Preventing thousands of dollars in fees and interest and transferring your credit card balance to a card without a balance transfer fee could help you reduce your debt. Although balance transfer credit cards without fees are uncommon, they do exist. Membership-required credit unions typically provide them; therefore, eligibility is not universal. We have curated and assessed the top no-balance-transfer credit cards to assist you in paying off your debt.

How Do Balance Transfer Fees Work?

When a balance is converted to a new card, the applicable fee is additionally assessed to the transferred debt amount. Consider transferring $5,000 in high-interest card balances to a new card with a 3 percent balance transfer fee.

With an amended balance of $5,150, you would initiate repayment on your new card in this instance. This quantity consists of the transferred debt ($5,000) and the balance transfer fee of 3% ($150). A balance transfer fee will be assessed for each transferred balance.

It is crucial to remember this when calculating the maximum amount to be transferred to one’s card. Like conventional credit cards, your balance transfer card will have a predetermined limit. As with your debt, the balance transfer fee will be deducted from the amount of that limit that you are utilizing.

Suppose your card’s credit limit must be increased to accommodate the balance transfer and fee. In that case, you will be required to transfer a portion of the balance initially and remit the remainder to your card once the transferred balance has been reduced slightly.

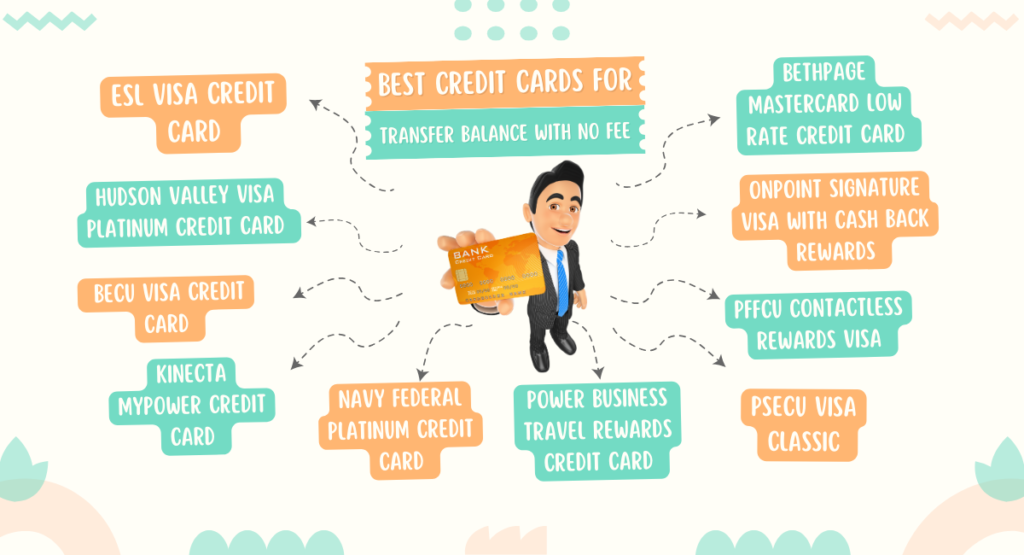

Best Credit Cards For Transfer Balance With No Fee

The following are the top credit cards that offer fee-free balance transfers:

1. ESL Visa Credit Card

The ESL Visa Credit Card offers substantial savings and low-interest rates. There are no balance transfer, annual, or cash advance fees to consider. Additionally, you will have one year to repay the transferred balance before incurring a low ongoing variable APR ranging from 13.50% to 17.99%.

2. Hudson Valley Visa Platinum Credit Card

Although the Hudson Valley Visa Platinum Credit Card does not provide rewards or benefits, balance transfers are eligible for an extended introductory APR. The ongoing APR for balance transfers on the card is nominal.

Ultimately, despite being unable to settle your credit card balance during the interest-free period, the remaining balance will not be subject to excessive interest charges.

3. BECU Visa Credit Card

The BECU Visa Credit Card is an outstanding option for debt consolidation. It provides one year for the balance transfer to be repaid in full before interest charges, following which any outstanding balance will incur a variable APR ranging from 13.24% to 25.24%.

