The ideal place to get a personal loan is from a lender with the lowest interest rate and costs, making it simple to complete an application and providing a speedy disbursement. You have several options when borrowing money, including online lenders, banks, and credit unions. Here’s how to determine which is ideal for taking out a personal loan.

The best personal loans provide inexpensive monthly payments at a rate within your budget. Other advantages, such as no fees, rate discounts, and mobile apps, may distinguish some personal loan lenders.

How To Get A Personal Loan?

Check your credit. Your credit score significantly affects whether you qualify for an individual loan and the rate you receive. Resolve any issues lowering your score, and pay down loans to reduce your DTI ratio. Get a free credit report from NerdWallet or AnnualCreditReport.com.

Prequalify with several lenders. This will give you an idea of the rate and terms you can expect. Compare prequalified deals to find the lowest APR and monthly payments within your budget.

Apply. Documents verifying your identification and income are required as part of the formal application procedure. Once authorized, you can expect to receive your loan cash within a week.

Best Place To Get A Personal Loan

You can obtain a personal loan via internet lenders, banks, or credit unions. The most incredible selection provides you with the rate, terms, and features appropriate for your financial circumstances.

For example, choose an online lender if a quick and easy loan application is crucial to you. On the other hand, if reduced rates and in-person help are essential, a bank or credit union loan may be preferable.

1. Personal Loans from Banks

Traditional banks can be found anywhere, from large international institutions to small community banks. Most institutions provide loans, including personal ones.

Pros of Bank Personal Loans

Known history: Because the bank’s name is familiar, some customers may feel more comfortable borrowing from it. Trust is important when dealing with money, and working with a bank that has a proven track record makes it simpler to feel comfortable.

In-person access: If you like traditional financial institutions, consider working with a national bank rather than a credit union. The former is more likely to have a larger number of branches and a broader ATM network. Some people value having physical access to help and money, particularly while coping with debt.

Cons of Personal Loans from Banks

More work to qualify: Borrowers seeking a personal loan from a bank need to have a reasonably high credit score. Because personal loans are often unsecured, credit criteria are tighter to offset the risk of making a loan without security.

Higher interest rates and fees: Banks charge more excellent rates and costs than credit unions and online lenders. If you are not eligible for a discount rate, you may pay more with a bank than with another lender.

2. Personal Loans from Credit Unions

Credit unions and banks are similar, but one of the most significant differences is that banks are for-profit financial entities, whereas credit unions are non-profit.

Pros of Credit Union Personal Loans

Easier qualification: Many credit unions serve consumers regardless of their financial situation. If you believe you will not qualify for a personal loan elsewhere, a credit union may be more willing to give you a try.

Potentially lower interest rates: For most federal credit unions, personal loan interest rates can reach 18% for eligible customers with fair or weak credit. Banks and online lenders may charge you higher interest rates, up to 36%.

Cons of Credit Union Personal Loans

You usually have to be a member: Many credit unions require you to join before you can use their goods, including personal loans. Many credit unions enable you to join and borrow on the same day, although the membership requirements differ. Some lenders may require you to be a member for some time before you can apply for a loan, which might be problematic if you need financing immediately.

Accessibility limitations: Most credit unions serve their local communities and may not have many branches.6 Furthermore, many credit unions lack the resources that larger banks have to stay up with the latest technologies.

3. Personal Loans From Online Lenders

Online lenders provide personal loans to a wide range of clients and conditions.

Pros of Personal Loans from Online Lenders

Easy access: Thanks to online lenders, most people can quickly fill out an application and download an app to manage their personal loans.

Pre-qualification: Many internet lenders, like traditional banks, provide pre-qualification, which allows you to determine if you’re eligible without having to do a hard credit check, all from the convenience of your own home. Online applications are also typically simple and may be finished fast.

Cons of Personal Loans from Online Lenders

More challenging to qualify for: Unless otherwise noted, many online lenders, like traditional banks, require a better credit score. That means you may have difficulty obtaining a personal loan from an Internet lender if you have bad or even fair credit.

There are no physical locations: If you would rather have the option of visiting a physical branch, you are unlikely to prefer to work with an online lender for your loan. As the name implies, online-only lenders have no physical branches.

