The best credit cards for beginners will consider you even if you have little or no credit history (even if you are a student or an immigrant), help you develop credit through responsible use, and save you money. We compared over 1,500 cards using WalletHub’s patented 100-point credit card rating system to find the best cards.

Our most recent research shows that beginning credit cards often have a $300+ starting credit limit, no annual fees, and benefits of up to 1% cash back on purchases. When choosing between these starter credit cards, you should pay as few fees and interest as feasible. As long as you pay your bills on time and in full every month, you can develop credit cheaply.

How Old Do You Need To Be To Get A Credit Card?

To apply for your credit card, you must be at least 18 years old and, if under 21, establish an independent ability to pay. Few issuers allow co-signers, so you’ll have to qualify independently.

Likewise, teenagers and young adults can be authorized users on a trusted adult’s credit card. This might be a good approach to helping teens build credit and educate their children on proper financial practices.

However, this should not be undertaken lightly. The account holder is responsible for full payment of any costs made by the authorized user; nevertheless, late or missed payments have a detrimental influence on both parties.

What Is The Best Credit Card To Start With?

Here are some lovely credit cards to begin with:

1. Discover It® Student Cash Back

The Discover it® Student Cash Back is a straightforward student card. While it isn’t the most flashy card on the market, it does provide healthy—but limited—earnings in rotating areas, an introductory APR on purchases, and a substantial welcome bonus.

This card is ideal for students who don’t mind tracking their expenditures to use the rotating 5% cash-back categories.

Who it’s best for: Students looking to earn the most significant cash-back rewards on their school and living expenditures, particularly in Discover’s quarterly rotating bonus spending areas.

Rewards: Earn 5 percent cash back on everyday purchases at various locations each quarter, including grocery stores, restaurants, gas stations, and more, up to the quarterly limit once activated. In addition, you will automatically earn an unlimited 1% cash back on any other transactions.

Welcome Offer: Discover offers an Unlimited Cash-back Match™, matching all cash back earned at the end of the first year. There are no minimum or maximum awards.

Annual fee: $0.

Other advantages and disadvantages: The Discover it® Student Cash Back card provides a 0% introductory APR on purchases for 6 months, after which the usual variable purchase APR of 18.24% – 27.24% applies. Cardholders can also modify their card designs and get their FICO Score for free every month.

2. Bank of America® Customised Cash Rewards Credit Card for Students

Because the Bank of America® Customized Cash Rewards credit card for Students is a student card, it is geared toward students who are just starting with credit and hence has less severe approval standards. However, this card outperforms most other cards in its category by providing returns comparable to some of the best cash-back cards.

Who it’s perfect for: Students who want to get cash back and improve their credit score.

Rewards: Get 3% cash back in your preferred category and an automatic 2% at grocery stores and wholesale clubs. Every quarter, the first $2,500 combined in the 3% and 2% categories is eligible for a bonus. Earn an unlimited 1% on every other transaction.

Welcome bonus: Earn $200 in cash rewards after making at least $1,000 purchases within the first 90 days of opening your account.

Annual fee: $0.

Other advantages and disadvantages: If you are a student using this card and intend to study abroad, be aware that it has a 3% foreign transaction fee. If you travel internationally or study abroad frequently, these expenses might soon pile up.

However, the card provides free access to your FICO score and a 0% introductory APR for 15 billing cycles on purchases and balance transfers finished in the first 60 days; after that, a variable APR of 18.24% – 28.24% applies. The balance transfer charge is 3% for the first 60 days after the account is opened and then 4%.

3. Capital One Savor One Student Cash Rewards Credit Card.

The Capital One SavorOne Students Cash Rewards Credit Card (rates and fees) rewards student-friendly purchases such as restaurants, entertainment, select streaming services, and grocery stores. With no annual fee, it’s an excellent solution for students with fair credit looking to improve their credit score while receiving cash back.

Who it’s perfect for: It is best suited to students on or off campus who spend monthly money on meals and entertainment.

Rewards: Earn a 10 percent cash back reward on Uber and Uber Eats purchases through 11/14/2024, 3% cash back on popular streaming services, dining, entertainment, and grocery stores (excluding superstores such as Walmart and Target), 5% cash back on lodging and car rentals scheduled through Capital One Travel, 8 percent cash back reward on Capital One Entertainment purchases, and 1% on all other purchases.

Welcome offer: Get $50 after spending $100 in the first three months.

The annual charge is $0.

Other benefits and drawbacks: Cardholders can earn 10 percent cash back on the company Uber and Uber Eats purchases through 11/14/2024, 3% in cash back on eating out, watching popular streaming services, and grocery stores, 5% cash back on rental cars and hotels scheduled through Capital One Travel, 8 percent cash back on the Capital One Recreation purchases, and 1% on everything else. When shopping abroad, no international transaction costs apply.

4. Capital One Quicksilver Student Cash Reward Credit Card

The Capital One Quicksilver Student Cash benefits Credit Card’s benefits (rates and fees) are straightforward, making it an excellent introductory rewards card for students who want to set it and forget it. There is no annual charge, and there is also a welcome gift for those who are just getting started.

Who it’s perfect for: Students who want to earn cash back on their purchases without having to track various categories or spending limits.