In addition, membership eligibility can be obtained in various methods, including without residing in Washington, Oregon, or Idaho.

4. Kinecta MyPower Credit Card

In contrast to several other cards mentioned, the Kinecta MyPower Credit Card is available to all citizens of the United States. While a 0% introductory APR is not provided for balance transfers, the 4.99% introductory APR for 18 billing cycles can be advantageous in reducing high-interest credit card debt.

After the introductory period concludes, you will be charged a low ongoing variable rate of 13.24% to 18.00% on any remaining balance.

5. Navy Federal Platinum Credit Card

Those with affiliations to the Department of Defense, the Navy, or the United States Armed Forces should consider applying for the Navy Federal Platinum Credit Card. For your balance transfer, locating a card with lower introductory and ongoing interest rates will be challenging. Additionally, the card offers the benefit of no foreign transaction fees, which enhances its suitability for international travel.

6. Power Business Travel Rewards Credit Card

In addition to its low ongoing APR of 7.90%, the Power Business Travel Rewards Credit Card is one of the outstanding credit cards for transferring balances due to its no-fee balance transfer offer. It also provides reward points for dining, travel, and petrol.

7. PSECU Visa Classic

For Pennsylvania residents seeking a balance transfer card with no annual fee and low-interest rates, the PSECU Visa Classic is an excellent option to help them save on interest payments. Applicants may qualify for a credit line of up to $30,000, making this card intriguing for individuals who require a substantial balance transfer.

8. PFFCU Contactless Rewards Visa

The PFFCU Contactless Rewards Visa supplies a lengthy introductory APR period for balance transfers, alongside the opportunity to accumulate rewards points with each purchase.

Balance transfers on the card incur a low ongoing variable APR ranging from 14.4% to 18.00%, which reduces the cost of paying off any remaining balance following the conclusion of the introductory period.

9. OnPoint Signature Visa with Cash Back Rewards

The OnPoint Signature Visa with Cash Back Rewards is a worthwhile investment for eligible residents due to its competitive interest rates and continuous cash-back rewards. You can reduce the cost of paying off your balance transfer by taking advantage of the card’s low introductory and ongoing APRs, even if you cannot settle your balance ultimately during the introductory period. Additionally, you will receive 2 percent cash back on all purchases, comparable to the cash-back rates offered by some of our preferred credit cards.

10. Bethpage Mastercard Low Rate Credit Card

Due to its low interest rates, the Bethpage Mastercard Low Rate Credit Card is one of the few cards on this list that is available to consumers nationwide. Furthermore, it is an excellent choice if you require a substantial credit limit, as you are eligible for a credit line of no more than $35,000.

How Do You Calculate A Balance Transfer Fee?

A more minor balance transfer charge results in a reduced amount being deducted from the final payoff. To ascertain the balance transfer fee, check a credit card’s complete fee schedule before enrolling.

Balance transfer fees usually vary from 3 to 5 percent of the transferred balance, although this can differ depending on the specific offer. It is important to note that this fee is applied to the balance in advance when balances are transferred to a balance transfer card.

To determine the balance transfer charge, you must first convert your new card’s percentage balance transfer fee to a decimal (e.g., 5% to 0.5). Multiplying that decimal by your outstanding balance will yield the amount of the cost you must pay.

As an illustration, the fee of transferring $10,000 in credit card debt to the balance transfer card could vary depending on the credit card you enroll in: 3% of your balance ($300) or 5% of your balance ($500). Thus, you will have $10,300 or $10,500 in debt to repay.

How Do You Avoid Balance Transfer Fees?

Finding a card that completely waives balance transfer fees is typically the only method to circumvent such charges. The fact that these cards are usually issued by credit unions rather than significant credit card issuers can be advantageous and disadvantageous.

It may be difficult to find numerous credit union cards, for instance, that offer a protracted introductory APR of 0% and charge no balance transfer fees.

Furthermore, apart from credit unions that provide cards with waived balance transfer fees, you may encounter a conventional credit card that offers an introductory balance transfer fee or receive an offer from your current credit card issuer.

