Southwest is a significant travel partner through the Chase Ultimate Rewards loyalty program. If you have one of Chase’s travel cards and want to transfer Chase rewards to Southwest, you will receive a 1:1 transfer ratio. That implies 1,000 Chase Ultimate Rewards points equal 1,000 Southwest Rapid Rewards points.

Here’s all you need to know about transferring Chase rewards to Southwest, including what Chase credit cards provide this feature, how the transfer procedure works, and how to make the most of your points when purchasing a flight.

The Value Of Chase Points

Chase Ultimate Rewards points might be significant, but how you utilize them is crucial. For example, redeeming points for cash-back is not the most excellent option. This method makes each point worth one penny.

Redeeming points through Chase’s travel gateway may be a viable solution. However, the value you receive will vary depending on the card you own. If you hold the Chase Sapphire Premier Card, you’ll receive 1.25 cents per point.

If you hold the Chase Sapphire Reserve®, each point is worth 1.50 cents under this redemption option.

Moving points to a travel exchange partner may result in even greater value. The value varies depending on the transfer partner and how you spend your points. NerdWallet predicts that this strategy might yield a value of up to 2.2 cents per point.

How Do You Transfer Points From Chase To Southwest?

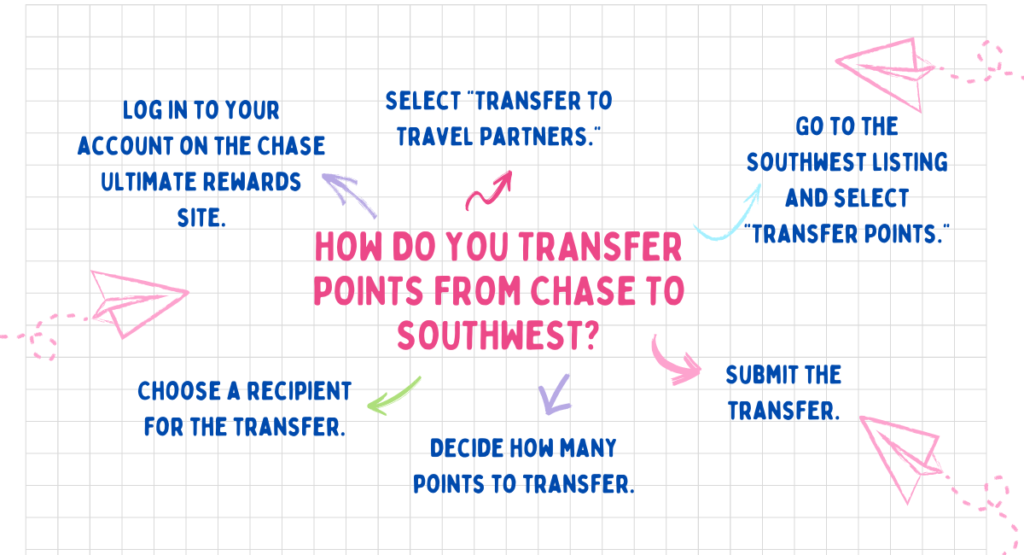

To transfer Chase points to Southwest in minutes, follow these steps:

1. Log in to your account on the Chase Ultimate Rewards site.

You can also log in to your Visa credit card account and navigate the Ultimate Rewards website. If you have multiple Visa credit cards, after logging in, choose the one with the points you want to utilize.

2. Select “Transfer to Travel Partners.”

This option is in the “Travel” dropdown menu.

3. Go to the Southwest listing and select “Transfer Points.”

It is listed alphabetically under the Airlines section.

4. Choose a recipient for the transfer.

Chase requires you to transfer points to yourself or a household member designated as an authorized user on your account. Once you’ve picked a recipient from the dropdown menu, enter their Rapid Rewards account number.

5. Decide how many points to transfer.

You have to transfer points in quantities of 1,000.

6. Submit the transfer.

Chase reviews all transfer facts. This screen allows you to transfer Chase points to Southwest.

Transfers are usually instant. Chase claims that most transfers are completed by the next business day, which may take up to seven business days. However, according to cardholder reports, transfers almost invariably occur immediately.

Keep in that all transfers are one-way. After transferring Chase points to Southwest, there is no way to cancel or transfer them back. That is why you should discover the flight you wish to book first, followed by the transfer.

When To Transfer Points

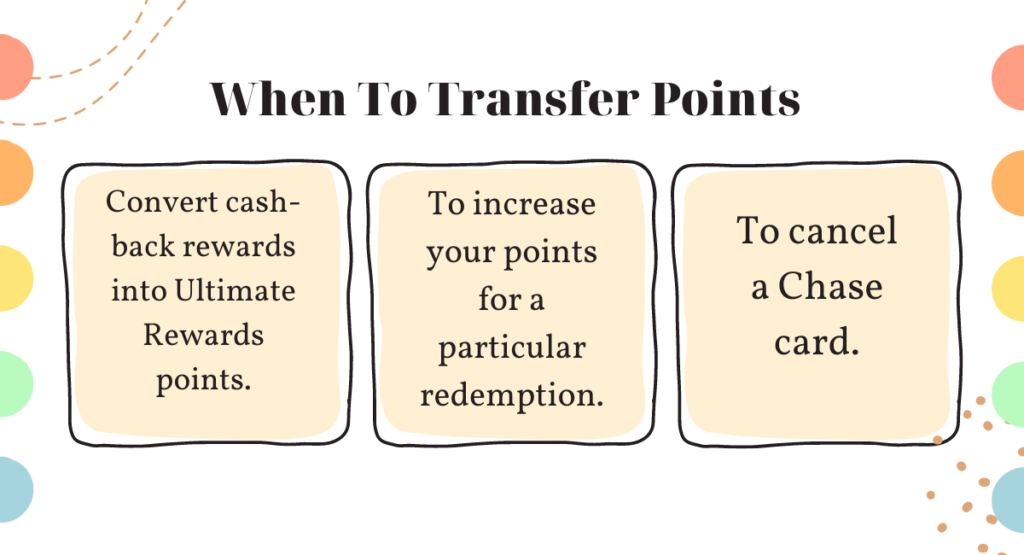

In some cases, transferring may be the most effective way to maximize the value of the points.

1. Convert cash-back rewards into Ultimate Rewards points.

The ideal approach to maximizing your benefits is to transfer your points from a Chase card that earns non transferable points worth up to 1 cent to a premium card with Ultimate benefits points.

For example, with the Chase Sapphire Reserves, points are worth 1.5 cents when paid for travel via the Chase Ultimate Rewards system, whereas the Chase Sapphire Preferred card increases the value of your points to 1.25 cents. Transferring your Ultimate Rewards miles to the correct transfer partner may allow you to stretch your cash-back reward dollars even further.

2. To increase your points for a particular redemption.

You may need more reward points for redemption on one of your own, but if you transfer to another account in your household, your combined points may be sufficient for your goal.

3. To cancel a Chase card.

If you have several Chase credit cards, you may need to cancel one of them. Transferring points from one account to another is an excellent technique to avoid losing any Chase points you’ve earned. You may transfer to another account or a member of your specified household.

Should You Transfer Your Chase Points?

Regardless of your Chase card, you should consider transferring your Chase points, especially if you want more flexibility and the ability to redeem your rewards for the most value.

If you have one of Chase’s cash-back cards, you can earn added rewards in everyday locations such as grocery stores, restaurants, and pharmacies. These points can then be moved to a Chase card that awards Ultimate Rewards points.

The Chase Ultimate Rewards program provides exceptional value, allowing you to redeem your rewards through its travel gateway for a price rarely seen with other travel rewards programs. It also allows you to transfer your points to a different reward program, increasing their worth.

Should You Transfer Your Chase Points To Southwest Or Redeem Them Through The Chase Portal?

Chase offers the option of arranging travel through the Chase Travel platform. If you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card, you may use your points for travel purchases at $0.0125 per point. With the Chase Sapphire Reserve®, you earn $0.015 per point.

Booking a flight this way typically gives you points with the airline. Award tickets do not accumulate points, giving the Chase Travel platform an advantage.

You may compare the value of a flight using each technique to see which is the best price. If that’s too time-consuming, here’s a more straightforward method based on the credit cards you have:

If you hold the Chase Sapphire Reserve Preferred® Card or the Ink Business Preferred® Credit Card, you can transfer Chase rewards to Southwest.

If you own a Chase Sapphire Reserve®, you can redeem Chase points through the Chase Travel portal.

Southwest flights do not appear in the Ultimate Rewards flight search, so you must call Chase Travel at 1-866-951-6592 to book them.

Chase Southwest Credit Cards.

Consider one of their credit cards if you’re a frequent Southwest flyer. Chase and Southwest offer three personal credit cards together:

All three airline credit cards offer sign-up incentives, yearly anniversary point bonuses, and the ability to earn Rapid Rewards points on purchases. One significant benefit is that those points count towards a Southwest Companion Pass.

You must earn 135,000 eligible points or fly 100 qualifying one-way trips in a calendar year to receive a Companion Pass.

Getting one of these cards makes sense if you’re a frequent Southwest client. You’ll be well on your approach to obtaining a Companion Pass, which is an excellent bonus if you frequently travel with someone. You’ll also earn some bonus points each year.

However, the Chase Ultimate Rewards cards provide significantly more adaptable travel points. Chase points can be transferred to Southwest and other airline and hotel partners or redeemed through the Chase Travel portal. One of these cards is the best if you want greater freedom when redeeming your travel points choice.

Book A Southwest Flight Using Chase Points.

Once you know how to move Chase points to Southwest, the process is quick and easy. Southwest may not offer a flashy first-class product or many foreign routes, but its fares are among the best.

Southwest’s low fares and Companion Pass make it ideal for families searching for an affordable vacation. Keep an eye out for offers; you can get roundtrip flights without using too many points.

In conclusion, transferring the Chase Ultimate Rewards points to Southwest Airways is a simple process that can result in significant travel savings. With some forethought and three simple steps, you’ll be on your way to booking your next vacation with Southwest Airlines, using points to make your trip both reasonable and fun.

To get the most out of your points, regularly check the official sites of Chase and Southwest for updates on transfer ratios and eligibility!

Thank you for reading…..

Read More: What Is The Best Credit Card For Balance Transfers?