Knowing how to calculate interest expense on an income statement is important for understanding a company’s financial health and debt.

Interest expense is the cost of borrowing money. In this article, we will look at how to calculate interest expense, what it means for a company’s profits, and how it affects its financial performance.

Understanding interest expense can help you see how much debt a company has and how they manage it. Let’s explore interest expense calculation and why it matters in financial reporting.

What Exactly Is Interest Expense?

Interest expense is a key cost on a company’s income statement. Companies need to borrow money to buy things, and when they do, they have to pay interest on that borrowed money. Knowing how much a company spends on interest can show how it manages its money and how well it’s doing financially.

Interest is usually shown as its own item on financial statements EBIT. Some companies may include interest in the SG&A section instead, depending on how they do their accounting.

Interest expense usually comes from a company borrowing money. But it can also come from leasing assets from another company. This generates interest expense that shows up on the income statement.

How To Calculate Interest Expense On Income Statement?

To figure out interest expense on an income statement, follow these steps. Here’s an easy way to calculate this important financial measure:

To predict how much money will be spent on interest in a financial plan, it’s common to find the average of the starting and ending debt amounts from the balance sheet.

In simple terms, the interest expense a company has to pay depends on how much debt they have and the terms of the loan agreement.

The interest you pay is calculated by taking the amount you owe and multiplying it by the interest rate, which can stay the same or change depending on market rates.

How loans and bonds are priced differently: Loans usually have an interest rate that can change, while bonds have a set interest rate.

Principal Amortization Schedule: The amount of money you owe can go down by making regular payments on the loan and extra payments if you choose to.

Interest Expense Formula And Example

Use this formula to figure out how much interest you owe:

Interest Expense = Principal x Period x Interest Rate

For example, let’s say Company ABC borrowed $75,000 at a 5% interest rate. An accountant at Company ABC is preparing financial statements for the first three months of 2021 and needs to find out how much interest they need to pay. To calculate this, they would use the interest expense formula.

$75,000 Principal x 0.25 Period x .05 Interest rate = $937.50

The period is shown as 0.25 because it’s one-fourth of the year with a 5% yearly interest rate. In the first three months of 2021, the company paid $937.50 in interest and can put this on its financial statement.

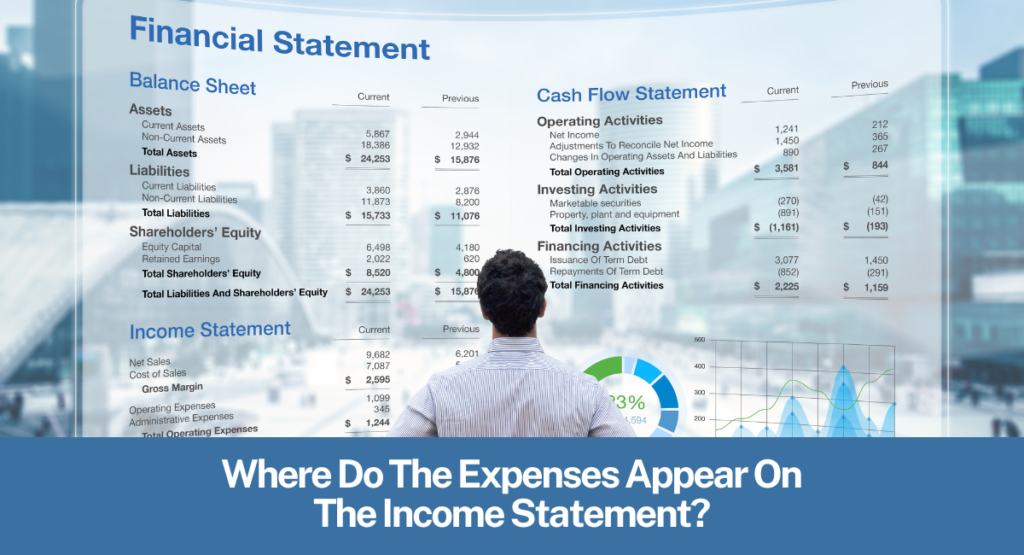

Where Do The Expenses Appear On The Income Statement?

Interest can be seen in the income statement or calculated using a debt schedule. The schedule lists all the company’s debts and their balances at the beginning of each period.

The balance is multiplied by the interest rate to calculate the expense. Capital leases are usually not included in the debt schedule.

Learn how to determine interest costs and debt repayment plans in CFI’s finance classes.

Accounting Definition For Interest Expense

The interest cost is listed in the non-operating part of the income statement because it is not a main part of the company’s business.

The company records its interest expense as “Interest Expense, net,” which is the total interest expense minus any interest income it earns from short-term investments like marketable securities.

Interest expense is handled in accounting like this:

- Income Statement (I/S): On the income statement, interest expense affects the earnings before taxes (EBT) line item, which lowers the amount of taxes owed (the “interest tax shield”).

- Cash Flow Statement (CFS): The cash flow statement doesn’t show interest expense directly, but it is included in the income statement and affects the net income. So, interest expense is indirectly included in the cash from operations (CFO) section of the cash flow statement because net income is the first item listed.

- Balance Sheet (B/S): The balance sheet is affected by interest expense due to profits, which then goes into the retained earnings section. The amount of interest paid is based on how much money is still owed on loans.

What Is the Interest Coverage Ratio?

The interest coverage ratio shows if a business can pay its interest costs. It’s important to check this ratio before getting a loan to make sure the business can repay the debt.

Lenders and investors also care about this ratio when deciding if they will give a loan to a company.

A low interest coverage ratio means a business might not be able to pay its debts. A high interest coverage ratio means the business can pay its loans.

The interest coverage ratio is found by dividing the company’s earnings before paying interest and taxes by the total interest expenses it owes.

Is The Interest Expense An Operating Expense?

Interest expense is different from operating expenses. Operating expenses are costs involved in running a business every day. Interest expense is the cost of borrowing money from lenders. It is shown separately on the income statement, after calculating operating income.

When figuring out how much money a company makes, there could be different types of income that count in or leave out things like interest costs.

- Earnings Before Interest, Taxes, Depreciation, and Amortization

- Earnings Before Interest and Taxes

- Earnings Before Tax

- Net Income

EBITDA is a number that shows how much money a company makes before subtracting interest, taxes, depreciation, and amortization costs. It’s not an official accounting number and won’t be on the income statement, but companies can choose to mention it in the financial statements.

Operating income, also known as earnings before interest and taxes (EBIT), is the profit a company makes from its main business activities. It only includes revenue from sales and expenses related to operations. Interest expenses are not included because they are not directly linked to the company’s daily operations.

Earnings before tax is the amount of money a company makes before paying income tax. Net income is the final amount left after subtracting all expenses.

Interest Expense For Personal Finance

When you buy stocks “on margin,” you may need to pay interest. This is common for individual investors. With taxable investment accounts (not retirement accounts like IRAs or 401(k)s), you can borrow money from a brokerage to buy stocks, bonds, or other investments.

The brokerage will charge you an interest rate, also known as margin interest, on the borrowed funds. The interest expense is just the amount of money you borrowed multiplied by the interest rate.

You can subtract investment interest costs from any investment money you make, but only if you list your tax deductions. To avoid paying interest, just don’t buy stocks with borrowed money.

In conclusion, interest expense on the income statement adds up all the interest payments made during the reporting period. This includes interest on loans, bonds, or other debt the company has. The total amount is reported as interest expense. This is subtracted from the company’s revenues to find its operating profit or net income, showing the cost of borrowing money for its operations.

Thanks for reading. I hope you find it interesting.

Read More: What Is A Variable Expense For Many Adults?