The issuer will then waive the charge for transfers finalized within a specified period. However, these offers are uncommon, so be prepared to factor the balance transfer charge into your repayment schedule unless you select a credit card that has entirely waived the fee.

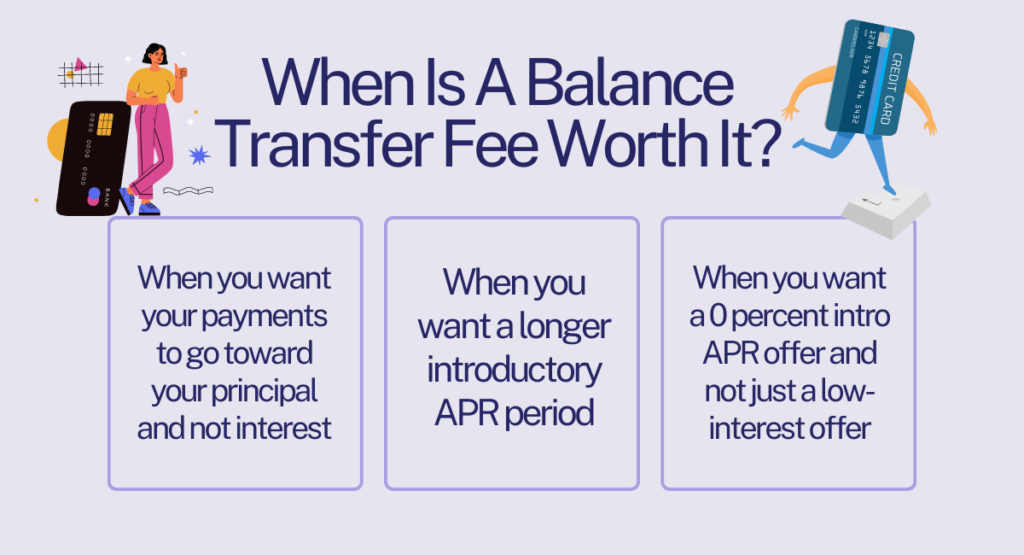

When Is A Balance Transfer Fee Worth It?

There are numerous financial situations in which the cost of a balance transfer fee is justified. To name a few:

1. When you want your payments to go toward your principal and not interest

If you need to pay off credit card debt and want to ensure that all of your payments are applied to the principal and not interest, paying a balance transfer fee is still worthwhile.

You will save quite a bit on interest payments compared to using a new balance transfer card with an introductory APR of 0 percent, notwithstanding the charge. In addition, regardless of the balance transfer fee, paying off debt with the balance transfer card will improve your credit score.

Consider the card illustration from earlier, which involved a $5,000 balance. Suppose you transfer the funds to a balance transfer card with a 3% balance transfer charge and an introductory APR of 0% for the first 18 months.

Assume that the variable APR on your current card is 20.75 percent. As determined by the credit card repayment calculator on Bankrate, the following are the interest rates and the amount of time required to pay off each card:

2. When you want a longer introductory APR period

Despite meeting the eligibility requirements for credit cards without balance transfer fees, such as those offered by credit unions, a balance transfer fee may still be justified. This is generally contingent upon the card’s introductory APR offer.

For instance, it is more advantageous to pay a fee for a prolonged introductory APR period, which would entail additional costs, as opposed to having no fee and a comparatively brief period of six months.

3. When you want a 0 percent intro APR offer and not just a low-interest offer

Not all credit club balance transfer cards also feature introductory APRs of 0%. Although you may qualify for a card that waives the balance transfer fee, you will still be required to make monthly payments at a low-interest rate while the balance is being repaid.

In this situation, obtaining a card with a balance transfer fee may be worthwhile, contingent on how quickly the balance can be refunded.

In conclusion, selecting an appropriate no-fee balance transfer credit card can substantially diminish the expenses associated with debt repayment. By comparing the introductory APR, introductory period duration, and additional card features, one can discern a card that most optimally aligns with their financial objectives and facilitates more efficient debt management. Maintaining excellent credit practices, including on-time bill payment and credit score monitoring, will allow you to maximize the advantages of the balance transfer card.

Thank you for reading….

Read More: