Nobody enjoys waiting. However, waiting for a new credit card to arrive in the mail is the unavoidable second step following approval. After all, the bank must print a personalized card and ship it to you. But what if there was a quicker solution, such as a digital card for a digital wallet?

That technology is available, and Chase is deploying digital wallets to allow new cardholders to begin spending on their new card immediately after opening it. Chase calls this function Spend Instantly.

Eligible Chase cardholders can begin using their new Chase card immediately after approval by linking it to a digital wallet like Apple Pay or Google Pay.

Can I Use A Chase Credit Card Before It Arrives?

Yes, you can use a Visa credit card before it arrives. Most are instant-use, so you don’t have to wait two weeks to begin making purchases. The Chase mobile app features a function called “Spend Instantly” that allows you to install your newly approved charge card.

A person using a letter opener to open a mail

You can add your chosen card to an e-wallet, such as Google Pay, and spend it on overseas travel, eating, and other purchases. However, you can only spend half of the accepted card’s limit this way. Additionally, Spend Instantly excludes Chase business cards.

In addition to business cards, Chase has designated the following ineligible for instant use:

- Amazon Visa

- Prime Visa

- Disney Visa Card

- Disney Premier Visa Card

- Chase Freedom Flex

- Doordash Rewards Mastercard

- Instacart Mastercard

- Aeroplan

- IHG One Rewards Premier

- IHG One Rewards Traveler

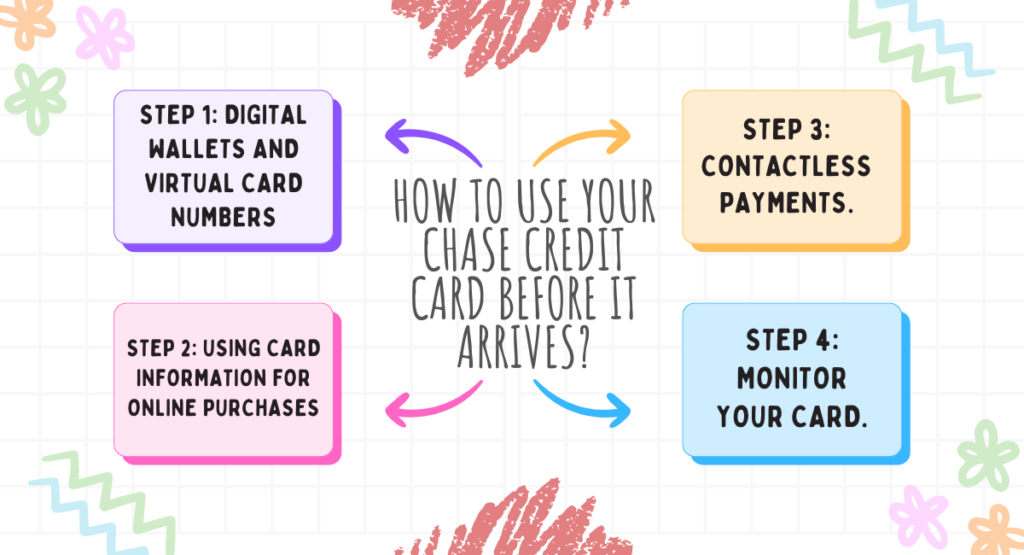

How To Use Your Chase Credit Card Before It Arrives?

Fortunately, Chase provides ways to start using your credit card immediately, even before it arrives in the mail. Here’s a complete guide to using your new Chase credit card immediately.

Step 1: Digital Wallets and Virtual Card Numbers

After your Chase credit card application is approved, you can link your card to a digital wallet like Apple Pay, Google Pay, or Samsung Pay. Chase frequently offers rapid access to your credit card information via its mobile app, which can activate your card in any compatible digital wallet. Here’s how you can accomplish it:

- Download the Chase Mobile App: If you still need to do so, download it from your app store.

- Log into Your Account: Log in with your Chase online banking credentials.

- Find Your Credit Card Details: If eligible, you may access your new credit card in the “Accounts” area. Chase may supply you with a digital version of your card.

- Add to Digital Wallet: You can link your card to your preferred digital wallet. Follow the steps to complete the setup. Using your card with a digital wallet allows you to make purchases at contactless payment-accepting retailers and online or in-app transactions where digital wallets are supported.

Step 2: Using Card Information for Online Purchases

In some situations, Chase may issue a virtual card number via the mobile app or website. This function enables you to begin using your credit card number for online purchases immediately:

- Access the Virtual Card Number: Check the card data in the Chase app or website to check if a virtual card number is available.

- Use during checkout: When making an online transaction, provide the expiration date, virtual card number, and CVV code precisely as you would for a physical card.

Step 3: Contactless Payments.

Using the card attached to your digital wallet, you can make contactless transactions using your phone or other smart devices. This is especially beneficial for making everyday purchases at grocery stores, petrol stations, and restaurants that accept this payment method.

Step 4: Monitor your card.

- Set Up Alerts: Chase lets you set up alerts for each transaction. This is a fantastic way to keep track of your expenses and look for unwanted transactions.

- Review Statements: Review your statements regularly using the Chase mobile app or internet banking to confirm that all charges are correct.

What Should You Consider Before Using A Chase-Approved Card Pre-Arrival?

Chase Bank’s policy of not disclosing the credit card number before issuance is annoying. The rise of a cashless payment culture and a plethora of incentives make it difficult to wait. Take your time when selecting the proper credit card to maximize the benefits.

Remember to choose a card that allows you to limit your spending habits so that your financial condition remains constant.

Benefits Of Chase Spend Instantly

Chase Spend Instantly overcomes a common difficulty for credit cardholders: waiting for a credit card to appear in the mail.

Whether you’re looking forward to using new advantages or just getting started on your welcome bonus, you need more than two weeks for your new card to arrive. New Chase cardholders may ask for expedited processing, but your new Chase card will still take a few days to come in the mail.

While you wait, the time is ticking. Chase welcome bonuses often provide bonus points or miles once you spend a particular amount within a specified time frame. That time limit begins the day you open your card, regardless of how long it takes to get in the mail.

You can use your new Chase card immediately by adding it to a virtual wallet. For example, new Sapphire Reserve®* cardholders may qualify for a card and use their $300 Annual Travel Credit to book a vacation on the same day. Book your trip through the Chase Travel℠ platform to earn up to 10 points for every dollar spent after the first $300 credit for travel is applied.

Chase Travel℠ offers 5 points for every dollar on flights and 10 points for every dollar on hotels and auto rentals after the first $300 spent annually. Earn three points for every dollar spent on other travel and dining and one for every dollar spent on all other purchases.

What Should You Consider Before Applying For An Instant-Use Credit Card?

If you want a credit card, you can use it immediately. Seek one that provides the incentives or credit-building benefits you desire. If the card has an annual cost, consider whether you can gain enough value to justify the fee. Here are some other factors to consider before applying for a credit card that you may use immediately:

Check your credit score. Knowing your credit rating before applying for an additional credit card will help you estimate the probability of being accepted. We recommend learning the elements that affect credit and checking your score before proceeding with a credit card application.

Consider why you require an instant line of credit. If you are financing a purchase right now, make sure you can pay it off by the due date; otherwise, an instant-use card may cause you to develop debt. If you plan to carry a balance, you could face hefty interest rates and even late fees if you pay the minimum payment on time.

See if you’ve been preapproved. Some instant-use credit cards allow you to see if you’re preapproved online before submitting a complete application. It enables you to assess your chances of approval without conducting a hard inquiry into your credit records.

In conclusion, using your Chase credit card immediately following approval via digital wallets and virtual card numbers is valuable to help you manage your money more efficiently. To avoid debt growth, keep your expenditures under control and manage your credit correctly. With these steps, you may take advantage of your Chase credit card’s benefits without waiting for it to arrive.

Thank you for reading….

Read More: Best Credit Cards For Fair To Good Credit