fees, interest rates, and timescales for each potential debit card to see which is best for you.

- Apply for a new card. To apply for a balance-transferring credit card, follow the same steps as any other credit card.

- Collect balance information. Once accepted for a new card, you’ll need to gather information to transfer the balance, such as account numbers and total transfer amounts.

- Create a payment plan. Ideally, you’ll construct a payment plan to pay off the transfer before interest accrues.

- Start the balance transfer. Request a transfer with the new card issuer as soon as possible, as balance transfers might take up to two weeks to process.

In conclusion, choosing the best credit card for debt transfers necessitates careful analysis of introductory APR offers, transfer fees, ongoing APR rates, and financial objectives. By selecting a card that meets your needs and utilizing it carefully, you can make considerable progress toward debt repayment and financial wellness.

Thank you for reading….

Read More: When Do Credit Cards Report To The Credit Bureau?