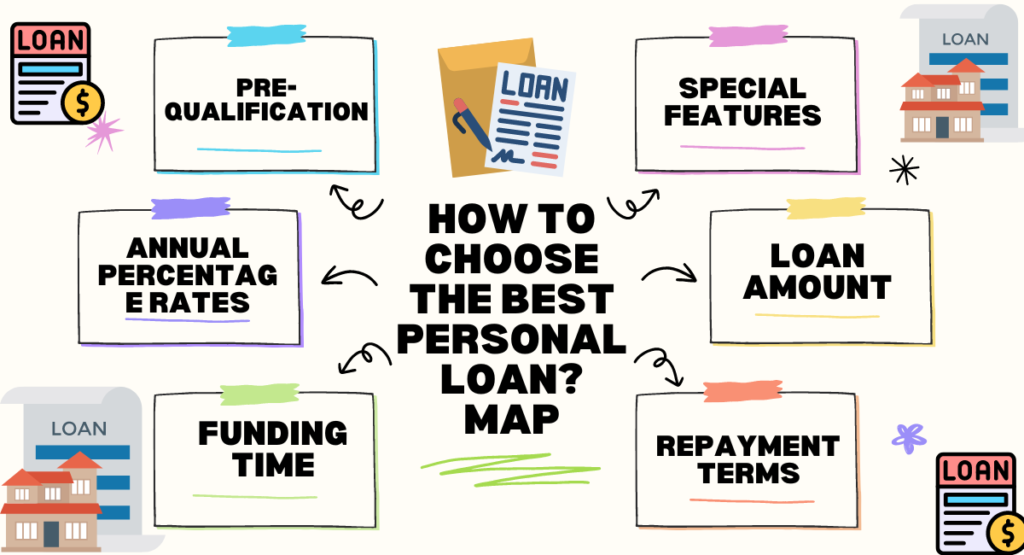

How To Choose The Best Personal Loan?

Here are some things to think about when shopping around for personal loans.

1. Pre-qualification. Most web lenders enable you to prequalify and view your expected interest rate. This process includes a soft credit check, which will not influence your credit score. It pays to prequalify for a loan and examine multiple lenders and financing options.

2. Annual percentage rates. Because APRs include interest rates and costs, so they provide borrowers with an accurate cost comparison between personal loan offers. Use our loan calculator to determine monthly payments and total costs.

3. Funding time. The time it takes to secure a personal loan varies depending on the lender. Many online lenders will approve your request and provide funds the same day, but credit unions and banks may take up to one week.

4. Repayment terms. With a wide range of repayment terms, you can choose between a shorter-term loan with lower interest rates and a longer term with a lower monthly cost. Depending on your budget, one may make more financial sense than the others.

5. Loan amount. Depending on the amount of money you require, specific lenders may be a better fit than others. Some lenders offer modest to medium-sized loans ranging from $2,000 to $50,000, while others provide up to $100,000. Calculating the amount you require will allow you to compare and decide.

6. Special features. Check whether the lender you’re considering offers advantages that could help you achieve your financial goals. Features like autopay rate savings, financial planning, or hardship support programs could benefit you.

How To Compare The Best Personal Loans?

Consider these ideas when comparing personal loans:

1. Wherever feasible, prequalify. Many personal loan providers allow prospective borrowers to prequalify for a loan. This means that the applicant can provide information about their financing requirements, income, housing condition, and other relevant details to figure out what loan amounts, rates, and repayment terms they are likely to qualify for. Further, this approach usually involves a mild inquiry, enabling you to shop around without hurting your credit score.

2. Consider the purpose of your financing. While personal loans can be used for various purposes, they are typically confined to consumer debt consolidation, funerals, vacations, weddings, home upgrades, significant purchases, and other personal needs.

As a result, lenders frequently limit the usage of personal loans to postsecondary education fees, business reasons, and unlawful activities at a minimum. When choosing a lender, ensure that your intended use of the loan is permitted under its borrower agreement.

3. Keep an eye out for any additional fees. Some lenders provide fee-free personal loans, which do not require borrowers to pay origination fees, late payment fees, prepayment penalties, or other typical loan costs. However, this is more of an exception than the rule, so it’s crucial to inquire about fees when looking for the finest loan conditions.

Also, if a lender charges an origination fee, determine if it is included in the APR or deducted from the loan amount before funding, as this may affect the loan amount you can request.

4. Evaluate the lender’s customer service choices. If you’ve found a lender willing to lend you the money you need on reasonable conditions, there’s one more thing to consider before signing the loan agreement.

While customer service may seem insignificant during the honeymoon time of your loan, it can significantly impact you if you have payment troubles or endure financial hardship during your repayment period. Check out the lender’s customer service resources and read reviews from previous and present customers to ensure it’s a suitable fit.

In Conclusion, Evaluate the lender’s customer service choices. If you’ve found a lender willing to lend you the money you need on reasonable conditions, there’s one more thing to consider before signing the loan agreement.

While customer service may seem insignificant during the honeymoon time of your loan, it can significantly impact you if you have payment troubles or endure financial hardship during your repayment period. Check out the lender’s customer service resources and read reviews from previous and present customers to ensure it’s a suitable fit.

Thank you for reading….

Read More: How Do You Transfer Points From Chase To Southwest?