Rewards: Receive 10% cash back on Uber and Uber Eats purchases until 11/14/2024, an unlimited 5 percent cash back reward on hotels and rental cars scheduled through Capital One Travel, and 1.5 percent cash back on other transactions.

Welcome bonus: Earn $50 after spending $100 within the first three months.

Annual fee: $0.

Other advantages and disadvantages: Students can earn bonus points on certain scheduled travel through Capital One Travel and Taxi purchases for an extra boost of cash back. Furthermore, there are no foreign transaction fees, which makes it an ideal card to use whether studying abroad or traveling internationally during spring break.

5. Discover It® Secured Credit Card

The Discover it® Secured Credit Card provides simple cash back and an unlimited match of all cash back earned during the first year. This might be an excellent strategy for establishing credit while also earning some extra money. A deposit is required as a secured card, but it can be recovered if timely payments are made.

Who it’s perfect for: It’s perfect for Those looking to double their cash-back benefits on credit card purchases for the first year.

Rewards: Earn a 2% cash-back reward at gas stations and restaurants on combined purchases of up to $1,000 per quarter. Earn an unlimited 1% cash-back reward on all other purchases.

Welcome Offer: Discover offers Unlimited Cash-back Match™, which automatically matches all cash back received at the end of the first year.

Annual fee: $0.

Other advantages and disadvantages: Discover will assess your account after seven months to see if you are eligible to upgrade to an unprotected account. The additional cash back on restaurants and petrol stations is limited to $1,000 per quarter in total spending.

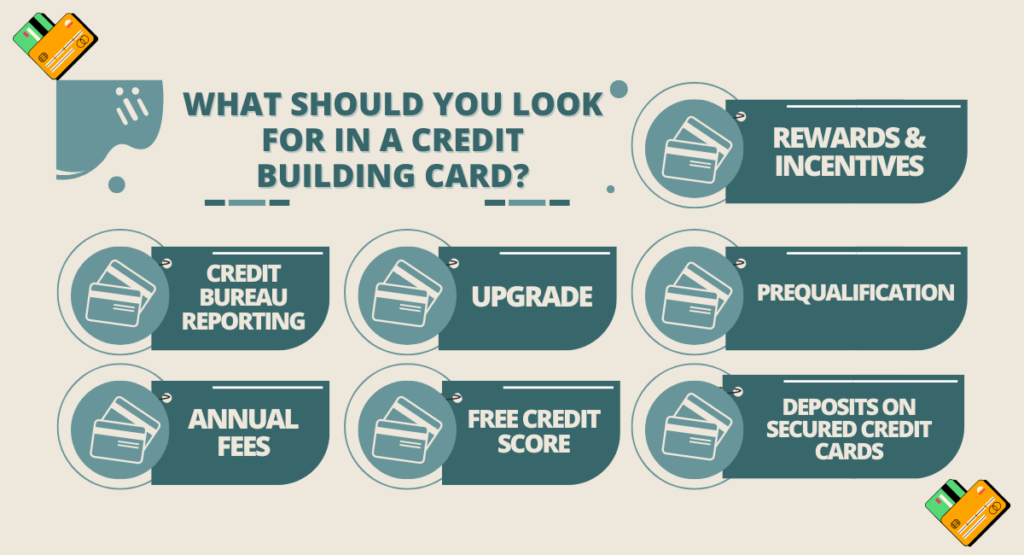

What Should You Look For In A Credit Building Card?

Before selecting a credit card, ensure it meets your credit-building requirements and that the rates and fees are affordable. Please pay close attention to the following.

1. Credit bureau reporting: Most credit card issuers report to credit bureaus. However, if you want to establish credit, ensure your credit card issuer sends your payment history to the credit bureaus. If it reports to the bureaus, you can develop your credit history.

2. Annual fees: Many starting credit cards charge annual fees, but some do not. Be careful to check the rates and fees so you understand how much it will cost to use the card.

3. Prequalification: Prequalifying for a credit card allows you to postpone applying for a card that you are unlikely to be approved for. Each time you apply for credit, you may lose up to five points from your score. Even if you prequalify, there is no guarantee that you will be approved. It implies that you meet the minimum requirements and are likely to be accepted.

4. Upgrade: Some issuers provide a way to advance to a better credit card from the same firm. For example, if you use a secured card correctly, the issuer may upgrade you to one of their unsecured cards.

5. Rewards & incentives: If relevant, read the rewards program to learn how to earn them. Some issuers even provide incentives for timely payments or good grades, such as extra awards or credit limit increases.

6. Free credit score: Most credit card providers provide free credit ratings. These can be FICO or Vantage Scores. This is an excellent way to keep track of your score each month. And it is free!

7. Deposits on secured credit cards: The minimum and maximum security amounts vary by card. Usually, the credit limit is equal to your deposit amount. However, there are a few protected cards that provide a more flexible solution.

In conclusion, the first credit card you get should help you develop credit and teach you about financial responsibility without charging excessive fees or convoluted reward mechanisms. The most important thing to remember when choosing a student card, a secured card, or a card that accepts those with a low credit history is to utilize it responsibly.

To build a solid credit score, pay your amount in full every month and keep track of your spending. This careful financial behavior lays the groundwork for more profitable loan prospects in the future.

Thank you for reading….

Read More: How To Use A Chase Credit Card Before It Arrives?